The COVID-19 outbreak negatively impacted the non-invasive fat reduction market due to a halt in nonelective procedures during the pandemic. The market's growth was also impacted due to the disruption in the supply chain during lockdowns and a delay in the delivery of essential products required for the development of non-invasive fat reduction technology. However, after the easing of lockdown restrictions, there has been a surge of patients adopting aesthetic procedures. For instance, according to the International Society of Plastic Surgery (ISAPS) 2021 report, the number of non-surgical fat reduction procedures conducted globally was 560,464 in 2020, indicating a 21.1% increase compared to the previous year. Though the market was severely impacted during the initial phases of the pandemic, it started to recover after the easing of government regulations, growing at a normal pace.

The increasing adoption of non-invasive fat reduction procedures, growing prevalence of obesity, rising demand for minimally invasive procedures, and growing awareness of health risks are the major factors driving the market's growth. The increasing prevalence of obesity is one of the major factors propelling market growth. For instance, according to the World Obesity Federation 2022, about 1 billion people globally, including 1 in 5 women and 1 in 7 men, will be living with obesity by 2030. This figure indicates that there is a high burden of obesity in the world, which is likely to augment the growth of the market over the forecast period. The combination of non-invasive fat reduction treatment using high-focus ultrasound (HIFU), endermology, mesotherapy, and laser reduces resistant fat that does not respond to current treatment modalities of diet, exercise, and pharmacotherapy, as well as reduces body fat percentage. Thus, non-invasive fat reduction procedures are considered one of the effective treatments for obesity. Therefore, increasing cases of obesity are anticipated to boost the market over the forecast period.

The increasing number of initiatives from key market players for the launch of innovative cool sculpting devices may also propel the market over the forecast period. For instance, in January 2022, INDIBA launched ReBorn, a new and revolutionary fat loss device in the Spanish market. With its unique power LED technology, ReBorn can target fat cells while leaving surrounding tissue unaffected. It destroys adipocytes while leaving the skin unharmed. It also uses a proprietary cooling system to make treatments for patients much safer and more comfortable. In January 2021, Allergan Aesthetics, an AbbVie company, launched CoolSculpting Elite, a fat reduction system with applicators designed to complement the body's natural curves. CoolSculpting Elite is an FDA-approved device to treat visible fat bulges in different areas of the body. Hence, innovative product launches are expected to bolster the market's growth, along with the rising adoption of new devices in performing aesthetic procedures.

However, high treatment costs and side effects of laser are likely to hinder the market's growth over the forecast period.

Key Market Trends

Ultrasound Fat Removal Technology Segment is Expected to Witness Significant Growth During the Forecast Period

Ultrasound fat removal or ultrasonic liposuction is a type of fat loss procedure that liquefies fat cells before their removal. It is done by combining an ultrasound with ultrasonic waves to target fat cells. Ultrasound-assisted liposuction is considered to be more precise and much safer as it preserves surrounding nerves.The significance of ultrasound technology in non-invasive fat reduction is expected to boost the segment's growth over the forecast period. For instance, according to a study published in PLOS One in April 2021, aerobic exercise in combination with focused ultrasound cavitation is more effective in redcuing abdominal and intrahepatic fat, making it a superior option. Therefore, the importance of ultrasound technology in fat reduction to treat diseases such as non-alcoholic fatty liver disease is expected to drive the segment's growth.

Increasing adoption of minimally invasive procedures is one of the major factors that may propel the segment's growth over the forecast period. Key market players are launching a number of ultrasound fat removal devices, thus driving the segment's growth. For instance, in April 2021, Alma launched Alma PrimeX for non-invasive fat removal procedures. PrimeX is Alma’s proprietary combination of ultrasound and radiofrequency technology selectively affecting adipose tissue and reducing fat thickness.

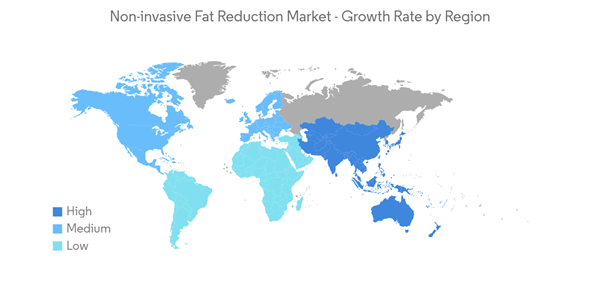

North America is Expected to Hold a Significant Share in the Market During the Forecast Period

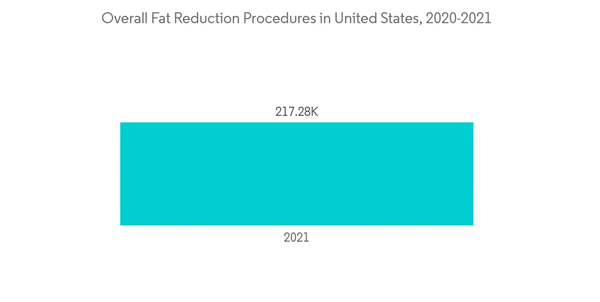

The North American market is growing due to factors such as the rising cases of obesity and the increasing adoption of minimally invasive procedures. For instance, according to the American Society of Plastic Surgeons (ASPS) 2022 report, non-invasive fat reduction surgery stood third among the top 5 minimally invasive surgeries in the United States during 2021-2022. In addition, according to the Aesthetic Plastic Surgery National Databank Statistics 2021, 22,513 non-invasive fat reduction surgeries were performed in the United States. Therefore, such a huge demand for non-invasive fat reduction surgeries in the United States is expected to bolster the market during the forecast period.According to the World Obesity Federation report published in March 2022, the estimated prevalence of obesity in the United States is likely to be 47% by 2030, with 64 million women and 61 million men in the United States likely to be obese by 2030. Thus, the huge prevalence of obesity in the country is one of the key contributors to the market's growth.

Key product launches, high concentration of market players or manufacturers, and acquisitions and partnerships among major players in the United States are some of the factors driving the growth of the non-invasive fat reduction market in the country. For instance, in September 2022, MedSpa Partners expanded to a third US state by partnering with Bodify. Bodify is solely focused on non-invasive body contouring and is known worldwide as a center of excellence for body contouring with CoolSculpting procedures. Such company developments are anticipated to drive the growth of the market in the United States and North America.

Competitive Landscape

The non-invasive fat reduction market is moderately competitive in nature, with several companies operating globally and regionally. The competition in the market is due to the rising initiatives from key market players, the increasing adoption of technologically advanced products, and growing partnerships among market players. Some of the players operating in the market include Cutera Inc., Zeltiq Aesthetics Inc., Bausch Health Companies, Venus Concept, Alma Lasers, and Candela Corporation.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cutera Inc.

- AbbVie Inc. (Allergan Aesthetics)

- Bausch Health Companies

- Venus Concept

- Alma Lasers

- Cynosure Inc.

- Candela Corporation

- Lumenis Ltd

- Fotona

- Sciton Inc.

- Solta Medical

- Lynton Lasers Ltd