Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Commercial Sector Across the Region

The growing commercial sector across India is a key driver for the expansion of the Chiller market. As a part of this, according to a recent study, as of October 2024, India’s office space market is on track to exceed 70 million sq. ft. in absorption this year, with major cities like Bengaluru, Delhi-NCR, and Mumbai leading the surge, driven by high demand in tech, flexible workspaces, and BFSI sectors. As urbanization accelerates and cities become more developed, there is a rising demand for commercial spaces such as office buildings, shopping malls, hotels, and hospitals, all of which require efficient cooling systems. Chillers, being a crucial part of HVAC systems, are increasingly being adopted to meet the cooling needs of these commercial establishments.With the commercial real estate sector booming, especially in metropolitan cities like Delhi, Mumbai, and Bengaluru, there is a substantial rise in demand for energy-efficient cooling solutions that can handle large-scale requirements. Also, the need for temperature control in industries like pharmaceuticals, food processing, and electronics - where precise cooling is vital - further drives the demand for chillers. Government initiatives and green building certifications are also pushing for more energy-efficient solutions in commercial buildings. As a result, commercial builders and businesses are opting for advanced, sustainable chiller systems to comply with environmental regulations while reducing operational costs. This trend is expected to continue as India's commercial sector expands, making it a significant driver for the growth of the Chiller market in the region, and further accelerating the adoption of energy-efficient, reliable cooling solutions.

Product Upgradation by Key Players

Product upgradation by key players is a significant driver in the India Chiller market. As the demand for energy-efficient and high-performance cooling solutions increases, leading manufacturers are continuously innovating and improving their products to meet the evolving needs of industries and commercial sectors. As a part of this, as of May 2024, Carrier Airconditioning & Refrigeration Limited launched 30 RB Air-Cooled Modular Scroll Chiller. This product is precisely created to meet the changing needs of the Indian market, setting new standards for cooling efficiency and reliability while delivering value to areas such as railways, MES, metro, and others. Carrier India is part of Carrier Global Corporation, a global pioneer in intelligent climate and energy solutions. Upgrades focus on enhancing energy efficiency, reducing operational costs, and improving the overall environmental impact of chillers.Key players in the market are incorporating advanced technologies such as variable speed drives, smart controls, and eco-friendly refrigerants into their chiller systems. These innovations help optimize energy consumption, lower carbon emissions, and extend the lifespan of the equipment. Manufacturers are also introducing compact, modular, and customized solutions that cater to diverse customer needs, from small businesses to large industrial applications. The emphasis on sustainability is driving the upgradation of chillers to meet stricter environmental standards.

As a result, more companies are adopting chillers with reduced global warming potential (GWP) refrigerants and higher efficiency ratings, aligning with global and national environmental regulations. Also, advancements in IoT integration and real-time monitoring systems enable businesses to track performance, predict maintenance needs, and optimize energy usage. As key players continue to innovate and upgrade their products, the India Chiller market sees an ongoing shift toward smarter, greener, and more cost-effective cooling solutions.

Expansion of Hospitality Sector Across the Region

The expansion of the hospitality sector across India is a significant driver for the growth of the Chiller market. As a part of this, according to the Confederation of Indian Industry (CII) and EY, as of December 2024, India's tourism and hospitality sectors are on track to create over 6.1 million new employment by 2036-37.By 2036-37, spending in this sector is expected to increase by 1.2 times, necessitating the hiring of an extra 6.1 million workers, including 4.6 million males and 1.5 million women. This rise demonstrates the sector's ability to drive gender inclusion and workforce expansion. With an increasing influx of domestic and international tourists, the demand for hotels, resorts, and other hospitality services is rapidly rising.The hospitality industry requires reliable, energy-efficient, and large-scale cooling systems to provide comfort and maintain the temperature of their establishments, from guest rooms to common areas like conference halls, restaurants, and swimming pools. This creates a growing demand for high-performance chillers capable of managing the cooling needs of these large spaces. As India continues to emerge as a global travel destination, both the luxury and budget segments of the hospitality sector are expanding.

New hotel projects and resorts are adopting advanced chiller systems that offer greater efficiency and sustainability, ensuring they meet the rising energy demands while adhering to environmental regulations. Also, eco-conscious consumers and businesses are increasingly prioritizing green technologies, prompting hotels and resorts to invest in energy-efficient chillers that reduce their carbon footprint and operational costs. As the hospitality sector expands, the demand for chillers will continue to grow, making it a crucial driver in the India Chiller market.

