Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces a significant scalability hurdle due to a critical global shortage of trained technicians and radiologists, which limits the capacity of healthcare systems to handle rising procedural volumes. This workforce deficit causes severe bottlenecks and delays in patient care. For instance, the Royal College of Radiologists reported in 2024 that the clinical radiology workforce operated with a 29% shortfall, as the demand for complex scans like CT and MRI increased by 8% while the consultant workforce grew by only 4.7%.

Market Drivers

The integration of artificial intelligence and machine learning into imaging workflows is revolutionizing the Global Diagnostic Imaging Market by improving diagnostic accuracy and operational efficiency. These technologies are becoming essential for mitigating workforce shortages by automating routine image analysis, optimizing scan protocols, and prioritizing urgent cases for review. Regulatory approvals for these sophisticated algorithms are accelerating; according to the U.S. Food and Drug Administration, the cumulative number of authorized AI and ML-enabled medical devices reached 950 in August 2024, with radiology applications comprising 76% of these approvals. By streamlining workflows and reducing scan times, AI integration enhances patient throughput and maximizes the utility of existing imaging infrastructure.Market growth is further propelled by increasing government and private investments in healthcare infrastructure, aimed at clearing post-pandemic backlogs and modernizing aging equipment. Public sector initiatives are allocating substantial funds to procure advanced diagnostic tools, thereby decentralizing care and improving accessibility. For example, the UK Government allocated £1.5 billion in its October 2024 Autumn Budget to expand diagnostic capabilities, including the deployment of modern scanners and the establishment of new surgical hubs. These investments are generating robust financial performance for major industry players; Siemens Healthineers reported a 7.7% comparable revenue growth for its Imaging segment in November 2024, highlighting the sustained global demand for advanced diagnostic systems.

Market Challenges

The shortage of trained radiologists and technicians presents a structural barrier that fundamentally limits the scalability of the global diagnostic imaging market. Although the rising prevalence of chronic diseases creates a theoretical demand for higher procedure volumes, healthcare providers are unable to fully convert this into market growth due to the scarcity of human expertise. Diagnostic equipment cannot generate value without qualified personnel to operate it and interpret results, effectively placing a hard ceiling on operational throughput. Consequently, facilities are often forced to delay acquiring new technologies, diverting capital budgets toward premium labor costs rather than expanding diagnostic capabilities.This operational strain significantly impedes the market's trajectory by causing systemic inefficiencies. In 2024, the Royal College of Radiologists indicated that 97% of radiology departments were compelled to rely on expensive outsourcing or insourcing measures to manage unmanageable reporting workloads. This heavy dependence on external support suggests that the market has reached a saturation point where existing staffing levels cannot support organic growth. As healthcare systems struggle to manage these bottlenecks, the deployment of additional imaging infrastructure is stalled, directly hampering the broader expansion potential of the market.

Market Trends

The market is increasingly prioritizing sustainable and eco-friendly imaging solutions, driven by the urgent need to reduce the environmental impact of energy-intensive modalities like MRI and CT. Manufacturers are engineering systems that minimize power consumption and reduce dependency on scarce resources such as helium, which is critical for cooling conventional magnets. This shift is both regulatory and operational, as healthcare facilities seek to lower long-term running costs and protect against supply chain volatilities. According to a March 2025 report by Royal Philips, their BlueSeal magnet technology has collectively saved over 2.75 million liters of helium since 2018, illustrating the rapid adoption of helium-free infrastructure.Simultaneously, the proliferation of portable and point-of-care devices is democratizing diagnostic access, moving imaging beyond traditional hospital suites into diverse clinical settings. Advancements in semiconductor technology have enabled the development of handheld ultrasound units that offer high-resolution imaging at a fraction of the size and cost of cart-based systems. This trend facilitates immediate bedside diagnosis, reducing patient wait times and alleviating the burden on central radiology departments. In May 2025, Butterfly Network reported a 20% year-over-year revenue growth in its first-quarter financial results, underscoring the surging global demand for agile, handheld imaging solutions.

Key Players Profiled in the Diagnostic Imaging Market

- GE HealthCare Technologies Inc.

- Koninklijke Philips N.V.

- Hitachi High-Tech Corporation

- Hologic, Inc.

- Siemens Healthineers AG

- Samsung Medicine Co., Ltd.

- Shimadzu Corporation

- Toshiba Medical Systems Corporation

- Esaote S.p.A

- Fujifilm Corporation

Report Scope

In this report, the Global Diagnostic Imaging Market has been segmented into the following categories:Diagnostic Imaging Market, by Product:

- X-Ray

- Ultrasound

- Computed Tomography

- Nuclear Imaging

- Magnetic Resonance Imaging

Diagnostic Imaging Market, by Application:

- Oncology

- Neurology

- Cardiology

- Gynecology

- Orthopedics

- Others

Diagnostic Imaging Market, by End Use:

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Imaging Centers

Diagnostic Imaging Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Diagnostic Imaging Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Diagnostic Imaging market report include:- GE HealthCare Technologies Inc.

- Koninklijke Philips N.V.

- Hitachi High-Tech Corporation

- Hologic, Inc.

- Siemens Healthineers AG

- Samsung Medicine Co., Ltd.

- Shimadzu Corporation

- Toshiba Medical Systems Corporation

- Esaote S.p.A

- Fujifilm Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

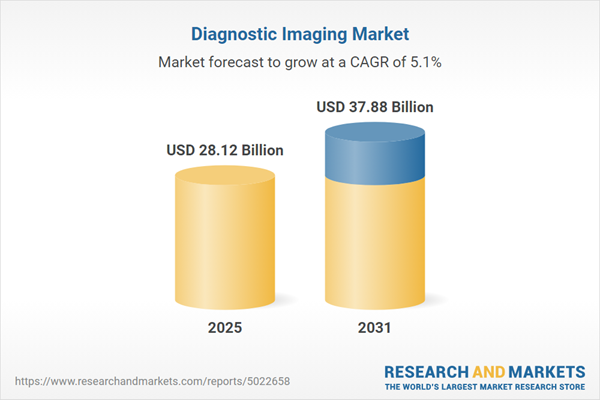

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 28.12 Billion |

| Forecasted Market Value ( USD | $ 37.88 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |