The COVID-19 pandemic negatively impacted the white oil market. To prevent the spread of the COVID-19 pandemic, many countries took a wide variety of restrictive measures, which had, in general, a negative effect on demand, and, thus, on industrial production in many areas. Moreover, the steel industry has been one of the major victims of this pandemic. Steel production witnessed a decline in 2020 due to production halts and decreased demand from various end-user industries because of the COVID-19 crisis. Similarly, the food and beverage industry was negatively affected due to significant disruptions in the supply chain.

Key Highlights

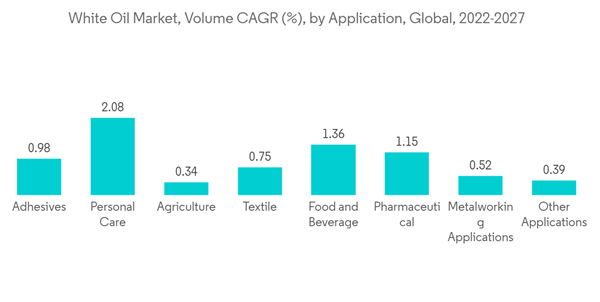

- Over the medium term, the major factors driving the growth of the white oil market are the growing demand from the cosmetics and personal care industry and the growing pharmaceutical industry.

- However, the availability of substitute products is acting as a restraint to the market studied.

- The potential usage of white oil in the food and beverage industry is expected to provide opportunities for the white oil market.

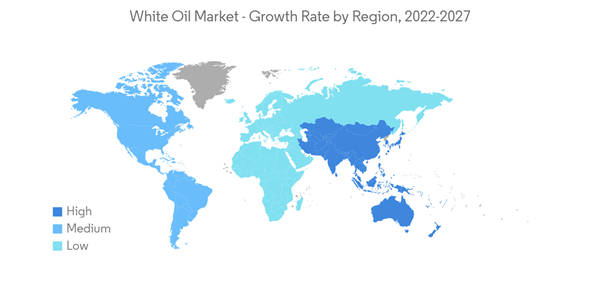

- The Asia-Pacific region is expected to dominate the global white oil market owing to the rapid growth of countries like China, India, and Japan.

White Oil Market Trends

Increasing Demand from Personal Care across the World

- White oils are an essential part of many cosmetic formulations. They are commonly used in almost all cosmetic and personal care products, from emulsions to anhydrous cosmetics, such as lip balm, baby oil, skincare, haircare products, creams, lotions, and emollients.

- White oil can be used to ease diaper rash and eczema irritation. The cosmetic industry also makes good use of liquid paraffin. The substance is used in various beauty products, including detergent creams, cold creams, hydrated creams, bronzed oils, and makeup products.

- In the United States, the revenue in the beauty and personal care market stood at USD 80.21 billion in 2021, of which USD 39.66 billion accounted for personal care products. These products include lotions, hair dyes, lipsticks, cosmetics, creams, deodorants, bath soaps, dental care products, shampoos, toothpaste, perfumes, UV filters, detergents, sunscreens, fragrances, and household items.

- According to Cosmetic Europe, the personal care association, Europe's 500 million consumers use cosmetic and personal care products daily to protect their health, enhance their well-being and boost their self-esteem. They range from antiperspirants, fragrances, makeup, and shampoos to soaps, sunscreens, toothpaste, and cosmetics.

- Key players, such as L'Oréal, P&G, Unilever, and Shiseidō, dominate the market for personal care products. According to the report by L'Oreal, the global beauty and personal care market revenue stood at USD 511 billion in 2021. It is anticipated to ascend to USD 784.6 billion in 2025.

- Thus, all the above factors are expected to drive the demand for white oil during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific dominated the market as the largest and fastest-growing market for white oil in 2021.

- China is the largest textile-producing and exporting country in the world. With its rapid growth over the last two decades, the Chinese textile industry has become one of the main pillars of the country's economy. China's top export goods are clothing accessories, textile yarns, and textile articles.

- According to the National Bureau of Statistics of China, the textile production volume in China accounted for 12.4 billion meters in the first four months of 2022, compared to 11.8 billion meters during the same period in the previous year.

- In China, more women are joining the workforce, thus driving the instinct to look good. Interestingly, the cosmetics industry has also witnessed a surge in demand among men, owing to factors such as awareness, the importance of grooming, and a greater number of women in the workplace.

- Products with natural ingredients, especially fruit- and plant-based products, are in high demand. L'Oreal group is coming up with a series of product introductions and a rollout of customized social initiatives in China. Such trends are driving the demand for white oil in the country.

- The country's most extensive application of white oils in India is hair oil, a part of the cosmetics and personal care industry. The overall cosmetics and pharmaceutical industries account for around three-fourths of the white oil consumption in the country.

- India is also the second-largest producer of garments and textiles globally and the fifth-largest textile exporter, with a 23% contribution to India's GDP and 12% to exports in 2021. In 2021, India's textile and apparel exports stood at USD 30.4 billion.

- Owing to such trends in various industries in Asia, the demand for white oils is likely to increase during the forecast period.

White Oil Industry Overview

The global white oil market is partially consolidated with many healthy competitions in the market. The major companies are China Petrochemical & Chemical Corporation (Sinopec), HF Sinclair Corporation, Calumet Specialty Products Partners, Savita Oil Technologies Limited, and Exxon Mobil Corporation (not in any particular order).Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Growing Demand from Cosmetics and Personal Care Industry

4.1.2 Growing Pharmaceutical Industry

4.2 Restraints

4.2.1 Availability of Substitute Products

4.2.2 Other Restraints

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Buyers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree Of Competition

4.5 Distribution Channel Analysis

4.6 Factors Affecting Purchase Decisions

5 MARKET SEGMENTATION (Market Size in Volume)

5.1 By Application

5.1.1 Plastics and Elastomers

5.1.2 Adhesives

5.1.3 Personal Care

5.1.4 Agriculture

5.1.5 Textile

5.1.6 Food and Beverage

5.1.7 Pharmaceutical

5.1.8 Metalworking Applications

5.1.9 Other Applications

5.2 By Grade

5.2.1 Technical/Industrial Grade

5.2.2 Pharmaceutical Grade

5.3 By Base Oil

5.3.1 Group I

5.3.2 Group II

5.3.3 Group III

5.3.4 Naphthenic

5.4 By Viscosity

5.4.1 Low

5.4.2 Medium

5.4.3 High

5.5 By Geography

5.5.1 Asia-Pacific

5.5.1.1 China

5.5.1.2 India

5.5.1.3 Japan

5.5.1.4 Rest of Asia-Pacific

5.5.2 North America

5.5.2.1 United States

5.5.2.2 Canada

5.5.2.3 Rest of North America

5.5.3 Europe

5.5.3.1 Germany

5.5.3.2 United Kingdom

5.5.3.3 Italy

5.5.3.4 Rest of Europe

5.5.4 Rest of the World

5.5.4.1 South America

5.5.4.2 Middle East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%) Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Bharat Petroleum Corporation Ltd. (BPCL)

6.4.2 Calumet Specialty Products Partners

6.4.3 China Petrochemical & Chemical Corporation (Sinopec)

6.4.4 Columbia Petro Chem Pvt. Ltd.

6.4.5 Exxon Mobil Corporation

6.4.6 H&R Group

6.4.7 HF Sinclair Corporation

6.4.8 Nynas AB

6.4.9 Oxiteno (Indorama Ventures)

6.4.10 Renkert Oil

6.4.11 Shell PLC

6.4.12 Sasol

6.4.13 Savita Oil Technologies Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Potential Usage in the Food and Beverage Industry

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bharat Petroleum Corporation Ltd. (BPCL)

- Calumet Specialty Products Partners

- China Petrochemical & Chemical Corporation (Sinopec)

- Columbia Petro Chem Pvt. Ltd.

- Exxon Mobil Corporation

- H&R Group

- HF Sinclair Corporation

- Nynas AB

- Oxiteno (Indorama Ventures)

- Renkert Oil

- Shell PLC

- Sasol

- Savita Oil Technologies Limited