Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Demand of Diamond Coatings in Healthcare Industry

Diamond coatings are increasingly utilized in medical applications due to their outstanding hardness, thermal conductivity, chemical inertness, and biocompatibility. These attributes make diamond-coated surgical tools more durable, with sharper and longer-lasting edges, which helps reduce surgical trauma and lowers infection risk. In dentistry and orthopedics, diamond-coated tools and implants improve performance and reduce bacterial contamination. As medical technology advances and demand grows for precision instruments that are both reliable and safe, the healthcare sector’s reliance on diamond coatings is expected to rise steadily, fueling market growth.Key Market Challenges

Limited Availability of High-Quality Diamonds

The diamond coatings industry faces a persistent challenge due to the limited supply of high-quality natural diamonds, which are essential for producing effective coatings. Diamond extraction is complex and environmentally sensitive, leading to strict regulatory oversight and supply chain constraints. While synthetic diamonds offer an alternative, their production remains cost-intensive and technologically demanding, posing scalability issues for many manufacturers. This restricted availability and the cost burden associated with high-quality diamonds present a significant bottleneck for market expansion, particularly as demand rises across industries like electronics, automotive, and healthcare.Key Market Trends

Advancements in Nanodiamond Coatings

Significant progress in nanodiamond synthesis and application is transforming the diamond coatings landscape. Techniques such as detonation synthesis are enabling the production of highly pure nanodiamonds, which offer improved mechanical and chemical properties. Functionalized nanodiamond surfaces and hybrid nanodiamond composites - such as nanodiamond-ceramic blends - are expanding application possibilities by enhancing wear resistance, hardness, and chemical stability. These technological innovations are gaining traction in high-performance sectors including aerospace, medical devices, and electronics, where demand for lightweight yet durable materials continues to grow.Key Market Players

- Blue Wave Semiconductors Inc.

- De Beers Corp

- Diamond Materials GmbH

- Endura Manufacturing Company Limited

- NeoCoat SA

- OC Oerlikon Corp. AG

- Robb-Jack Corp.

- Sandvik AB

- Smiths Group PLC

- SP3 Inc.

Report Scope:

In this report, the Global Diamond Coatings Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Diamond Coatings Market, By Substrate:

- Metal

- Ceramic

- Composite

- Others

Diamond Coatings Market, By End User:

- Electronics

- Mechanical

- Industrial

- Medical

- Automotive

- Others

Diamond Coatings Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Diamond Coatings Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Blue Wave Semiconductors Inc.

- De Beers Corp

- Diamond Materials GmbH

- Endura Manufacturing Company Limited

- NeoCoat SA

- OC Oerlikon Corp. AG

- Robb-Jack Corp.

- Sandvik AB

- Smiths Group PLC

- SP3 Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | June 2025 |

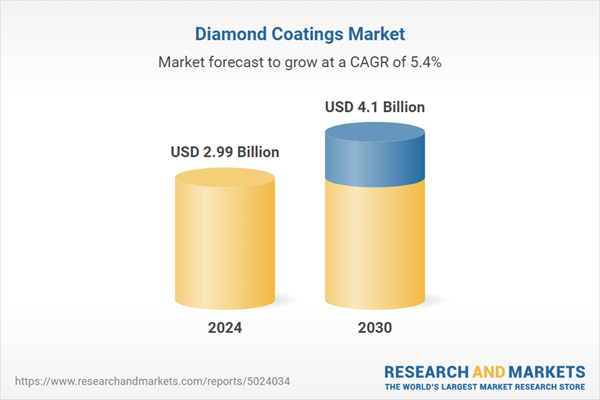

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.99 Billion |

| Forecasted Market Value ( USD | $ 4.1 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |