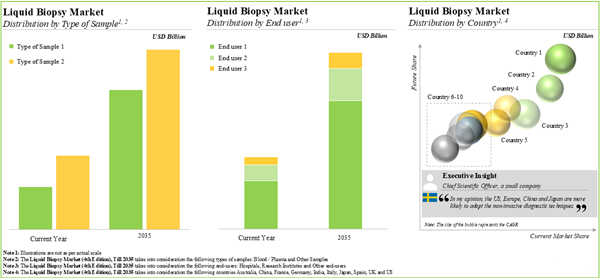

The global liquid biopsy market is estimated to grow from USD 6.09 billion in the current year to USD 29.8 billion by 2035, at a CAGR of 15.53% during the forecast period to 2035.

Liquid Biopsy Market: Growth and Trends

Cancer remains the second leading cause of the death, after cardiovascular diseases, occurring worldwide. Early screening of cancer helps in finding and curing the disease even before the symptoms are observed, and the disease is in a curable stage. Further, it allows to improve the survival rate in patients. Owing to the growing burden of cancer, the demand for non-invasive diagnostics has observed a surge in the past few years.

In the recent past, liquid biopsy has emerged as a viable technique for cancer detection. The past decade has witnessed substantial innovation in liquid biopsy platforms that have resulted in increased regulatory approvals for minimally invasive blood based liquid biopsy tests. These tests use blood samples or other bodily fluids, such as plasma or urine to identify various circulating biomarkers, including cell free DNA, circulating tumor DNA and extracellular vesicles. Driven by lucrative investments, ongoing research and development efforts, and increased involvement of prominent players, the liquid biopsy market is anticipated to witness significant growth in the foreseen future.

Liquid Biopsy Market: Key Insights

The report delves into the current state of the liquid biopsy market and identifies potential growth opportunities within the industry. Some key findings from the report include:

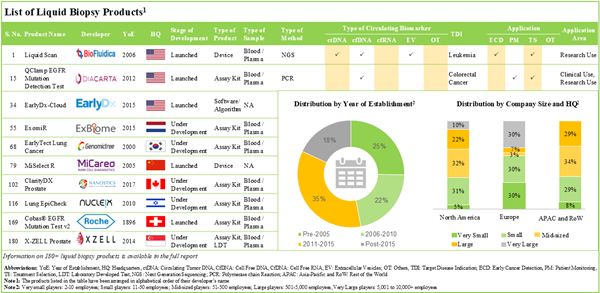

- Over 180 liquid biopsy products are commercially available / being developed by various stakeholders; of these, ~45% use next generation sequencing techniques for the detection of various cancer indications.

- Close to 160 liquid biopsy products comprise of assay kits and laboratory developed tests; of these, ~55% have the capability to detect circulating tumor DNA biomarkers.

- Over the past five years, ~110 partnerships have been established by liquid biopsy product manufacturers; of these, ~20% were established for the development of liquid biopsy product / technology.

- Having realized the opportunity in this domain, several investors have invested around USD 7.3 billion (across over 125 funding instances) in the past nine years.

- Driven by the growing burden of cancer and increasing investments, the market for liquid biopsy and other non-invasive cancer diagnostics is poised to witness significant growth in the foreseeable future.

- The liquid biopsy market is projected to grow at a CAGR of ~15%, till 2035; the forecasted opportunity is likely to be distributed across various disease indications and biomarkers.

- The growing demand for different non-invasive techniques is anticipated to drive the growth of the liquid biopsy market; the market growth is likely to be the fastest in North America and Asia-Pacific.

Liquid Biopsy Market: Key Segments

Early Cancer Diagnosis Segment is Likely to Dominate the Liquid Biopsy Market During the Forecast Period

Based on the application, the market is segmented into early cancer diagnosis, patient monitoring and recurrence monitoring. At present, early cancer diagnosis holds the maximum share of the liquid biopsy market. This trend is likely to remain the same in the coming decade.