Key Market Challenges

Stringent Government Regulation

Stringent government regulations pose a significant challenge to the India Chiller market, particularly as the country works toward reducing carbon emissions and improving energy efficiency. As a part of this, as of September 2023, The Department for Promotion of Industry and Internal Trade of India's Ministry of Trade and Industry stressed the need for BIS certification for self-contained drinking water coolers. The Self-Contained Drinking Water Cooler Quality Control Order intends to improve the quality of water chillers in the Indian market.The guideline stipulates that all self-contained drinking water coolers must meet Indian Standard 1475 (Part 1): 2001, which focuses on energy consumption and performance. Manufacturers must get BIS-ISI certification by March 25, 2024, to import or sell products in this category in India after that date. The Indian government has implemented various environmental policies aimed at reducing the carbon footprint of industrial and commercial operations. These include stringent energy consumption standards, refrigerant regulations, and environmental guidelines, all of which require manufacturers to upgrade their chiller systems to comply with evolving norms.

Chillers, being energy-intensive equipment, are heavily affected by these regulations. Manufacturers must invest in research and development to produce systems that are energy-efficient and use environmentally friendly refrigerants, such as low Global Warming Potential (GWP) alternatives. This upgradation can be costly, which can hinder the ability of small and mid-sized companies to comply with new regulations.

Also, the growing focus on reducing hydrofluorocarbon (HFC) emissions adds complexity, as many traditional chillers use HFC-based refrigerants that are being phased out under international agreements like the Kigali Amendment to the Montreal Protocol. Businesses may face challenges in replacing old systems or retrofitting them with new refrigerants that meet compliance standards. While these regulations aim to protect the environment, they create a challenge for the India Chiller market by increasing the operational and investment costs for both manufacturers and End Uses, slowing market growth in the short term.

Intense Competition Among Key Players

Intense competition among key players presents a notable challenge in the India Chiller market. With the rapid growth of industries such as manufacturing, hospitality, and pharmaceuticals, the demand for cooling solutions has surged, attracting numerous local and international players. As the market becomes increasingly saturated, companies are facing heightened pressure to differentiate themselves through product innovation, pricing strategies, and service offerings. This competition results in thinner profit margins for manufacturers, as they are compelled to offer competitive prices while maintaining the quality and efficiency of their products.To stand out, companies are focusing on improving the energy efficiency of their chillers, incorporating advanced technologies, and meeting stringent environmental regulations. However, this often requires significant investment in research and development, which can be a challenge for smaller players who may lack the resources to keep up with the technological advancements introduced by larger competitors. Also, the focus on providing after-sales service, including maintenance and energy optimization, is intensifying competition. Customers increasingly expect not only reliable products but also comprehensive service packages. As the competition grows fiercer, companies must balance innovation, cost control, and customer service to maintain their market share, making it a challenging environment for businesses in the India Chiller market.

Key Market Trends

Rising Adoption of Smart Chiller

The rising adoption of smart chillers is a prominent trend in the India Chiller market. As industries and businesses in India seek more efficient, cost-effective, and environmentally friendly solutions, the demand for smart chillers has grown significantly. Smart chillers incorporate advanced technologies, such as IoT (Internet of Things) integration, automation, and real-time monitoring, enabling users to remotely manage and optimize their cooling systems. These features allow businesses to reduce energy consumption, improve system performance, and enhance operational efficiency.Smart chillers also offer predictive maintenance capabilities, which can detect potential issues before they lead to system failures, minimizing downtime and reducing maintenance costs. Also, by continuously monitoring and adjusting the cooling output based on actual demand, these systems help businesses maintain consistent temperatures while minimizing energy waste. This adaptability is particularly valuable in energy-intensive sectors like manufacturing, data centers, and commercial buildings.

The Indian government’s push toward energy efficiency and sustainability is another factor driving the adoption of smart chillers, as businesses seek to comply with regulations and reduce their environmental impact. As energy costs rise and the need for operational efficiency becomes more critical, the trend toward smart chillers is expected to continue. This shift is positioning smart chiller systems as an increasingly essential component of modern cooling infrastructure in India.

Green Technology Integration

Green technology integration is a significant trend in the India Chiller market, driven by the need to comply with stringent environmental standards and reduce carbon footprints. As India focuses on sustainable development, there is a growing emphasis on using eco-friendly refrigerants in chiller systems. Traditional refrigerants, such as hydrofluorocarbons (HFCs), have high global warming potential (GWP), contributing to environmental harm. To address this, the market is shifting towards low-GWP alternatives like hydrofluoroolefins (HFOs) and natural refrigerants such as ammonia and carbon dioxide.This transition is aligned with international agreements like the Kigali Amendment to the Montreal Protocol, which mandates the phase-out of high-GWP refrigerants. In response, manufacturers are developing chillers that incorporate these greener refrigerants without compromising on efficiency or performance. Also, energy-efficient chillers that reduce power consumption while maintaining effective cooling are becoming more popular. The push for green technology is also supported by government policies encouraging sustainable practices. Energy-efficient certifications and green building standards, such as LEED, are influencing businesses to invest in eco-friendly chiller systems. As a result, the integration of green technology in chillers is not only helping businesses meet regulatory requirements but also reducing their environmental impact, ultimately driving growth in the Indian chiller market.

Growing Demand for Modular & Compact System

The growing demand for modular and compact chiller systems is a notable trend in the India Chiller market. As space constraints and the need for scalable solutions become more prominent in both commercial and residential sectors, modular chillers are gaining traction. These systems are designed to be flexible, allowing users to install and expand the system as needed, without requiring a large footprint. This adaptability makes them ideal for a wide range of applications, from small offices to large industrial plants.Modular chillers offer several advantages, including ease of installation, reduced downtime during setup, and the ability to scale cooling capacity based on demand. They are also easier to maintain and upgrade, as individual modules can be serviced or replaced without disrupting the entire system. The trend towards compact chiller systems is also driven by the increasing demand for energy-efficient solutions. Smaller, more efficient units are easier to integrate into existing infrastructure, providing cost-effective cooling without sacrificing performance. As industries and commercial establishments continue to focus on sustainability, modular and compact chillers are becoming an essential part of the India Chiller market, offering a flexible, scalable, and environmentally friendly option to meet evolving cooling needs.

Segmental Insights

Product Type Insights

Screw dominated the India Chiller market, due to their high efficiency, reliability, and capacity for handling large cooling loads. These systems are particularly favored in industrial and commercial applications, such as manufacturing, pharmaceuticals, and HVAC systems in large buildings. Screw chillers are known for their ability to provide consistent cooling even under fluctuating demand, making them suitable for a variety of environments. Their durability, lower maintenance costs, and energy efficiency contribute to their popularity. Also, the growing emphasis on energy-efficient solutions and sustainable practices has further boosted the adoption of screw chillers in the market.Regional Insights

The North region dominated the India Chiller market, due to its rapidly growing industrial, commercial, and hospitality sectors. Major cities like Delhi, Chandigarh, and Gurgaon are witnessing significant infrastructure development, leading to a higher demand for efficient cooling solutions in commercial buildings, manufacturing units, and data centers. The region’s industrial growth, particularly in pharmaceuticals, food processing, and IT sectors, further drives the need for large-scale cooling systems like chillers. Also, the focus on energy-efficient and eco-friendly solutions, along with government incentives, is accelerating the adoption of chillers in North India, reinforcing its dominance in the market.Key Market Players

- Daikin Air Conditioning India Pvt Ltd

- Blue Star Limited

- Voltas Limited

- Carrier Airconditioning & Refrigeration Ltd

- Johnson Controls-Hitachi Air Conditioning India Limited

- Kirloskar Chillers Pvt Ltd

- LG Electronics India Pvt. Ltd.

- Mitsubishi Electric India Pvt. Ltd. (Climaveneta)

- Flamingo Chillers

- Thermax Limited

Report Scope:

In this report, the India Chiller Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Chiller Market, By Product Type:

- Screw

- Centrifugal

- Scroll

- Absorption

India Chiller Market, By End Use:

- Industrial

- Commercial

India Chiller Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Chiller Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Daikin Air Conditioning India Pvt Ltd

- Blue Star Limited

- Voltas Limited

- Carrier Airconditioning & Refrigeration Ltd

- Johnson Controls-Hitachi Air Conditioning India Limited

- Kirloskar Chillers Pvt Ltd

- LG Electronics India Pvt. Ltd.

- Mitsubishi Electric India Pvt. Ltd. (Climaveneta)

- Flamingo Chillers

- Thermax Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | January 2025 |

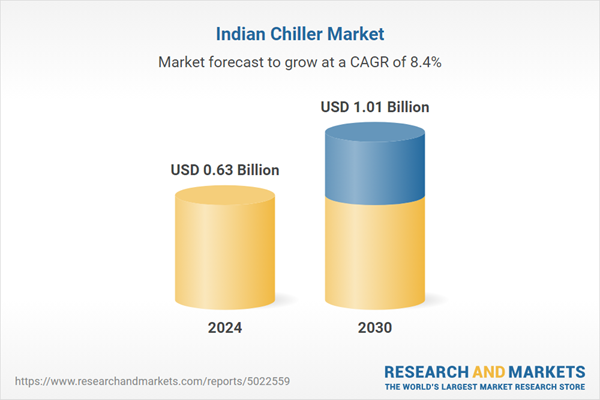

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.63 Billion |

| Forecasted Market Value ( USD | $ 1.01 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |