The COVID-19 pandemic has impacted all industries, including livestock vaccines. Supply disruption and shortages of veterinary medicines have been observed in several countries, primarily due to the temporary lockdowns of manufacturing sites, export bans, and increased demand for COVID-19 medicines. Governments are taking measures to mitigate the supply of medicines. Certain specific and precautionary guidelines were given to veterinary professionals to treat companion animals during the COVID-19 pandemic by the Centers for Disease Control and Prevention in July 2020. Additionally, many government authorities, such as the Centers for Disease Control and Prevention, recommended veterinary hospitals and clinics prioritize urgent and emergency visits and procedures. This initiative by such national bodies may reduce the dependence on and usage of diagnostic equipment in veterinary healthcare management. Hence, a slight short-term negative impact is witnessed on the companion livestock vaccine market, primarily due to the reduced veterinary visits during the COVID-19 outbreak.

Globally, the livestock sector is witnessing an increased demand for livestock products such as meat and dairy products. Though this trend has traditionally been evident in developed countries across North America and Europe, demand for livestock products has increased significantly in emerging Asia Pacific and Latin American countries over the past decade.

This can primarily be attributed to the growing population in these regions, coupled with the rapid urbanization and economic growth. The repeated outbreaks of certain diseases in livestock animals are expected to support growth of the veterinary vaccines market by increasing the focus on animal health and preventive animal healthcare approaches among stakeholders in the livestock sector.

The coronavirus spreads from animal to animal with contact or aerosol transmission, thus infecting other animals. Incidents such as COVID-19 infected farmed minks were reported in numerous nations such as the U.S. and Denmark during late 2020. Thereby, such incidents have triggered the need for the COVID-19 animal vaccine. As a result, the market players are getting involved to manufacture veterinary vaccines against COVID-19. For instance, Zoetis is in process of donating over 11,000 doses of its experimental COVID-19 vaccine to help protect the health and well-being of Zoo animals. On the other hand, in April 2021, Russia has registered the world's first Covid-19 vaccine called Carnivac-Cov for animals. Thus, the growing cases of COVID-19 infections in domestic and wild animals will promote the acceptance of animal vaccines for safeguarding preventive animal health, thus soaring the industry growth.

In June 2021, the Government of the United Kingdom announced the establishment of a United Kingdom. Animal Vaccine Manufacturing and Innovation Centre in Surrey, intending to accelerate the vaccine development for livestock and to control the spread of viral diseases including coronavirus. The United Kingdom government will contribute USD 24.79 million while the Bill & Melinda Gates Foundation will contribute USD 19.43 million to establish this center. Thereby, the research initiatives adopted by the market players, growing COVID-19 infection cases in animals, and government support will enable the significant expansion of the livestock vaccines industry.

In addition, in an attempt to retain share and diversify the product portfolio, major players are frequently opting for various strategies such as mergers and acquisitions, partnerships, and new product launches. For instance, in February 2021, Ceva partnered with the French National Research Institute for Agriculture, Food, and Environment (INRAE) for R&D in the prevention of infectious diseases from animal origin and improvement of animal health. Similarly, in January 2021, Zoetis launched the Poulvac Procerta HVT-IBD vaccine for the protection of poultry against Infectious Bursal Disease (IBD).

However, high storage cost of vaccines and lack of veterinarians and skilled farm workers to administer vaccines is expected to restrain the Livestock Vaccines market growth.

Livestock Vaccines Market Trends

Poultry Vaccine is Expected to Cover a Large Share of the Livestock Vaccines Market

Poultry includes domesticated birds kept by humans for their eggs, their meat, or their feathers. Poultry is the most produced livestock in the world. The world's average stock of chickens is nearly19 a billion, or three per person, according to statistics from the United Nations Food and Agriculture Organisation. Moreover, the production of poultry is expected to increase in the future.In December 2020, a bird flu outbreak was reported in 9 Indian states. Due to this, the price of poultry products has gone down, severely affecting the overall livestock industry. According to the Poultry Federation of India, chicken consumption has reduced to 50%, with a drop of 30% in the prices, as of December 2020. While most Asian countries have adopted vaccination policies, India has primarily resorted to the culling of birds. Punjab and Haryana state governments are close to legalizing vaccinations, which is expected to positively impact the segment's growth.

