The Global Bus Chassis Market Study provides a comprehensive analysis of the bus chassis industry, offering industry experts critical insights into market dynamics, technological advancements, and competitive strategies shaping this evolving sector. This study delves into the market's structure, segmentation, and key developments, with a focus on the competitive landscape to equip stakeholders with actionable intelligence for strategic decision-making.

Market Overview and Scope

The Global Bus Chassis Market Study examines the global market for bus chassis, defined as the foundational framework supporting bus bodies across various types and propulsion methods. The scope encompasses market segmentation by axle type (single axle and multi-axle), bus type (single decker, coach, double decker, and others), propulsion method (diesel, CNG, and electric), and geography (North America, South America, Europe, Middle East and Africa, and Asia Pacific). This segmentation enables a granular understanding of market trends and opportunities, addressing the needs of manufacturers, suppliers, and policymakers navigating this dynamic industry.Business and Technological Insights

The study analyzes key market drivers, such as increasing urbanization and demand for sustainable public transportation, alongside restraints like high production costs for electric chassis. Opportunities, including government incentives for green technologies, are explored, supported by a Porter’s Five Forces analysis and an industry value chain assessment. The technological outlook highlights advancements in lightweight materials and electric propulsion systems, which are redefining chassis design and performance standards. Policies and regulations, particularly emissions standards and electrification mandates, are also evaluated to provide a holistic view of the market's business landscape.Competitive Environment and Analysis

In the Global Bus Chassis Market Study, the competitive environment is a focal point, offering detailed insights into major players and their strategic initiatives. The study highlights recent developments from key market players, showcasing their efforts to strengthen market positions. For instance, Tata Motors has advanced its electric bus chassis portfolio with the launch of the Starbus EV chassis, designed for urban transit with enhanced battery efficiency and modular configurations. This development aligns with global sustainability goals and positions Tata Motors as a leader in the Asia Pacific region, particularly in India, where government-backed electrification programs are accelerating.Similarly, AB Volvo has made significant strides in the competitive landscape by introducing its BZL Electric chassis, optimized for single and double-decker buses. This chassis integrates advanced battery management systems and regenerative braking, catering to European markets with stringent emissions regulations. Volvo’s strategic focus on partnerships with battery suppliers and investments in R&D underscores its commitment to dominating the electric chassis segment. These developments reflect broader industry trends toward electrification and innovation, as outlined in the Global Bus Chassis Market Study’s competitive dashboard, which maps players’ strategies, market shares, and collaborative efforts.

The study also notes mergers and acquisitions, such as Daimler AG’s collaboration with local manufacturers in Asia to expand its multi-axle chassis production, enhancing cost efficiencies and market reach. Such moves highlight the competitive strategies employed to address regional demand variations and regulatory pressures. The Global Bus Chassis Market Study provides a market share analysis, revealing how players like Scania, MAN, and Hyundai Motor Company are leveraging technological advancements and strategic alliances to capture emerging opportunities in electric and CNG-powered chassis markets.

Regional and Segmental Analysis

The study segments the market geographically, covering key regions such as North America (USA, Canada, Mexico), Europe (Germany, France, UK, Spain), Asia Pacific (China, India, Japan, South Korea), and others. Each region’s market dynamics, including regulatory frameworks and infrastructure development, are analyzed to provide a comprehensive global perspective. By axle type, multi-axle chassis dominate heavy-duty applications, while single-axle chassis cater to lighter urban buses. Propulsion-wise, the electric segment is witnessing rapid growth, driven by innovations from companies like Tata Motors and AB Volvo, as detailed in the competitive analysis.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others).

Market Segmentation

By Axle Type

- Single Axle

- Multi-Axle

By Bus Type

- Single Decker

- Coach

- Double Decker

- Others

By Propulsion Method

- Diesel

- CNG

- Electric

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Indonesia

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Tata Motors

- AB Volvo

- Scania

- MAN

- Eicher

- Daimler AG

- Hino Motors, Ltd.

- Ashok Leyland

- Hyundai Motor Company

- Bus Tech Group

Table Information

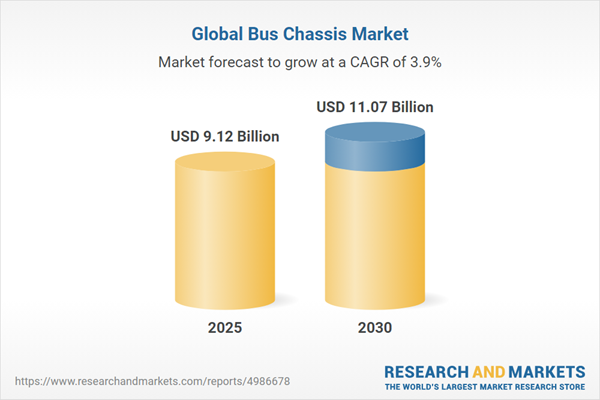

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 9.12 Billion |

| Forecasted Market Value ( USD | $ 11.07 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |