The market was impacted by the COVID-19 outbreak in 2020. Polyvinyl alcohol is used in co-binder, optical brightener, and precise sizing at the press while manufacturing paper. The paper manufacturing sector was negatively affected due to the pandemic; considering the demand drop from various paper-consuming segments like newspapers, thus the market demand also decreased. However, the increasing packaging usage in the food industry significantly increased, stimulating the need for the polyvinyl alcohol market.

Key Highlights

- Over the short term, increasing usage in the construction industry materials, including caulks and sealants, joint compounds like joint cement and drywall mud, and dispersible powders such as grouts and mortars, coupled with the expanding food packaging industry are expected to drive the market’s growth.

- Hazardous health effects while manufacturing polyvinyl alcohol is hindering the market’s growth.

- The growing opportunity in the electronics sector for manufacturing devices like a transistor, which needs high dielectric permittivity, is likely to act as an opportunity for the market in the coming years.

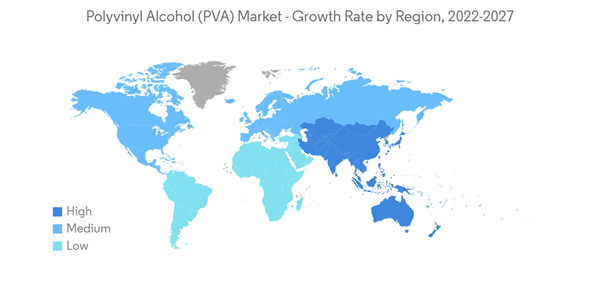

- Asia-Pacific dominated the global market, with the most significant consumption in countries such as India, China, etc.

Polyvinyl Alcohol (PVA) Market Trends

Food Packaging to Dominate the Market

- In the food packaging industry, PVA is used as a binding and coating agent, a film coating agent, in applications where moisture barrier or protection properties are required.

- PVA protects the active food ingredients from moisture, oxygen, and other environmental components, while simultaneously masking their taste and odor. It allows for easy handling of finished products and facilitates ingestion and swallowing. Furthermore, the viscosity of PVA provides for the application of the PVA coating agents to tablets, capsules, and other forms to which film coatings are typically applied at relatively high solids.

- Emerging demographic conditions, new customer demands, growing purchasing powers in emerging markets, increasing emphasis on sustainable, easy-to-use packaging, and out-of-home consumption trends are expected to drive the food packaging market in the future.

- The United States and China are among the most significant food packaging industry while emerging economies such as Africa are expected to register substantial growth through the forecast period.

- The food and beverage industry is essential to the US economy. E-commerce and delivery are also gaining popularity. With the high internet penetration rate and the rising demand for convenience, consumers are increasingly ordering groceries and other food products online.

- Services like Amazon Fresh are increasing, allowing consumers to shop for fresh produce without leaving the house. Moreover, in New York, bakery manufacturing accounts for most food and beverage processing plants, followed by wineries and animal slaughter and processing plants.

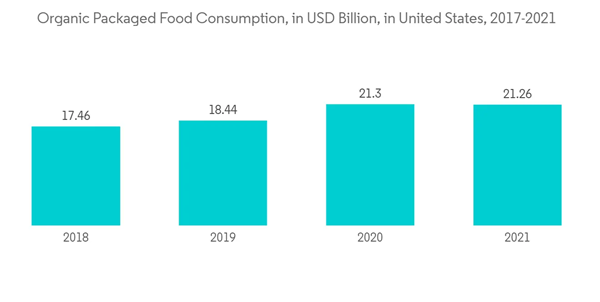

- The rising demand for organic food across the globe will also boost the consumption of food packaging. The United States is the largest consumer of packaged organic food. The country accounted for USD 21.3 billion in 2021, representing about 40% of the global market, with a per capita expenditure of USD 71.40.

- In 2021, food spending by US consumers, businesses, and government entities totaled USD 2.12 trillion, recovering from a sharp decline in 2020 in which the food market was disrupted by the COVID-19 pandemic and the recession in which food spending totaled USD 1.81 trillion.

- In September 2022, China produced approximately 11.6 million metric tons of processed paper and cardboard, up from 10.74 million metric tons in September 2021. This growth is attributed to the growing awareness about environmental protection and increasing packaging usage for recyclable food. The value is expected to grow in the coming years, thus leading to increased demand for the polyvinyl alcohol market.

- Therefore, the above factors are expected to impact the market in the coming years significantly.

China to Dominate the Asia-Pacific Region

- In Asia-Pacific, China is the largest economy in terms of GDP. In 2021, the country witnessed about 8.1% growth in its GDP, despite having trade disturbance caused due to its trade war with the United States.

- Globally, China dominated the PVA market with the country's growing construction and textile industry. China ranks at the top in the global textile manufacturing industry. In 2021, China's exports of textiles, apparel, and clothing accessories increased to USD 189.3 billion in the first seven months of 2022, registering a growth rate of 17.35% year-on-year, and garments and clothing accessories export reached USD 99.6 billion, which was 18.5% higher than the same period of last year. Therefore, this significantly enhanced the market's growth for polyvinyl alcohol.

- The textile industry in China is going through a tough restructuring, with enormous production capacity, oversupply at home, high labor costs, and rising global protectionism, which eroded its competitiveness. Still, the country continues to dominate, both in the textile manufacturing industries and continue being the major exporter of textiles through the years to come.

- In January 2022, China produced about 5.7 billion m of clothing fabric and reached 3.81 billion m in October 2022, with consistent production above three billion m throughout 2022, which impacted the market demand for the polyvinyl alcohol (PVA) market.

- The Chinese food packaging industry is expected to register significant growth, owing to the rising health and wellness consciousness, expanding middle-class population, and rising consumer purchasing power.

- The construction industry is expanding significantly, with the country expected to be among the top contributors to global construction spending (along with the United States and India) through 2023.

- Therefore, the above factors are expected to impact the market in the coming years significantly.

Polyvinyl Alcohol (PVA) Market Competitor Analysis

The polyvinyl alcohol (PVA) market is fragmented in nature. Some significant players include Sekisui Chemical Co. Ltd, Mitsubishi Chemical Corporation, SNP Inc., Merck KGaA, and Kuraray Europe GmbH, among others (not in any particular order).Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Increasing Use in the Construction Industry

4.1.2 Growing Food Packaging Industry

4.2 Restraints

4.2.1 Hazardous Health Effects While Manufacturing

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Grade

5.1.1 Fully Hydrolyzed

5.1.2 Partially Hydrolyzed

5.1.3 Sub-partially Hydrolyzed

5.1.4 Low Foaming Grades

5.1.5 Other Grades (Tactified Grades and Fine Particle Grades)

5.2 End User

5.2.1 Food Packaging

5.2.2 Paper Manufacturing

5.2.3 Construction

5.2.4 Electronics

5.2.5 Textile Manufacturing

5.2.6 Other End User Industries

5.3 Geography

5.3.1 Asia-Pacific

5.3.1.1 China

5.3.1.2 India

5.3.1.3 Japan

5.3.1.4 South Korea

5.3.1.5 Rest of Asia-Pacific

5.3.2 North America

5.3.2.1 United States

5.3.2.2 Canada

5.3.2.3 Mexico

5.3.3 Europe

5.3.3.1 Germany

5.3.3.2 United Kingdom

5.3.3.3 Italy

5.3.3.4 France

5.3.3.5 Rest of Europe

5.3.4 South America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.4.3 Rest of South America

5.3.5 Middle-East and Africa

5.3.5.1 Saudi Arabia

5.3.5.2 South Africa

5.3.5.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%)**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Anhui Wanwei Group

6.4.2 Astrra Chemicals

6.4.3 Chang Chun Group

6.4.4 Japan Vam & Poval Co. Ltd

6.4.5 Kemipex

6.4.6 Kuraray Europe GmbH

6.4.7 Merck KGaA

6.4.8 Mitsubishi Chemical Corporation

6.4.9 Polysciences Inc.

6.4.10 Sekisui Chemical Co. Ltd

6.4.11 SNP Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Growing Opportunity in the Electronics Sector

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anhui Wanwei Group

- Astrra Chemicals

- Chang Chun Group

- Japan Vam & Poval Co. Ltd

- Kemipex

- Kuraray Europe GmbH

- Merck KGaA

- Mitsubishi Chemical Corporation

- Polysciences Inc.

- Sekisui Chemical Co. Ltd

- SNP Inc.