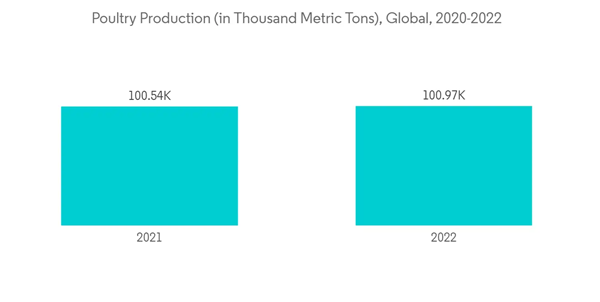

According to the United States Department of Agriculture, Foreign Agricultural Service, January 2022 report 'Livestock and Poultry: World Markets and Trade,' global chicken meat production for 2022 is forecast at 100.8 million tons, virtually unchanged from October. Similarly, global chicken meat exports for 2022 are raised by 1% to 13.4 million tons.

Therefore with the increasing poultry production, the number of poultry affected by the diseases is also expected to increase. To counter this, the farmers are expected to opt for preventive vaccines to prevent future economic loss. This is expected to help the growth of the Livestock Vaccines Market.

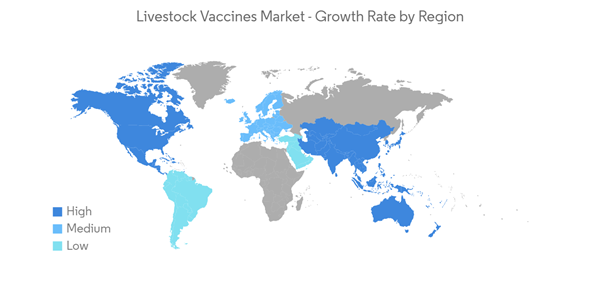

North America is Expected to Dominate the Market

North America is expected to grow due to the increasing adoption of veterinary vaccines for quality food products and for better animal health.As per the January 2022 report by the United States Department of Agriculture and the Food and Agriculture Organization, cattle and calves on feed for the slaughter market in the United States for all feedlots totaled 14.7 million head in January 2022. The inventory is up slightly from the January 2021 total of 14.7 million heads. Cattle on feed in feedlots with a capacity of 1,000 or more head accounted for 81.9 percent of the total cattle on feed on January 1, 2022, up slightly from the previous year.

Additionally, in the United States, advancements in vaccine development include the development of live vector vaccines, non-replicating recombinant antigen vaccines, nucleic acid-mediated vaccines, and live-gene-deleted vaccines. For instance, in January 2020, Zoetis, a leading animal health company, further expanded its poultry vaccine portfolio by introducing Poulvac Procerta HVT-ND, a vectored recombinant vaccine for protection against Newcastle and Marek's disease viruses.

Moreover, the North American countries of the United States and Canada have a developed and well-structured health care system. These systems also encourage research and development. These policies encourage global players to enter the US and Canada. Hence, as a result, these countries enjoy the presence of many global market players. As high demand is met by the presence of global players in the region, the market is further expected to increase.

Livestock Vaccines Industry Overview

The livestock vaccines market is fairly competitive and consists of several major players. The majority of livestock vaccines are being manufactured by the global key players. Market leaders with more funds for research and better distribution system have established their position in the market. Moreover, Asia-pacific is witnessing an emergence of some small players due to the rise of awareness and the livestock industry in the region. This has also helped the market grow.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AniCon Labor GmbH

- Animal Science Products Inc.

- Biovac

- Boehringer Ingelheim International GmbH

- ADL BIONATUR SOLUTIONS, S.A.

- Ceva Sante Animale

- Elanco

- Merck & Co.

- Phibro Animal Health Corporation

- Zoetis Inc