Executive Summary and Market Analysis

The genetic testing services sector in North America is witnessing substantial expansion, primarily fueled by advancements in technology, a rising demand for personalized medicine, and an increasing emphasis on preventive healthcare. The United States stands out as a major player in this market, characterized by the widespread use of genetic testing for various applications, including cancer diagnosis, prenatal screening, and the identification of hereditary diseases. The presence of prominent companies such as 23andMe, Illumina, and LabCorp is further propelling market growth through continuous innovation and enhancements in testing technologies. Additionally, government initiatives supporting genomics research and increased healthcare funding are expected to significantly contribute to the market's growth, solidifying North America's position as a global leader in genetic testing services.Market Segmentation Analysis

The genetic testing services market can be segmented based on service type, disease, and service provider.- Service Type: The market is divided into several categories, including predictive testing, carrier testing, prenatal testing, newborn screening, diagnostic genetic testing, and others. In 2023, the predictive testing segment emerged as the largest contributor to the market.

- Disease: The market is also segmented by disease, including cancer, cardiovascular diseases, metabolic disorders, and other conditions. The cancer segment held the largest market share in 2023, reflecting the significant role of genetic testing in cancer risk assessment and management.

- Service Provider: The market is categorized into hospital-based laboratories, diagnostic laboratories, and other service providers. Hospital-based laboratories accounted for the largest share in 2023, highlighting their critical role in delivering genetic testing services.

Market Outlook

The increasing prevalence of genetic diseases globally is a major factor driving the demand for genetic testing services. Genetic disorders often present with rare and atypical symptoms, many of which are currently incurable. According to the World Health Organization (WHO) in 2021, approximately 10 out of every 1,000 individuals are affected by single-gene diseases, translating to an estimated 70 to 80 million people worldwide. The Global Genes organization reports that around 7,000 rare diseases and disorders have been identified, with new conditions being discovered regularly.Research from the University of Sheffield indicates that approximately 300 million people globally are living with genetic diseases. For instance, a 2022 report by MJH Life Sciences estimated that around 300,000 newborns are diagnosed with sickle cell disease each year, representing about 5% of the global population. Furthermore, a study published in August 2023 highlighted that 1 in 500 African Americans is affected by sickle cell disease, with about 1 in 12 carrying the autosomal recessive mutation.

This rising incidence of genetic diseases is a key driver for the growth of the genetic testing services market.

Country Insights

The North American genetic testing services market includes the United States, Canada, and Mexico, with the US holding the largest market share in 2023. According to the Centers for Disease Control and Prevention (CDC), approximately 1,603,844 new cancer cases were diagnosed in the US in 2020, resulting in 602,347 cancer-related deaths. Projections for 2023 estimate around 1,958,310 new cancer cases and 609,820 deaths. The International Agency for Research on Cancer anticipates that new cancer incidences could reach 30.2 million by 2040. Many cancers have a hereditary component, making genetic testing essential for assessing risk factors in individuals with a family history of cancer.The US Government Accountability Office reported in October 2021 that between 25 to 30 million Americans suffer from rare diseases, with nearly half of these patients being children. It is estimated that 80% of rare diseases are genetic in origin.

Genetic testing has become integral to the US healthcare system over the past few decades. As the adoption of genetic testing increases, there is a growing need to ensure the quality of tests conducted across the country. The Clinical Laboratory Improvement Amendments (CLIA) regulate genetic testing laboratories, ensuring compliance with quality control and assurance standards. Additionally, the US Food and Drug Administration (FDA) oversees the quality of genetic testing kits used by clinical laboratories.

The demand for genetic testing in the US is expected to continue growing, driven by its applications in cancer, autoimmune diseases, and infectious diseases. Innovations in genetic testing products, such as Avellino Labs' AvaGen genetic eye test and the FDA's approval of a genetic test for Fragile X Syndrome, illustrate the ongoing advancements in this field.

Company Profiles

Key players in the North American genetic testing services market include Eurofins Scientific SE, Exact Sciences Corp, Laboratory Corp of America Holdings, 23andMe Holding Co, Ambry Genetics Corp, Quest Diagnostics Inc, Illumina Inc, F. Hoffmann-La Roche Ltd, NeoGenomics Inc, Centogene NV, Ancestry Genomics Inc, Gene By Gene Ltd, SIVOTEC BioInformatics LLC, Progenesis, Fulgent Genetics, Inc, VERITAS INTERCONTINENTAL, and GeneDx, LLC. These companies are employing various strategies, including expansion, product innovation, and mergers and acquisitions, to enhance their market presence and offer innovative solutions to consumers.Table of Contents

Companies Mentioned

- Eurofins Scientific SE

- Exact Sciences Corp

- Laboratory Corp of America Holdings

- 23andMe Holding Co

- Ambry Genetics Corp

- Quest Diagnostics Inc

- Illumina Inc

- F. Hoffmann-La Roche Ltd

- NeoGenomics Inc

- Centogene NV

- Ancestry Genomics Inc

- Gene By Gene Ltd

- SIVOTEC BioInformatics LLC

- Progenesis

- Fulgent Genetics, Inc

- VERITAS INTERCONTINENTAL

- GeneDx, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | July 2025 |

| Forecast Period | 2023 - 2031 |

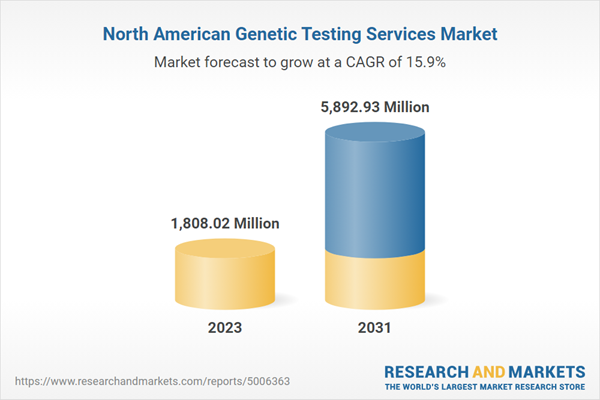

| Estimated Market Value in 2023 | 1808.02 Million |

| Forecasted Market Value by 2031 | 5892.93 Million |

| Compound Annual Growth Rate | 15.9% |

| Regions Covered | North America |

| No. of Companies Mentioned | 17 |