The current report covers the booming technology of digital therapeutics. It also investigates the current shift in trends away from conventional methods of treatment toward the advanced means offered by digital therapeutics. This report is an update of an earlier report of the same title but focuses on more in-depth information. This report offers a comprehensive analysis of the global digital therapeutics market. Segmentation is based on application and sales channels. Based on application, the market is segmented as diabetes, psychiatric and addiction, neurological, cardiovascular diseases, and others. Based on sales channel the market is segmented as business-to-consumer (B2C) and business-to-business (B2B). The regional markets covered are North America, Europe, Asia-Pacific, and the Rest of the World (RoW). For market estimates, data has been provided for 2019, 2020, and 2021 as the base year, 2022, and a forecast for 2027.

The report provides a detailed overview and analysis of the present and future global market for digital therapeutics. Industry growth drivers, restraints, and opportunities are also discussed in detail. The report also provides a competitive landscape, elaborative company profiles, and the impact of COVID-19 on the market. The report focuses on the companies that are developing and encouraging digital therapeutics technology and doing research to develop the technology further.

Report Includes

- A brief general outlook of the global market for digital therapeutics scenario

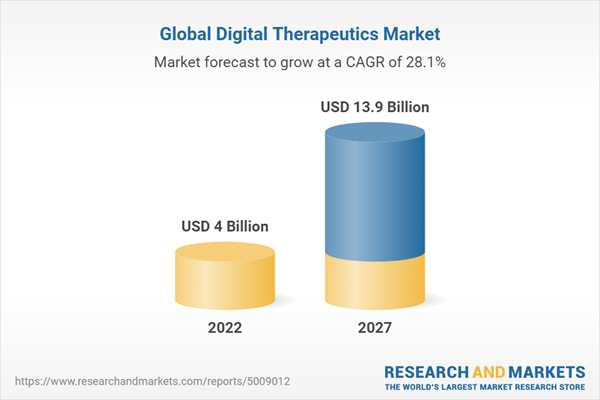

- Analyses of the global market trends, with market revenue data from 2019 to 2021, estimates for 2022, and projections of compound annual growth rates (CAGRs) through 2027

- Highlights of the current and upcoming market potential for digital therapeutics, and areas of focus to forecast this market into various segments and subsegments

- Updated information on market opportunities and drivers, key shifts and trends, regulations and industry specific challenges, and other factors that will shape this market demand in the coming years (2022-2027)

- Identification of the companies best positioned to meet the demand owing to their proprietary technologies, product launches, mergers and acquisitions, and other market strategic advantages

- Review of the technology landscape for digital therapeutics marketplace with emphasis on recently approved products as well as products under development or in different stages of clinical trials

- Profile descriptions of the market leading participants, including Big Health, Happify, Omada Health Inc., Pear Therapeutics and Welldoc

Table of Contents

Companies Mentioned

- Akili Interactive Labs Inc.

- Big Health

- Click Therapeutics

- Happify

- Omada Health Inc.

- Orexo Ab

- Pear Therapeutics

- Propeller Health

- Voluntis

- Welldoc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 61 |

| Published | November 2022 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 13.9 Billion |

| Compound Annual Growth Rate | 28.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |