Global Hybrid Vehicles Market - Key Trends and Drivers Summarized

Are Hybrid Vehicles the Bridge to a Cleaner, More Efficient Future of Transportation?

Hybrid vehicles are transforming the automotive industry, but why are they so critical in the transition to cleaner, more efficient transportation? Hybrid vehicles combine internal combustion engines (ICEs) with electric motors and batteries, offering the best of both worlds: the range and reliability of traditional gasoline engines and the efficiency and lower emissions of electric power. By using both power sources, hybrid vehicles reduce fuel consumption, lower carbon emissions, and offer drivers better fuel economy without the range anxiety often associated with fully electric vehicles.The significance of hybrid vehicles lies in their ability to bridge the gap between conventional gasoline-powered cars and the rapidly emerging electric vehicle (EV) market. As governments, automakers, and consumers push for more sustainable transportation solutions, hybrids provide a practical and scalable solution for reducing emissions without requiring the infrastructure overhaul needed for widespread EV adoption. They offer a more immediate pathway toward reducing greenhouse gas emissions and fuel consumption while EV technology and charging infrastructure continue to develop. Hybrid vehicles are becoming a vital part of the global shift toward greener mobility, offering a more sustainable alternative for consumers today.

How Has Technology Advanced Hybrid Vehicles for Greater Efficiency and Performance?

Technological advancements have significantly enhanced the efficiency, performance, and overall appeal of hybrid vehicles, making them a powerful tool in reducing fuel consumption and emissions. One of the most critical advancements is the development of improved battery technology. Lithium-ion batteries, which are now commonly used in hybrid vehicles, offer higher energy density, faster charging, and longer life compared to older nickel-metal hydride (NiMH) batteries. These batteries store more energy in a smaller, lighter package, allowing hybrid vehicles to operate in electric mode for longer periods and at higher speeds. This reduces fuel consumption, particularly in stop-and-go city driving, where the electric motor can power the vehicle more frequently.The introduction of regenerative braking is another key technological advancement in hybrid vehicles. Regenerative braking systems capture energy that would otherwise be lost as heat during braking and use it to recharge the vehicle's battery. This process improves energy efficiency by allowing the vehicle to recover energy that can later be used to power the electric motor. In many hybrids, regenerative braking contributes significantly to extending the electric range and reducing fuel consumption, especially in urban environments with frequent stops.

Hybrid systems have also benefited from advancements in powertrain management and control systems. Modern hybrid vehicles use sophisticated electronic control units (ECUs) to seamlessly manage the interaction between the internal combustion engine and the electric motor. These ECUs monitor driving conditions and adjust the power source dynamically, optimizing performance and efficiency. For example, in low-speed driving, the system may prioritize electric power, while at higher speeds or during heavy acceleration, the gasoline engine may take over or work in tandem with the electric motor. This smart power management helps hybrid vehicles achieve superior fuel efficiency and lower emissions compared to traditional gasoline cars.

The development of plug-in hybrid electric vehicles (PHEVs) has further expanded the capabilities of hybrid vehicles. Unlike conventional hybrids, which rely on regenerative braking and the engine to charge the battery, PHEVs can be plugged into an external power source to recharge the battery. This allows PHEVs to operate in electric-only mode for longer distances, often covering daily commutes without using any gasoline at all. PHEVs offer the flexibility of running as a fully electric vehicle for short trips while maintaining the backup of a gasoline engine for longer journeys. As battery technology continues to improve, the electric range of PHEVs is increasing, making them an even more attractive option for eco-conscious drivers.

Advancements in engine technology have also played a role in improving the efficiency of hybrid vehicles. Many modern hybrids are equipped with Atkinson-cycle engines, which are designed to be more fuel-efficient than traditional Otto-cycle engines. The Atkinson-cycle engine operates with a longer expansion stroke and a shorter compression stroke, which reduces fuel consumption while still providing sufficient power when combined with the electric motor. This engine design is particularly effective in hybrid systems, where the electric motor can compensate for the lower power output of the engine during periods of high demand.

The integration of lightweight materials such as aluminum and carbon fiber in hybrid vehicle design has also contributed to improved efficiency. By reducing the overall weight of the vehicle, automakers can improve fuel economy and enhance the performance of both the engine and the electric motor. These lightweight materials also allow for better handling and acceleration, making hybrids more fun to drive without sacrificing efficiency. The use of advanced aerodynamics in hybrid design further improves fuel economy by reducing drag, allowing the vehicle to cut through the air more efficiently at higher speeds.

Hybrid vehicles have also benefited from the development of smart infotainment and energy management systems. Many modern hybrids are equipped with displays that show real-time information about energy usage, battery levels, and fuel efficiency. These systems encourage eco-friendly driving habits by providing feedback to the driver on how to optimize fuel efficiency. Additionally, connected vehicle technology allows hybrid drivers to monitor and manage charging remotely, helping them plan their trips more effectively and reduce reliance on gasoline.

Why Are Hybrid Vehicles Critical for Reducing Emissions, Improving Fuel Efficiency, and Supporting Sustainable Transportation?

Hybrid vehicles are critical for reducing emissions, improving fuel efficiency, and supporting sustainable transportation because they offer an immediate and practical solution for lowering the environmental impact of driving. One of the most important advantages of hybrid vehicles is their ability to significantly reduce fuel consumption. By combining electric motors with internal combustion engines, hybrids use less gasoline than traditional vehicles, particularly in urban environments where electric power can be used for short trips or during stop-and-go traffic. This reduction in fuel consumption translates directly into lower greenhouse gas emissions, making hybrids a key tool in the fight against climate change.In addition to reducing emissions, hybrid vehicles offer improved fuel efficiency compared to conventional gasoline-powered cars. This is especially important as fuel prices fluctuate and consumers look for more economical options. Hybrid vehicles provide better miles per gallon (MPG) ratings, making them more cost-effective for drivers who want to save on fuel costs without sacrificing performance or convenience. For drivers who commute long distances or frequently drive in congested areas, the fuel savings from a hybrid can be substantial over the life of the vehicle.

Hybrid vehicles are also critical for reducing dependence on fossil fuels and promoting the transition to cleaner energy sources. While fully electric vehicles represent the ultimate goal of zero-emission transportation, the infrastructure needed to support widespread EV adoption - such as charging stations and grid capacity - is still under development in many regions. Hybrid vehicles offer a more immediate solution by reducing gasoline consumption and emissions without requiring a complete shift to electric power. This makes hybrids an attractive option for consumers who want to reduce their environmental impact but may not have access to the necessary EV charging infrastructure.

Hybrid vehicles also play an important role in supporting sustainable transportation by making advanced technologies more accessible to a broader range of consumers. As automakers continue to innovate, the cost of hybrid technology has decreased, making hybrids more affordable than ever before. This has helped drive adoption across a wide range of vehicle segments, from compact cars to SUVs and even trucks. By offering hybrid options in different price ranges and vehicle types, automakers are ensuring that more drivers can participate in the transition to cleaner, more efficient transportation.

In addition to their environmental and economic benefits, hybrid vehicles are crucial for addressing the range anxiety that often discourages drivers from adopting fully electric vehicles. Range anxiety - the fear that a vehicle will run out of power before reaching a charging station - remains a significant barrier to EV adoption, particularly in regions with limited charging infrastructure. Hybrid vehicles, which combine electric power with gasoline engines, eliminate this concern by providing a backup power source. This makes hybrids a more practical option for drivers who want to reduce emissions but are not ready to rely solely on electric power.

The flexibility of hybrid vehicles is also an important factor in their growing popularity. Unlike fully electric vehicles, hybrids do not require drivers to change their driving or fueling habits significantly. Drivers can refuel at traditional gasoline stations while still benefiting from improved fuel economy and lower emissions. Additionally, plug-in hybrid vehicles (PHEVs) provide the option of charging the vehicle for short, all-electric trips, further reducing reliance on gasoline. This versatility makes hybrid vehicles a highly accessible option for a wide range of consumers, including those who live in rural areas or frequently travel long distances.

Hybrid vehicles also contribute to energy security by reducing the demand for gasoline and oil imports. By relying on a combination of electricity and gasoline, hybrids help decrease the overall demand for fossil fuels, which in turn reduces a country's dependence on foreign oil. This is particularly important for countries that are seeking to diversify their energy sources and reduce their vulnerability to fluctuations in global oil markets. Hybrid vehicles play a key role in this transition by offering a more energy-efficient and sustainable transportation option.

What Factors Are Driving the Growth of the Hybrid Vehicle Market?

Several factors are driving the rapid growth of the hybrid vehicle market, including the increasing demand for fuel-efficient vehicles, government regulations aimed at reducing emissions, and advancements in hybrid technology. One of the primary drivers is the growing consumer demand for more fuel-efficient vehicles. As fuel prices fluctuate and environmental concerns rise, consumers are increasingly looking for vehicles that offer better fuel economy without sacrificing performance. Hybrid vehicles provide a practical solution by offering significant fuel savings compared to traditional gasoline cars, making them an attractive option for cost-conscious and eco-conscious drivers alike.Government regulations and incentives are another major factor fueling the adoption of hybrid vehicles. Many countries have implemented stricter emissions standards to combat climate change and reduce air pollution. In response, automakers are investing heavily in hybrid technology to meet these regulatory requirements and offer cleaner vehicle options to consumers. Additionally, governments around the world are providing financial incentives for consumers who purchase hybrid or electric vehicles, such as tax credits, rebates, and exemptions from road tolls or congestion charges. These incentives are helping to lower the cost of hybrid vehicles, making them more accessible to a broader range of consumers.

Advancements in hybrid technology are also contributing to the growth of the hybrid vehicle market. Improvements in battery technology, powertrain efficiency, and regenerative braking have made hybrid vehicles more reliable, efficient, and affordable. As hybrid systems become more advanced, the performance gap between hybrids and traditional gasoline vehicles is narrowing, making hybrids a more appealing choice for a wider range of drivers. Automakers are also expanding their hybrid vehicle offerings, introducing hybrid versions of popular models across different vehicle segments, from compact cars to SUVs and trucks.

The growing awareness of environmental issues is another key factor driving the demand for hybrid vehicles. As concerns about climate change, air pollution, and resource depletion continue to rise, consumers are becoming more conscious of their environmental impact. Hybrid vehicles, which offer lower emissions and better fuel efficiency, provide a tangible way for individuals to reduce their carbon footprint. This growing environmental awareness is particularly strong among younger consumers, who are increasingly choosing hybrid vehicles as part of their commitment to sustainability.

The rise of urbanization and the increasing number of cities implementing low-emission zones are further boosting the demand for hybrid vehicles. In many urban areas, governments are imposing restrictions on high-emission vehicles in an effort to improve air quality and reduce traffic congestion. Hybrid vehicles, which produce lower emissions than traditional gasoline cars, are often exempt from these restrictions, making them a practical choice for city dwellers. Additionally, hybrid vehicles are well-suited for urban driving conditions, where regenerative braking and electric power can significantly reduce fuel consumption in stop-and-go traffic.

The expansion of charging infrastructure is also supporting the growth of plug-in hybrid electric vehicles (PHEVs). As more public charging stations are built, drivers have greater access to charging options, making it easier to operate PHEVs in electric-only mode. This is encouraging more consumers to consider PHEVs as a viable alternative to traditional hybrids or gasoline vehicles. As governments and private companies continue to invest in charging infrastructure, the convenience of owning a PHEV is expected to increase, driving further adoption.

With advancements in battery technology, increasing environmental awareness, and the push for fuel efficiency and emission reduction, the hybrid vehicle market is poised for continued growth. As automakers and consumers alike prioritize sustainability and energy efficiency, hybrid vehicles will play a critical role in the transition to cleaner, more sustainable transportation, bridging the gap between traditional gasoline-powered cars and the fully electric vehicles of the future.

Report Scope

The report analyzes the Hybrid Vehicles market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Degree of Hybridization (Full Hybrid, Plug-In Hybrid, Mild Hybrid); End-Use (Passenger Cars End-Use, Commercial Vehicles End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars End-Use segment, which is expected to reach US$376.5 Billion by 2030 with a CAGR of 11.9%. The Commercial Vehicles End-Use segment is also set to grow at 9.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $74 Billion in 2024, and China, forecasted to grow at an impressive 10.5% CAGR to reach $81.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hybrid Vehicles Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hybrid Vehicles Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

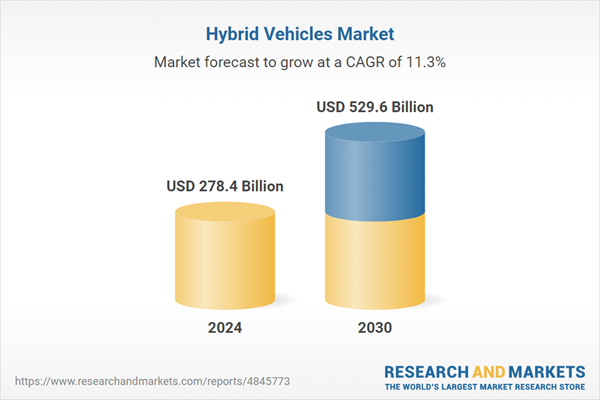

- How is the Global Hybrid Vehicles Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allison Transmission, Inc., American Axle & Manufacturing, Inc., Avl List GmbH, Avtovaz, BorgWarner, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Hybrid Vehicles market report include:

- Allison Transmission, Inc.

- American Axle & Manufacturing, Inc.

- Avl List GmbH

- Avtovaz

- BorgWarner, Inc.

- Continental AG

- Cummins, Inc.

- Daimler AG

- Delphi Technologies

- Denso Corporation

- Eaton Corporation PLC

- Ford Motor Company

- General Motors Company

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- LG Chem

- Magna International, Inc.

- MAHLE GmbH

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Schaeffler AG

- Toyota Motor Corporation

- Volvo Car Canada Ltd.

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allison Transmission, Inc.

- American Axle & Manufacturing, Inc.

- Avl List GmbH

- Avtovaz

- BorgWarner, Inc.

- Continental AG

- Cummins, Inc.

- Daimler AG

- Delphi Technologies

- Denso Corporation

- Eaton Corporation PLC

- Ford Motor Company

- General Motors Company

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- LG Chem

- Magna International, Inc.

- MAHLE GmbH

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Schaeffler AG

- Toyota Motor Corporation

- Volvo Car Canada Ltd.

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 278.4 Billion |

| Forecasted Market Value ( USD | $ 529.6 Billion |

| Compound Annual Growth Rate | 11.3% |

| Regions Covered | Global |