The market was impacted adversely during the initial phase of the pandemic due to the lockdowns and strict restrictions, globally. The number of transplants decreased during the initial phase of the pandemic. For instance, as per the article 'The Global Impact of COVID-19 on Solid Organ Transplantation: Two Years into a Pandemic' published in July 2022, over the course of 2020, there was an estimated 16% global decline in transplant activity. Kidney transplant and live donor programs were particularly affected, with significant negative spillover consequences for patients on the waiting list. In addition, as per the source mentioned above, even though the protocols were created and vaccination is undergoing to prevent the patients from the COVID-19 infection, transplant programs and solid organ transplant recipients continue to face challenges. Thus, the studied market was hampered during the pandemic phase. However, there was an increase in kidney diseases and cardiovascular diseases globally during the pandemic. This is anticipated to create demand for organ transplantations, creating opportunities for artificial organs and bionics during the later phase of the pandemic. Thus, COVID-19 has had a significant impact on the studied market.

Factors such as the rising incidence of organ failures, high incidence of road accidents leading to amputations, scarcity of organ donors, and technological advancements are anticipated to drive market growth over the forecast period. For instance, as per the article 'Organ donation in India - There is light at the end of the tunnel' published in April 2022, it is estimated that almost 5 lakh Indians face organ failure every year, and yet less than 2%-3% of them receive a life-saving transplant. This burden of organ failure is anticipated to create opportunities for artificial organs and the bionics market in India. Thus, this is anticipated to contribute to the global artificial organs and bionics market growth over the forecast period.

Moreover, according to the article 'Barriers to the donation of living kidneys for kidney transplantation' published in February 2022, the prevalence of kidney failure is increasing globally among end-stage kidney disease (ESKD) patients, but there is a lack of organ donors in most of the countries globally. Hence, as a kidney transplant is an important alternative for ESKD patients, the demand for artificial kidneys is increasing. This is expected to further fuel the market's growth.

Therefore, owing to the aforementioned factors, the market under study is expected to witness growth over the forecast period. However, strict regulations, compatibility issues, and malfunctions of the products are expected to hinder the market's growth.

Artificial Organs and Bionics Market Trends

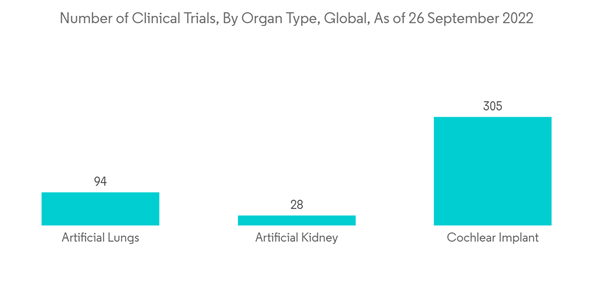

Artificial Kidney by Artificial Organ Segment is anticipated to Grow Over the Forecast Period

An artificial kidney is a wearable dialysis machine. An individual with end-stage renal disease may use a wearable artificial kidney on a daily or even a continuous basis. The increasing incidence and prevalence of renal failure globally are expected to drive segment growth.Kidney failure has become a global burden in recent years. As per the data published by Medindia in June 2022, annually, almost 66% of kidney failure occurs due to hypertension or diabetes, and nearly 7.85 million people are suffering from chronic kidney failure in India. Additionally, as per the source mentioned above, the incidence of kidney failure (or chronic kidney disease) has doubled over the past decade in the country. This shows a disease burden in the country. Thus, it is expected to create demand for the adoption of artificial kidneys for patient survival, fueling the segment's growth.

Furthermore, according to the National Kidney Foundation data updated in 2022, globally, more than 2 million people currently receive treatment with dialysis or a kidney transplant for survival. Additionally, as per the source mentioned above, more than 80% of renal failure patients are found in developed countries with widespread access to healthcare and sizable elderly populations. This shows a high burden of kidney failure worldwide. Thus, this is expected to increase the demand for artificial kidneys for patient survival. Thereby, driving the segment growth.

Therefore, owing to the aforementioned factors, the segment is expected to witness growth over the forecast period.

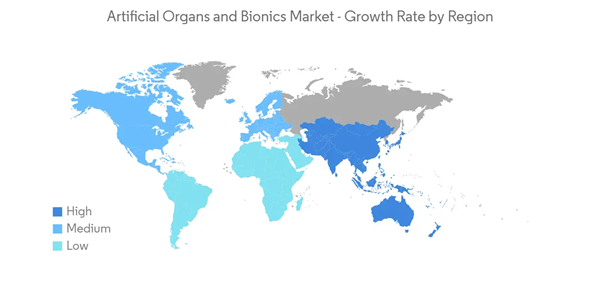

North America is Expected to Dominate the Artificial Organs and Bionics Market

Among the other regions, North America is anticipated to witness growth during the study period. Factors such as increasing serious accidents requiring amputations such as limbs, fingers, and hands, among others, are major contributors to the market growth in the region.According to the article 'Living Well After Amputation: Lessons in Innovation, Peer Support, and Health Policy' published in December 2021, aging, diabetes, and vascular disease are all predicted to cause an increase in the number of amputations in the United States. Additionally, as per the source mentioned above, 2.1 million people lost a limb in 2021, and 185,000 people have their limbs amputated annually in the country. This is further expected to increase the demand for artificial organs and bionics. Thereby, driving the market growth in the region.

Furthermore, according to data updated by the Canadian Institute for Health Information in December 2021, the living donor rate in 2020 was 12.9 donors per million population in Canada, which decreased by 21% from 2019 and is the lowest rate in the last 10 years. In addition, the source mentioned above also stated that a total of 41,670 Canadians (excluding Quebec) were living with ESKD in 2020 which increased from previous years. This increasing burden of ESKD and decreasing number of organ donors in Canada is driving the demand for artificial organs. Hence, driving the overall growth of the studied market in the region.

Therefore, owing to the factors mentioned above, North America is anticipated to dominate the market over the forecast period.

Artificial Organs and Bionics Industry Overview

The market for artificial organs and bionics is moderately competitive. The major players in the artificial organs and bionics market are Abiomed, Asahi Kasei Medical Co. Ltd, Baxter, Boston Scientific Corporation, Ekso Bionics Holdings Inc., Getinge AB, Medtronic, and Ossur, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abiomed Inc

- Asahi Kasei Medical Co., Ltd

- Baxter

- Berlin Heart GmbH

- Boston Scientific Corporation

- Cyberonics Inc.

- Ekso Bionics Holdings Inc.

- Ossur

- Getinge AB

- Medtronic

- Bornlife Prosthetic and Orthotic Inc.

- Sonova