Platinum Market - Trends & Growth Drivers in the Precious Metals Industry

Why Is Platinum Becoming Increasingly Valuable in Global Markets?

Platinum, one of the rarest and most valuable precious metals, is witnessing rising demand across various industries, from automotive manufacturing to jewelry and investment markets. As supply remains constrained due to limited mining operations, particularly in South Africa and Russia, platinum prices are experiencing upward pressure. Unlike gold, which is largely driven by investment demand, platinum's value is significantly influenced by its industrial applications. The automotive sector remains the largest consumer, utilizing platinum in catalytic converters to reduce vehicle emissions. With governments worldwide tightening environmental regulations to curb pollution, the demand for platinum in cleaner automotive technologies is set to rise. Additionally, platinum's role in emerging technologies, such as hydrogen fuel cells and renewable energy solutions, is further solidifying its importance. Investors are also turning to platinum as a hedge against economic uncertainty, particularly as global inflation concerns drive interest in tangible assets.How Are Technological Advancements Impacting Platinum Demand?

Platinum's unique properties, including high resistance to corrosion and excellent conductivity, make it an essential component in cutting-edge technologies. One of the most significant developments is the increasing adoption of hydrogen fuel cell technology, where platinum is used as a catalyst to generate electricity in hydrogen-powered vehicles. As nations push for greener alternatives to fossil fuels, platinum's role in fuel cells is expected to expand, particularly in countries investing heavily in hydrogen infrastructure. Beyond automotive applications, platinum is also widely used in electronics, medical devices, and chemical refining processes. In the medical field, platinum is a key material in pacemakers, cancer treatments, and surgical instruments due to its biocompatibility. Additionally, innovations in nanotechnology are leading to new uses for platinum in advanced computing and high-performance materials, further boosting its industrial significance.What Market Forces Are Influencing Platinum Production and Supply?

The platinum market is heavily influenced by mining challenges, geopolitical factors, and labor strikes, particularly in major producing countries like South Africa, which accounts for nearly 70% of global supply. Political instability, power shortages, and labor disputes often disrupt production, leading to supply shortages that impact global prices. Additionally, platinum mining is capital-intensive, requiring significant investments in infrastructure and processing facilities. Recycling has emerged as a critical component of the supply chain, with secondary platinum recovery from old catalytic converters and electronic waste playing an increasingly important role. Meanwhile, platinum's status as a store of value is attracting growing investor interest, with exchange-traded funds (ETFs) and bullion markets driving speculative demand. With central banks and institutional investors diversifying their portfolios, platinum's role as a strategic asset is gaining momentum.What Are the Key Growth Drivers for the Platinum Market?

The growth in the platinum market is driven by several factors. The increasing demand for cleaner transportation solutions, particularly with the rise of hydrogen fuel cell technology, is significantly boosting platinum consumption. Stricter global emission standards are also reinforcing the need for platinum in catalytic converters, especially in heavy-duty and commercial vehicles. Industrial applications, including electronics, chemical processing, and medical devices, are expanding the use of platinum in high-performance and life-saving technologies. Additionally, the surge in investment demand, fueled by economic uncertainties and inflationary pressures, is driving platinum prices upward. The ongoing exploration of new platinum deposits, alongside advances in recycling technologies, is expected to contribute to future supply stabilization. As sustainability initiatives and technological advancements continue to evolve, platinum is positioned as a critical material in the global shift toward cleaner energy and advanced industrial solutions.Report Scope

The report analyzes the Platinum market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Source (Primary, Secondary); Application (Automotive, Jewelry, Industrial, Investment).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Primary Source segment, which is expected to reach US$9.3 Billion by 2030 with a CAGR of a 5.5%. The Secondary Source segment is also set to grow at 7.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.2 Billion in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $2.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Platinum Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Platinum Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Platinum Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as African Rainbow Minerals, Anglo American Platinum Limited, Asahi Holdings, Inc., Chimet SpA, Eastern Platinum and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 257 companies featured in this Platinum market report include:

- African Rainbow Minerals

- Anglo American Platinum Limited

- Asahi Holdings, Inc.

- Chimet SpA

- Eastern Platinum

- Eurasia Mining PLC

- Heesung PMTech

- Heraeus Holding

- Hindustan Platinum Pvt. Ltd

- Impala Platinum Holdings Limited

- Implats Platinum Limited

- Johnson Matthey

- Nihon Material Co. Ltd

- Norilsk Nickel

- Northam Platinum Limited

- Sibanye-Stillwater

- Vale SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- African Rainbow Minerals

- Anglo American Platinum Limited

- Asahi Holdings, Inc.

- Chimet SpA

- Eastern Platinum

- Eurasia Mining PLC

- Heesung PMTech

- Heraeus Holding

- Hindustan Platinum Pvt. Ltd

- Impala Platinum Holdings Limited

- Implats Platinum Limited

- Johnson Matthey

- Nihon Material Co. Ltd

- Norilsk Nickel

- Northam Platinum Limited

- Sibanye-Stillwater

- Vale SA

Table Information

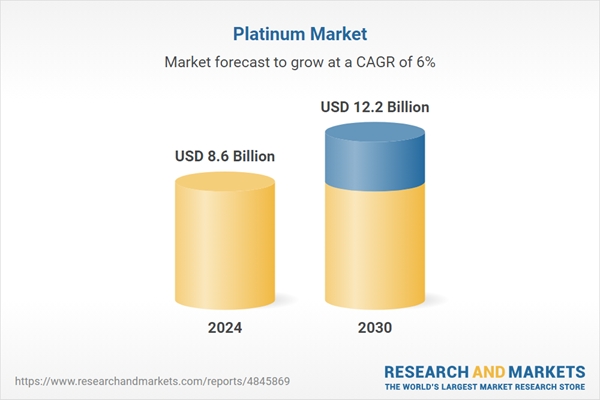

| Report Attribute | Details |

|---|---|

| No. of Pages | 494 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.6 Billion |

| Forecasted Market Value ( USD | $ 12.2 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |