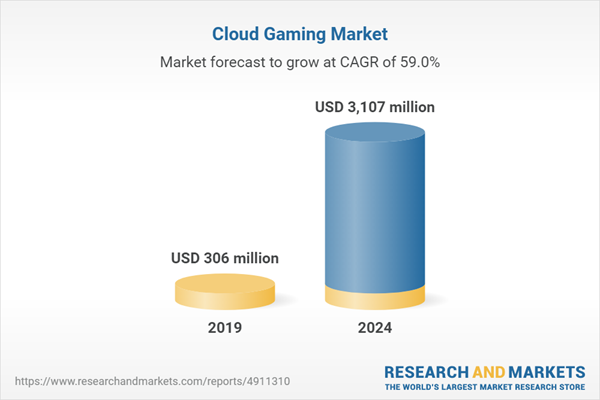

The cloud gaming market is estimated to be valued at USD 306 million in 2019 and is projected to reach USD 3,107 million by 2024, at a CAGR of 59.0%. Commercialization of 5G, rise in a number of gamers, and upsurge of immersive and competitive gaming on mobile are among the major driving factors for the growth of the cloud gaming market. An increase in the number of internet users is also expected to fuel the growth of the cloud gaming market.

Conventional consoles and PCs require regular up-gradation to play games, which leads to additional expenses. Gaming platform service is gaining more traction as it provides direct streaming of games to the user’s personal computer (PC), smartphones, tablets, or consoles with the help of remote servers. This approach bypasses the requirement to purchase additional gaming hardware devices and allows users to play various resource-intensive games irrespective of the specifications of their devices.

Smartphones to witness highest growth for cloud gaming in coming years

Smartphones have been a significant contributor to the accelerated growth of the games market. In the current scenario, cloud gaming is facing issues such as bandwidth, video compression, and latency. Bandwidth is an unavoidable factor when looking at cloud gaming on a large scale as it requires a huge amount of data transmitted in a short span of time. The advent of 5G promises to change the game by increasing speeds and reliability, making room for cloud gaming. With 4G, the latency is around 50 milliseconds, which makes smooth gameplay extremely challenging due to lags, whereas, 5G has a latency of 1-4 milliseconds.

Video streaming to account for largest share of cloud gaming market during forecast period

Video streaming renders all graphics, compresses resulting in videos and streams to the clients in the cloud on remote CPUs/GPUs. It does not require high computing power on the device to play a game that acts as a major driver video streaming in the cloud gaming market.

Casual gamer segment is expected to grow at highest CAGR in cloud gaming market from 2019 to 2024

Commercialization of 5G and introduction of AAA games at a lower cost is expected to be a major driver for the growth of the cloud gaming market for casual gamers. The introduction of 5G-based smartphones will lead to high speed and low latency properties, creating a wider adoption of cloud gaming for casual gamers.

APAC to hold largest share of cloud gaming market during the forecast period

Japan is expected to be a major contributor to the cloud gaming market in APAC. The rising adoption of smartphones & gaming consoles and constantly surging online population have created a plethora of opportunities to spur the size of the market. In addition, the cost-effective nature of the cloud gaming platforms is promoting its usage across various new customer classes that vary in investing in gaming systems due to their expensive nature.

The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 = 25%, Tier 2 = 45%, and Tier 3 = 30%

- By Designation: C-level Executives = 50%, Manager Level = 30%, and Others = 20%

- By Region: North America = 20%, Europe = 40%, APAC = 30%, and RoW = 10%

The major players in cloud gaming market are NVIDIA (US), Intel (US), Google (US), Microsoft (US), Amazon (US), Advanced Micro Devices (US), Sony (Japan), IBM (US), Tencent (China), Alibaba (China), Jump Gaming (US), Blade (US), Paperspace (US), Vortex (Poland), PlayGiga (Spain), Activision (US), Ubitus (Taiwan), Playkey (US), Loudplay (Russia), Electronic Arts (US), Hatch (Finland), and Blacknut (France).

Research Coverage:

This research report categorizes the cloud gaming based on offering, device type, solution type, gamer type, end-user industry, and geography. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the cloud gaming market and forecasts the same till 2024.

