Global Biocides Market - Key Trends and Drivers Summarized

What Are Biocides and How Do They Safeguard Our Health and Environment?

Biocides are chemicals or biological agents that control harmful organisms by chemical or biological means. They are crucial in a variety of applications ranging from public health and agriculture to industrial processes. Biocides include a wide array of substances like disinfectants, preservatives, antifouling agents, and pesticides which are used to control and destroy harmful organisms such as bacteria, viruses, fungi, and insects. These agents are essential in preventing the spread of diseases, protecting crops from pests and diseases, and preserving food and other perishable items. In industrial settings, biocides prevent the biological fouling of water systems and protect materials from microbial corrosion, thereby extending the life of materials and enhancing operational efficiency.How Is Technological Innovation Expanding the Potential of Biocides?

Technological advancements are significantly shaping the biocides industry, enhancing the effectiveness and safety of these crucial chemicals. Innovations in biocide formulations are increasingly leading to products that are not only more effective but also environmentally friendly and less toxic to non-target species. For example, the development of time-release capsules that deliver biocides more efficiently and reduce the need for frequent application is becoming more common. Additionally, advances in biotechnology have facilitated the development of natural biocides, such as certain plant extracts and bacteriophages, which offer an alternative to traditional chemical biocides and help reduce environmental impact. Furthermore, integration with digital technologies like IoT systems enables precise monitoring and control of biocide application, optimizing their usage and minimizing waste.What Challenges and Regulations Influence the Biocides Industry?

The biocides industry faces numerous challenges, primarily regulatory and environmental. Regulatory bodies worldwide, such as the Environmental Protection Agency (EPA) in the United States and the European Chemicals Agency (ECHA) in Europe, impose stringent regulations on the use of biocides to ensure they are safe for human health and the environment. These regulations require rigorous testing and evaluation of biocides before they can be approved for use, which can be a lengthy and costly process. Moreover, there is growing concern about the development of resistance to biocides in various microorganisms, which could undermine the long-term effectiveness of these products. This scenario necessitates continuous research and development of new and more effective biocidal substances. Additionally, public perception and increasing awareness about chemical exposure risks demand the industry to innovate towards safer and more sustainable biocide solutions.The Biocide Paradox: When Disinfectants Strengthen the Enemy

Widespread and sometimes indiscriminate use of biocides raises concerns about their impact on antibiotic resistance. Biocides are designed to kill or inhibit the growth of bacteria, but when used improperly or excessively, they can promote the development of antibiotic-resistant bacteria. This resistance arises because sub-lethal exposure to biocides can enable bacteria to evolve mechanisms to survive these chemical attacks, mechanisms that may also confer resistance to antibiotic treatments. This cross-resistance can occur because the genetic changes or adaptive responses that protect bacteria against biocides can also make them resistant to antibiotics. For example, efflux pumps, which some bacteria use to expel biocidal substances, can also eject antibiotic molecules from their cells. As a result, the misuse of biocides could inadvertently contribute to the broader issue of antibiotic resistance, complicating the treatment of bacterial infections and posing significant public health risks.What Drives the Growth in the Biocides Market?

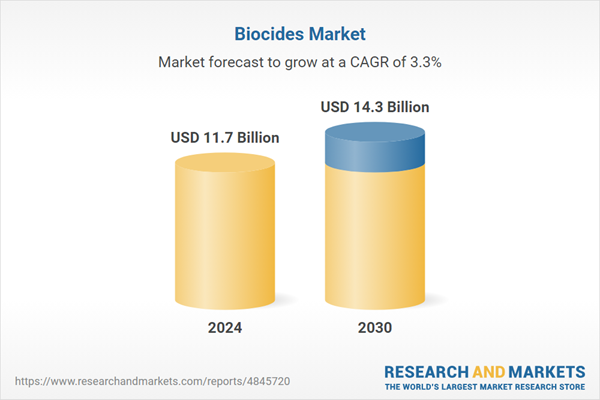

The growth in the biocides market is driven by several factors, including increased awareness about hygiene and sanitation, particularly in the wake of global health crises such as the COVID-19 pandemic. There is a rising demand for biocides in healthcare, water treatment, and food and beverage industries to ensure sterility and prevent microbial contamination. Additionally, the global expansion in industrial sectors such as oil and gas, paints and coatings, and plastics where biocides are used extensively to prevent microbial growth and biofouling contributes significantly to market expansion. Technological advancements that lead to more efficient and environmentally friendly biocides are also encouraging their adoption across various domains. Moreover, growing regulations that mandate the use of biocides in certain applications to meet hygiene standards are further propelling market growth. These factors, combined with the ongoing development of novel biocidal products, ensure robust demand in the global biocides market.Report Scope

The report analyzes the Biocides market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Household & Personal Care, Water Treatment, Paints & Coatings, Wood Preservation, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Household & Personal Care Application segment, which is expected to reach US$5.2 Billion by 2030 with a CAGR of 3.7%. The Water Treatment Application segment is also set to grow at 3.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.2 Billion in 2024, and China, forecasted to grow at an impressive 5.6% CAGR to reach $2.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Biocides Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Biocides Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Biocides Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzo Nobel NV, Albemarle Corporation, Arkema, Inc., Baker Hughes, a GE company, BASF Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 62 companies featured in this Biocides market report include:

- Akzo Nobel NV

- Albemarle Corporation

- Arkema, Inc.

- Baker Hughes, a GE company

- BASF Corporation

- BASF France

- BASF SE

- Caldic BV

- Chemtura Corporation

- Clariant International Ltd.

- Elementis PLC

- Johnson Matthey PLC

- Lanxess AG

- Lanxess Corporation

- Lonza, Inc.

- Mid South Chemical Co., Inc.

- Quat-Chem Ltd.

- Sanosil AG

- Stepan Company

- Troy Corporation

- Vulcan Materials Co.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel NV

- Albemarle Corporation

- Arkema, Inc.

- Baker Hughes, a GE company

- BASF Corporation

- BASF France

- BASF SE

- Caldic BV

- Chemtura Corporation

- Clariant International Ltd.

- Elementis PLC

- Johnson Matthey PLC

- Lanxess AG

- Lanxess Corporation

- Lonza, Inc.

- Mid South Chemical Co., Inc.

- Quat-Chem Ltd.

- Sanosil AG

- Stepan Company

- Troy Corporation

- Vulcan Materials Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.7 Billion |

| Forecasted Market Value ( USD | $ 14.3 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |