COVID-19 had a significant impact on the growth of the market during the pandemic period due to the reduction of surgical procedures. This was mainly due to the temporary suspension and postponement of non-elective surgeries due to the lockdown restriction by various governments across the world. These scenarios during the initial phase of the pandemic impacted the demand for auto-transfusion systems, thereby impacting the market's growth. However, the resumption of surgeries after the relaxation of regulations led to the growing demand for autotransfusion systems, and the current market scenario is expected to drive the growth of the market over the forecast period.

The major factor attributing to the growth of the market is the increase in the number of surgical procedures which can be attributed to the growing prevalence of chronic disease and lifestyle diseases. For instance, as per a report published by Moncloa Palace in May 2022, about 4,781 transplants were performed in Spain in 2021, an increase of 8% compared to transplant activity in the previous year. Moreover, as per the NFHS statistics released in November 2021, in India, 3.2% of births were delivered by cesarean section in urban areas, while 17.6% of births were delivered by cesarean section in rural areas till 2021. Such high surgical volume is expected to drive the demand for autotransfusion systems, thereby contributing to the growth of the market. Furthermore, the scarcity of donated blood or allogeneic blood is also boosting the market's growth owing to the extensive use of autotransfusion systems as they are highly useful in the purification of a patient's blood. For instance, according to the data published by the American Red Cross Society in January 2022, the red cross has experienced a 10% decline in the number of people donating blood since the beginning of the pandemic.

Additionally, the market player's initiatives such as partnerships, and collaborations to develop autotransfusion systems and provide safe and effective auto-transfusion systems are also expected to contribute to the growth of the market over the forecast period. For instance, in May 2022, Vetellus Specialities Ltd signed a five-year agreement with Euroset s.r.l, manufacturer of autotransfusion devices. The deal includes the supply of Vertullus PC technology coating to Eurosets for the application of equipment used in cardiopulmonary bypass surgery devices and others. Thus, the above-mentioned factors such as the high volume of surgeries, scarcity of donated blood or allogenic blood, and rising product approvals are expected to drive the growth of the market during the forecast period. However, the high cost of the auto-transfusion devices and the risk associated with the procedure are expected to restrain the market growth over the forecast period.

Auto-transfusion Systems Market Trends

Cardiac Surgeries Segment is Expected to Hold Significant Share in the Market Over the Forecast Period

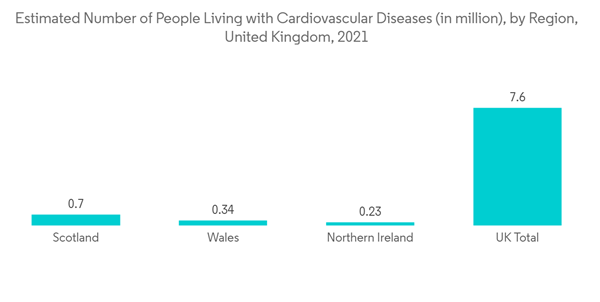

The cardiac surgeries segment is expected to occupy a significant share of the studied market due to the increasing prevalence of cardiac diseases and recommendations for autologous transfusion during cardiovascular surgeries. For instance, according to BHF January 2022 report, nearly 284,000 people were waiting for time-critical heart operations and other heart procedures at the end of November 2021 in the United Kingdom. Similarly, the BHF report on August 2022 mentioned that over 7.6 million people in the United Kingdom are living with heart or circulatory disease. Hence, the high volume of patients in need of cardiac surgeries is expected to drive the demand for autotransfusion systems, thereby contributing to segment growth over the forecast period.Furthermore, according to the article published by NCBI in August 2022, approximately 29,947 isolated coronary artery bypass grafting procedures, 36,714 isolated heart valve procedures, and 750 assist device implantations were registered in Germany in 2021. Additionally, the data published by International Registry in Organ Donation and Transplantation (IRODAT) in 2022 stated that the number of heart transplants in China was 738, 59 in Japan, and 116 in Australia in 2021. Such a high number of cardiovascular surgeries leads to the extensive usage of auto-transfusion systems, thereby contributing to the growth of the market. Furthermore, the growth of the segment is also increasing due to the growing inadequacy of donated blood or allogenic blood. Therefore, owing to the above-mentioned factors, the segment is expected to occupy a significant share of the market and grow over the forecast period.

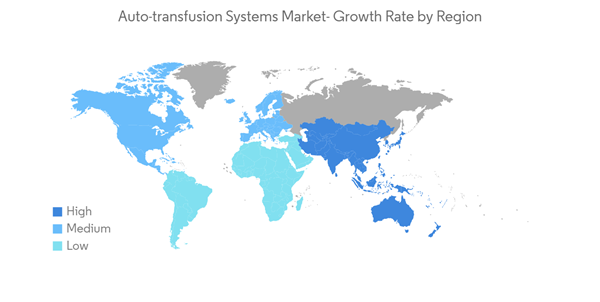

North America is Expected to Hold Significant Share in the Market Over the Forecast Period

North America is expected to dominate the overall market, throughout the forecast period. The market growth is due to factors such as the presence of key players, a high number of surgeries in the region, and established healthcare infrastructure. For instance, as per the data published by IRODAT in 2022, in the United States, nearly 19,519 kidney transplants, 8,667 liver transplants, and 3,863 heart transplants were performed in 2021. Similarly, as per the article published by the University of Alabama in November 2021, nearly 350,000 Coronary Artery Bypass Graft (CABG) Surgeries are done each year in the United States. Hence, the high volume of cardiovascular procedures is expected to give rise to the demand for autotransfusion systems in surgical procedures, thereby boosting market growth.Also, the demand for auto-transfusion systems due to the prevalence of chronic diseases among the Canadian population which may require surgical attention is expected to drive the growth of the market in Canada. For instance, as per data updated by the government of Canada in July 2021, overall, 6.3 million population of age 65 or more were estimated to be living with chronic conditions in 2021 in Canada. Thus, the chronic conditions among the elderly population in Canada mostly requiring surgical procedures are expected to result in high demand for autotransfusion systems, thereby propelling the market growth.

Moreover, the key player's market strategies such as acquisition, mergers, and collaborations in North America to provide advanced and effective autotransfusion systems are also expected to contribute to the growth of the market in this region. For instance, in October 2021, Morgan Stanley Infrastructure partnered and acquired Speciality Care Inc., to improve patient care outcomes and the company's growth. SpecialtyCare company provides autotransfusion system services in the United States. Thus, the above-mentioned factors such high volume of surgical procedures and the rise in chronic diseases are expected to contribute to the growth of the market over the forecast period in this region.

Auto-transfusion Systems Market Competitor Analysis

The Auto-transfusion Systems market is moderately competitive and consists of several major players. Some of the companies which are currently dominating the market are Becton, Dickinson and Company, Beijing ZKSK Technology Co., Ltd., Braile Biomédica, Haemonetics Corporation, LivaNova PLC, Medtronic, Redax, Teleflex Incorporated, Zimmer Biomet.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Becton, Dickinson and Company

- Beijing ZKSK Technology Co., Ltd.

- Braile Biomedica

- Zimmer Biomet

- Medtronic Plc

- LivaNova PLC

- Redax Spa

- Gen World Medical Devices

- Haemonetics Corporation

- Teleflex Incorporated

- Fresenius Kabi

- Soma Tech INTL