Breast Cancer Occupies the Largest Share of the Liquid Biopsy Market

Based on the target disease indication, the market is segmented into breast cancer, gastric cancer, ovarian cancer, leukemia, head and neck cancer, cervical cancer, lung cancer, brain cancer, colorectal cancer, bladder cancer, liver cancer, melanoma, nasopharyngeal cancer, oesophagus cancer, pancreatic cancer, prostate cancer, sarcoma and thyroid cancer. Currently, breast cancer captures the highest proportion of the liquid biopsy market. It is worth highlighting that the liquid biopsy market for leukemia is likely to grow at a relatively higher CAGR.

Circulating tumor DNA is the Preferred Biomarkers of the Liquid Biopsy Market

Based on the type of circulating biomarker, the market is segmented into cell free DNA, cell free RNA, circulating tumor DNA, exosomes and others circulating biomarkers. At present, circulating tumor DNA holds the maximum share of the liquid biopsy market. It is worth highlighting that the liquid biopsy market for exosomes is likely to grow at a relatively higher CAGR.

Blood Segment is Likely to Dominate the Liquid Biopsy Market During the Forecast Period

Based on the type of sample, the market is segmented into blood and other samples. At present, blood samples hold the maximum share of the liquid biopsy market. This trend is likely to remain the same in the coming decade.

Currently, Hospitals / Laboratories Occupies the Largest Share of the Liquid Biopsy Market

Based on the end-users, the market is segmented into hospitals / laboratories, research institutes and other end-users. It is worth highlighting that, currently, hospitals / laboratories hold a larger share of the liquid biopsy market. This trend is unlikely to change in the near future.

Next-Generation Sequencing Segment is the Fastest Growing Segment of the Liquid Biopsy Market During the Forecast Period

Based on the type of technique, the market is segmented into polymerase chain reaction and next generation sequencing. At present, polymerase chain reaction holds the maximum share of the liquid biopsy market. It is worth highlighting that the liquid biopsy market for next generation sequencing is likely to grow at a relatively higher CAGR.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe and Asia-Pacific. The majority share is expected to be captured by players based in North America. It is worth highlighting that the majority share is expected to be captured by players based in North America.

The market sizing and opportunity analysis has been segmented across the following parameters:

Application

- Early Cancer Diagnosis

- Patient Monitoring

- Recurrence Monitoring

Target Disease Indication

- Breast Cancer

- Gastric Cancer

- Ovarian Cancer

- Leukemia

- Head and Neck Cancer

- Cervical Cancer

- Lung Cancer

- Brain Cancer

- Colorectal Cancer

- Bladder Cancer

- Liver Cancer

- Melanoma

- Nasopharyngeal cancer

- Oesophagus Cancer

- Pancreatic Cancer

- Prostate cancer

- Sarcoma

- Thyroid Cancer

Type of Circulating Biomarker

- Cell Free DNA

- Cell Free RNA

- Circulating Tumor DNA

- Exosomes

- Others Circulating Biomarkers

Type of Sample

- Blood

- Other Samples

End-user

- Hospitals

- Research Institutes

- Other end-users

Type of Technique

- Polymerase Chain Reaction

- Next Generation Sequencing

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

Sample Players in the Liquid Biopsy Market, Profiled in the Report Include:

- Amoy Diagnostics

- ArcherDX

- Biocartis

- Cell Search

- CellMax Life

- Datar Cancer Genetics

- DiaCarta, EONE-DIAGNOMICS

- Exosome Diagnostics

- GeneCast Biotechnology

- Integrated DNA Technologies

- Lucence

- MDNA Life Sciences

- Miltenyi Biotec

- NeoGenomics

- ONCODE Scientific

- OncoDNA

- QIAGEN

- PANAGENE

- Personal Genome Diagnostics

- Predicin

- ScreenCell

- Tecan

- Thermo Fisher Scientific

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Director, Mid-sized Company, US

- Innovation Director, Mid-sized Company, Spain

- Founder and Medical Director, Small Company, Australia

- Founder and Chief Executive Officer, Small Company, India

- Chief Executive Officer, Small Company, Australia

- Chairman, Small Company, US

- Founder, President and Chief Technology Officer, Small Company, US

- Former Founder, Small Company, US

- Former Chief Executive Officer and Co-founder, Small Company, US

- Former Chief Executive Officer, Mid-sized Company, US

- Chief Operating Officer and Co-Founder, Small Company, Canada

- Chief Medical Officer, Mid-sized Company, US

- Chief Scientific Officer, Small Company, Sweden

- Chief Scientific Officer, Mid-sized Company, US

- Former Marketing Director, Mid-sized Company, Belgium

- Former Sales and Marketing Manager, Small Company, Italy

- Former Strategic Technology Advisor, Small Company, Australia

Liquid Biopsy Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the liquid biopsy market, focusing on key market segments, including application, target disease indication, type of circulating biomarker, type of sample, end-user, stage of development, type of product, type of technique, application area and key geographical regions.

- Market Landscape: A comprehensive evaluation of liquid biopsy products, considering various parameters, such as stage of development, type of product, type of sample, type of technique, type of circulating biomarker, target disease indication, application and application area. In addition, it provides a list of players engaged in manufacturing liquid biopsy products, along with the information on their year of establishment, company size (based on number of employees), location of headquarters (region), location of headquarters (country),most active players (in terms of number of liquid biopsy products).

- Non-Invasive Cancer Screening and Diagnosis: An overview on the need for non invasive cancer diagnostics and their importance; it also features different imaging techniques, screening assays and advanced approaches used for diagnosis of cancer along with their advantages and disadvantages.

- Company Profiles: In-depth profiles of key industry players manufacturing liquid biopsy products, focusing on company overviews, financial information (if available), product portfolio, recent developments and an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2020, based on several parameters, such as year of partnership, type of partnership, type of partner, type of circulating biomarker, target disease indication, most active players. This section also highlights the regional distribution of partnership activity in this market.

- Funding and Investment Analysis: A detailed evaluation of the investments made in the liquid biopsy domain, encompassing seed financing, venture capital, capital raised from IPOs, secondary offerings, grants / awards, other equity and debt financing, based on several parameters, such as year of investment, amount invested, type of funding, type of circulating biomarker, target disease indication, application area, geography, most active players (in terms of number of funding instances and amount invested) and leading investors (in terms of number of funding instances).

- Product Competitiveness Analysis: A comprehensive competitive analysis of liquid biopsy products, examining factors, such as supplier strength, product competitiveness and company size.

- Big Pharma Analysis: A comprehensive examination of various initiatives focused on liquid biopsy products undertaken by major pharmaceutical companies. This analysis covers various relevant parameters, such as number of initiatives, type of initiative, stage of development, type of product, type of circulating biomarker, target disease indication, application and application area.

- Key Acquisition Targets: A detailed analysis of the key acquisition targets, taking into consideration the historical trend of the acquisition activity of the players that have acquired other firms. It offers a means for other industry stakeholders to identify potential acquisition targets.

- Other Non-Invasive Cancer Diagnostics: A detailed overview of the various non invasive diagnostic tests other than liquid biopsies, being manufactured by various companies for cancer screening and early detection.

- Market Impact Analysis: The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting the market growth.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amoy Diagnostics

- ArcherDX

- Biocartis

- Cell Search

- CellMax Life

- Datar Cancer Genetics

- DiaCarta, EONE-DIAGNOMICS

- Exosome Diagnostics

- GeneCast Biotechnology

- Integrated DNA Technologies

- Lucence

- MDNA Life Sciences

- Miltenyi Biotec

- NeoGenomics

- ONCODE Scientific

- OncoDNA

- QIAGEN

- PANAGENE

- Personal Genome Diagnostics

- Predicin

- ScreenCell

- Tecan

- Thermo Fisher Scientific

Methodology

LOADING...