Key Benefits of Buying the Report

The report would help leaders/new entrants in this market in the following ways:

1. This report segments the cloud gaming market comprehensively and provides the closest market size projection for all subsegments across different regions.

2. The report helps stakeholders understand the pulse of the market and provides them with information on key drivers, restraints, challenges, and opportunities for market growth.

3. The report helps stakeholders to understand the value-chain of the cloud gaming market along with recent case studies.

4. This report would help stakeholders understand their competitors better and gain more insights to improve their position in the business. The competitive landscape section includes product launch, acquisition, collaboration, expansion, and partnership.

Table of Contents

1 Introduction

1.1 Study Objectives

1.2 Market Definition & Scope

1.3 Inclusions and Exclusions

1.4 Study Scope

1.4.1 Markets Covered

1.4.2 Years Considered

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in Cloud Gaming Market

4.2 Market, By Offering

4.3 Market, By Device Type

4.4 Market, By Solution Type

4.5 Market, By Gamer Type

4.6 Market, By Geography

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Commercialization of 5G Technology

5.2.1.2 Rise in Number of Gamers

5.2.1.3 Upsurge in Immersive and Competitive Gaming on Mobile Devices

5.2.1.4 Increase in Number of Internet Users

5.2.2 Restraints

5.2.2.1 Multiplayer Cloud Gaming Server Allocation Issues

5.2.3 Opportunities

5.2.3.1 Increased Popularity of Cloud Gaming in Multiplayer Scenarios

5.2.3.2 Greater Utilization of Cloud Gamification

5.2.3.3 Improved Cross-Platform Gaming Experience

5.2.4 Challenges

5.2.4.1 Limited Awareness Regarding Cloud Gaming Platforms

5.2.4.2 Fluctuating Internet Speed in Developing Countries

5.3 Cloud Gaming Use Cases

5.3.1 5G

5.3.2 AR/VR

5.4 Value Chain Analysis

6 Cloud Gaming Market, By Offering

6.1 Introduction

6.2 Infrastructure

6.2.1 Compute

6.2.1.1 GPUs are Essential for Ultra Low-Latency and Streaming of Most Demanding Games

6.2.2 Memory

6.2.2.1 Advantages Such as High Density With Simplistic Architecture, Low Latency, and High Performance have Made DRAM core Memory Technology

6.2.3 Storage

6.2.3.1 Low Power Consumption Makes Ssds Ideal for Data Center Storage

6.3 Gaming Platform Services

6.3.1 Content Services

6.3.1.1 Content Services are Cloud Streaming Services That Connect Users to Powerful Gaming Servers

6.3.2 Pc Services

6.3.2.1 Pc Services Enable Streaming of Fully-Featured Virtual Gaming Pc to Users’ Device

7 Cloud Gaming Market, By Device Type

7.1 Introduction

7.2 Smartphones

7.2.1 With Rapid Rise in Mobile Gaming, Cloud Gaming is Expected to Attain Significant Market Traction in Coming Years

7.3 Tablets

7.3.1 Owing to Better Computing Power Capabilities, Tablets Offer Enhanced Gaming Experience Than Other Devices

7.4 Gaming Consoles

7.4.1 Gaming Console Renders Favourable Opportunities to Cloud Gaming Providers By Enhancing Their Product Capabilities

7.5 Personal Computers & Laptops

7.5.1 Gamers Prefer Personal Computers Or Laptops to Explore Cloud Gaming as They Offer Immersive Gaming

7.6 Smart Televisions

7.6.1 Smart Television Manufacturers are Constantly Upgrading to Improve Product Features for Cloud Gaming

7.7 Head-Mounted Displays

7.7.1 AR & VR Devices are Rapidly Being Adopted in Gaming Landscape to Experience Immersive Gaming Experiences

8 Cloud Gaming Market, By Solution Type

8.1 Introduction

8.2 Video Streaming

8.2.1 Video Streaming Eliminates Requirement for Any Additional Hardware Devices

8.3 File Streaming

8.3.1 File Streaming Enables Downloading of Game Content in Form of Bits

9 Cloud Gaming Market, By Gamer Type

9.1 Introduction

9.2 Casual Gamers

9.2.1 Casual Gamers Actively Seek Free of Charge Games

9.3 Avid Gamers

9.3.1 Avid Gamers are Regular Players, But Not Professionals

9.4 Hardcore Gamers

9.4.1 Hardcore Gamers Tend to Invest Lot of Time and Money in Gaming

10 Geographic Analysis

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Video game companies based in the US are making efforts to ensure uninterrupted video game streaming to users

10.2.2 Canada

10.2.2.1 Growth of Gaming Market is Expected to Boost Market Growth Cloud Gaming in Canada

10.2.3 Mexico

10.2.3.1 Mexico is Expected to Witness Highest Growth Rate in Market in North America

10.3 Europe

10.3.1 Germany

10.3.1.1 France is a highly competitive market as it is coming up with varied start-ups for cloud gaming

10.3.2 UK

10.3.2.1 UK is Internationally Prominent Start-Up Hub for Innovative Games and Entrepreneurial Developers

10.3.3 France

10.3.3.1 France is Highly Competitive Market as It is Coming Up With Varied Start-Ups for Cloud Gaming

10.3.4 Italy

10.3.4.1 Italian Market is Excepted Be Propelled By Heavy Investments in Establishing High-Speed and Robust Networks

10.3.5 Rest of Europe

10.3.5.1 Spain and Sweden have Captured Huge Market Share and Created Immersive Gaming Experiences for Players Worldwide

10.4 APAC

10.4.1 China

10.4.1.1 China is Expected to Witness Highest CAGR in Coming Years

10.4.2 Japan

10.4.2.1 Japan Held Largest Market Size of Cloud Gaming in 2019

10.4.3 South Korea

10.4.3.1 Commercialization of 5G is Expected to Boost Market

10.4.4 Australia

10.4.4.1 Australia is an Early Adopter of Cloud Gaming

10.4.5 Rest of APAC

10.4.5.1 Gaming Market is Propelled By Rising Younger Population, Higher Disposable Incomes, and Increasing Number of Smartphone Users

10.5 RoW

10.5.1 Middle East & Africa

10.5.1.1 Middle East & Africa have a high potential of adopting cloud gaming

10.5.2 South America

10.5.2.1 Rise in Number of Smartphones is Expected to Fuel Growth of Market

11 Competitive Landscape

11.1 Overview

11.2 Market Ranking Analysis, 2019

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Innovators

11.3.3 Dynamic Differentiators

11.3.4 Emerging Companies

11.4 Strength of Product Portfolio (25 Companies)

11.5 Business Strategy Excellence (25 Companies)

11.6 Competitive Situation and Trends

11.6.1 Partnerships, Collaborations, and Agreements

11.6.2 Product Launches

11.6.3 Expansions

11.6.4 Acquisitions

12 Company Profiles

12.1 Key Players

12.1.1 NVIDIA

12.1.2 Intel Corporation

12.1.3 Google

12.1.4 Microsoft

12.1.5 Amazon

12.1.6 Advanced Micro Devices

12.1.7 Sony

12.1.8 IBM

12.1.9 Tencent

12.1.10 Alibaba

12.2 Right-To-Win

12.3 Other Key Players

12.3.1 Blade

12.3.2 Blacknut

12.3.3 Paperspace

12.3.4 Vortex

12.3.5 Playgiga

12.3.6 Activision

12.3.7 Ubitus

12.3.8 Playkey

12.3.9 Loudplay

12.3.10 Electronic Arts

12.3.11 Hatch Entertainment

12.3.12 Jump Gaming

13 Appendix

13.1 Discussion Guide

13.2 Knowledge Store: Subscription Portal

13.3 Available Customizations

13.4 Related Report

13.5 Author Details

List of Tables

Table 1 Cloud Gaming Market, By Offering, 2017-2024 (USD Million)

Table 2 Cloud Gaming Infrastructure Market, By Type, 2017-2024 (USD Million)

Table 3 Cloud Gaming Infrastructure Market, By Solution Type, 2017-2024 (USD Million)

Table 4 Cloud Gaming Infrastructure Market, By Region, 2017-2024 (USD Million)

Table 5 Cloud Gaming Infrastructure Market in North America, By Country, 2017-2024 (USD Thousand)

Table 6 Cloud Gaming Infrastructure Market in Europe, By Country, 2017-2024 (USD Thousand)

Table 7 Cloud Gaming Infrastructure Market in APAC, By Country, 2017-2024 (USD Thousand)

Table 8 Cloud Gaming Infrastructure Market in RoW, By Region, 2017-2024 (USD Thousand)

Table 9 Cloud Gaming Platform Services Market, By Type, 2017-2024 (USD Million)

Table 10 Cloud Gaming Platform Services Market, By Solution Type, 2017-2024 (USD Million)

Table 11 Cloud Gaming Platform Services Market, By Region, 2017-2024 (USD Million)

Table 12 Cloud Gaming Platform Services Market in North America, By Country, 2017-2024 (USD Thousand)

Table 13 Cloud Gaming Platform Services Market in Europe, By Country, 2017-2024 (USD Thousand)

Table 14 Cloud Gaming Platform Services Market in APAC, By Country, 2017-2024 (USD Thousand)

Table 15 Cloud Gaming Platform Services Market in RoW, By Region, 2017-2024 (USD Thousand)

Table 16 Cloud Gaming Market, By Device Type, 2017-2024 (USD Million)

Table 17 Market for Smartphones, By Region, 2017-2024 (USD Million)

Table 18 Market for Smartphones, By Solution Type, 2017-2024 (USD Million)

Table 19 Market for Smartphones, By Gamer Type, 2017-2024 (USD Million)

Table 20 Market for Tablets, By Region, 2017-2024 (USD Thousand)

Table 21 Market for Tablets, By Solution Type, 2017-2024 (USD Million)

Table 22 Market for Tablets, By Gamer Type, 2017-2024 (USD Million)

Table 23 Market for Gaming Consoles, By Region, 2017-2024 (USD Million)

Table 24 Market for Gaming Consoles, By Solution Type, 2017-2024 (USD Million)

Table 25 Market for Gaming Consoles, By Gamer Type, 2017-2024 (USD Million)

Table 26 Market for Personal Computers & Laptops, By Region, 2017-2024 (USD Million)

Table 27 Market for Personal Computers & Laptops, By Solution Type, 2017-2024 (USD Million)

Table 28 Market for Personal Computers & Laptops, By Gamer Type, 2017-2024 (USD Million)

Table 29 Market for Smart Televisions, By Region, 2017-2024 (USD Thousand)

Table 30 Market for Smart Televisions, By Solution Type, 2017-2024 (USD Thousand)

Table 31 Market for Smart Televisions, By Gamer Type, 2017-2024 (USD Thousand)

Table 32 Market for Head-Mounted Displays, By Region, 2017-2024 (USD Thousand)

Table 33 Market for Head-Mounted Displays, By Solution Type, 2017-2024 (USD Thousand)

Table 34 Market for Head-Mounted Displays, By Gamer Type, 2017-2024 (USD Thousand)

Table 35 Market, By Solution Type, 2017-2024 (USD Million)

Table 36 Market for Video Streaming, By Offering, 2017-2024 (USD Million)

Table 37 Market for Video Streaming, By Device Type, 2017-2024 (USD Thousand)

Table 38 Market for Video Streaming, By Region, 2017-2024 (USD Million)

Table 39 Market for Video Streaming in North America, By Country, 2017-2024 (USD Thousand)

Table 40 Market for Video Streaming in Europe, By Country, 2017-2024 (USD Thousand)

Table 41 Market for Video Streaming in APAC, By Country, 2017-2024 (USD Thousand)

Table 42 Market for Video Streaming in RoW, By Region, 2017-2024 (USD Thousand)

Table 43 Market for File Streaming, By Offering, 2017-2024 (USD Million)

Table 44 Market for File Streaming, By Device Type, 2017-2024 (USD Thousand)

Table 45 Market for File Streaming, By Region, 2017-2024 (USD Million)

Table 46 Market for File Streaming in North America, By Country, 2017-2024 (USD Thousand)

Table 47 Market for File Streaming in Europe, By Country, 2017-2024 (USD Thousand)

Table 48 Market for File Streaming in APAC, By Country, 2017-2024 (USD Thousand)

Table 49 Market for File Streaming in RoW, By Region, 2017-2024 (USD Thousand)

Table 50 Cloud Gaming Market, By Gamer Type, 2017-2024 (USD Million)

Table 51 Market for Casual Gamers, By Region, 2017-2024 (USD Million)

Table 52 Market for Avid Gamers, By Region, 2017-2024 (USD Million)

Table 53 Market for Hardcore Gamers, By Region, 2017-2024 (USD Thousand)

Table 54 Market, By Region, 2017-2024 (USD Million)

Table 55 Market in North America, By Country, 2017-2024 (USD Million)

Table 56 Market in North America, By Offering, 2017-2024 (USD Million)

Table 57 Market in North America, By Device Type, 2017-2024 (USD Thousand)

Table 58 Market in North America, By Solution Type, 2017-2024 (USD Million)

Table 59 Infrastructure Market in North America, By Gamer Type, 2017-2024 (USD Million)

Table 60 Market in US, By Offering, 2017-2024 (USD Million)

Table 61 Market in US, By Solution Type, 2017-2024 (USD Million)

Table 62 Market in Canada, By Offering, 2017-2024 (USD Thousand)

Table 63 Market in Canada, By Solution Type, 2017-2024 (USD Thousand)

Table 64 Market in Mexico, By Offering, 2017-2024 (USD Thousand)

Table 65 Market in Mexico, By Solution Type, 2017-2024 (USD Thousand)

Table 66 Market in Europe, By Country, 2017-2024 (USD Million)

Table 67 Market in Europe, By Offering, 2017-2024 (USD Million)

Table 68 Market in Europe, By Device Type, 2017-2024 (USD Thousand)

Table 69 Market in Europe, By Solution Type, 2017-2024 (USD Million)

Table 70 Market in Europe, By Gamer Type, 2017-2024 (USD Million)

Table 71 Market in Germany, By Offering, 2017-2024 (USD Million)

Table 72 Market in Germany, By Solution Type, 2017-2024 (USD Million)

Table 73 Market in UK, By Offering, 2017-2024 (USD Million)

Table 74 Market in UK, By Solution Type, 2017-2024 (USD Million)

Table 75 Market in France, By Offering, 2017-2024 (USD Million)

Table 76 Market in France, By Solution Type, 2017-2024 (USD Million)

Table 77 Market in Italy, By Offering, 2017-2024 (USD Thousand)

Table 78 Market in Italy, By Solution Type, 2017-2024 (USD Thousand)

Table 79 Market in Rest of Europe, By Offering, 2017-2024 (USD Million)

Table 80 Market in Rest of Europe, By Solution Type, 2017-2024 (USD Million)

Table 81 Market in APAC, By Country, 2017-2024 (USD Million)

Table 82 Market in APAC, By Offering, 2017-2024 (USD Million)

Table 83 Market in APAC, By Device Type, 2017-2024 (USD Thousand)

Table 84 Market in APAC, By Solution Type, 2017-2024 (USD Million)

Table 85 Market in APAC, By Gamer Type, 2017-2024 (USD Million)

Table 86 Market in China, By Offering, 2017-2024 (USD Million)

Table 87 Market in China, By Solution Type, 2017-2024 (USD Million)

Table 88 Market in Japan, By Offering, 2017-2024 (USD Million)

Table 89 Market in Japan, By Solution Type, 2017-2024 (USD Million)

Table 90 Market in South Korea, By Offering, 2017-2024 (USD Million)

Table 91 Market in South Korea, By Solution Type, 2017-2024 (USD Million)

Table 92 Market in Australia, By Offering, 2017-2024 (USD Thousand)

Table 93 Market in Australia, By Solution Type, 2017-2024 (USD Thousand)

Table 94 Market in Rest of APAC, By Offering, 2017-2024 (USD Thousand)

Table 95 Market in Rest of APAC, By Solution Type, 2017-2024 (USD Thousand)

Table 96 Market in RoW, By Region, 2017-2024 (USD Million)

Table 97 Market in RoW, By Offering, 2017-2024 (USD Million)

Table 98 Market in RoW, By Device Type, 2017-2024 (USD Thousand)

Table 99 Market in RoW, By Solution Type, 2017-2024 (USD Million)

Table 100 Market in RoW, By Gamer Type, 2017-2024 (USD Million)

Table 101 Market in Middle East & Africa, By Offering, 2017-2024 (USD Million)

Table 102 Market in Middle East & Africa, By Solution Type, 2017-2024 (USD Million)

Table 103 Market in South America, By Offering, 2017-2024 (USD Thousand)

Table 104 Cloud Gaming Market in South America, By Solution Type, 2017-2024 (USD Thousand)

Table 105 Partnerships, Collaborations, and Agreements, 2018-2019

Table 106 Product Launches, 2018-2019

Table 107 Expansions, 2018-2019

Table 108 Acquisitions, 2018-2019

List of Figures

Figure 1 Cloud Gaming Market Segmentation

Figure 2 Cloud Gaming Market: Research Design

Figure 3 Cloud Gaming: Bottom-Up Approach

Figure 4 Cloud Gaming: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market, By Offering, 2019 vs 2024 (USD Million)

Figure 7 Market, By Device Type, 2019 vs 2024 (USD Million)

Figure 8 Market, By Solution Type, 2019 vs 2024 (USD Million)

Figure 9 Market, By Gamer Type, 2019 vs 2024 (USD Million)

Figure 10 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 11 Commercialization of 5G to Drive Growth of Market

Figure 12 Gaming Platform Services to Account for Larger Market Size of Cloud Gaming in 2019

Figure 13 Market for Smartphones is Expected to Witness Highest CAGR During Forecast Period

Figure 14 Market for Video Streaming to Hold Larger Size in 2019

Figure 15 Market for Casual Gamers to Witness Highest Growth During Forecast Period

Figure 16 Market in China to Witness Highest CAGR During Forecast Period

Figure 17 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Market Drivers and Their Impact

Figure 19 Internet Users Traffic, 2010-2017

Figure 20 Market Restraint and Its Impact

Figure 21 Market Opportunities and Their Impact

Figure 22 Market Challenges and Their Impact

Figure 23 Market, By Offering

Figure 24 APAC is Expected to Account for the Largest Market Size of Cloud Gaming Platform Services in 2019

Figure 25 Market, By Device Type

Figure 26 Video Streaming to Witness Higher Growth in Market for Gaming Consoles During Forecast Period

Figure 27 APAC to Hold Largest Size of Market for Smart Televisions in 2024

Figure 28 Market, By Solution Type

Figure 29 Market for Gaming Platform Services to Witness Higher CAGR During Forecast Period

Figure 30 Cloud Gaming Market, By Gamer Type

Figure 31 APAC is Expected to Lead Market for Hardcore Gamers in Coming Years

Figure 32 China is Expected to Witness Highest CAGR in Coming Years

Figure 33 North America: Snapshot of Cloud Gaming Market

Figure 34 Europe: Snapshot of Cloud Gaming Market

Figure 35 APAC: Snapshot of Cloud Gaming Market

Figure 36 RoW: Snapshot of Cloud Gaming Market

Figure 37 Companies Adopted Product Launches and Partnerships & Acquisitions as Key Growth Strategies From 2018 to 2019

Figure 38 Ranking of Key Players in Market, 2019

Figure 39 Market (Global) Competitive Leadership Mapping, 2018

Figure 40 Market Evaluation Framework: Expansions, Partnerships, and Acquisitions have Fueled Growth of Market From 2018 to 2019

Figure 41 NVIDIA: Company Snapshot

Figure 42 Intel Corporation: Company Snapshot

Figure 43 Google: Company Snapshot

Figure 44 Microsoft: Company Snapshot

Figure 45 Amazon: Company Snapshot

Figure 46 Advanced Micro Devices (AMD): Company Snapshot

Figure 47 Sony: Company Snapshot

Figure 48 IBM: Company Snapshot

Figure 49 Tencent: Company Snapshot

Figure 50 Alibaba: Company Snapshot

Companies Mentioned

- Activision

- Advanced Micro Devices

- Alibaba

- Amazon

- Blacknut

- Blade

- Electronic Arts

- Hatch Entertainment

- IBM

- Intel Corporation

- Jump Gaming

- Loudplay

- Microsoft

- NVIDIA

- Paperspace

- Playgiga

- Playkey

- Right-To-Win

- Sony

- Tencent

- Ubitus

- Vortex

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 167 |

| Published | January 2020 |

| Forecast Period | 2019 - 2024 |

| Estimated Market Value ( USD | $ 306 million |

| Forecasted Market Value ( USD | $ 3107 million |

| Compound Annual Growth Rate | 59.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |