Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One noteworthy advantage of coil and extrusion coatings is their low content of volatile organic compounds (VOCs). This aligns perfectly with the growing trend towards environmentally friendly construction materials, as it helps in reducing the environmental impact of construction projects. With sustainability becoming a key focus in the industry, these coatings have become a preferred choice for architects, builders, and homeowners alike.

The demand for coil and extrusion coatings is experiencing significant growth, particularly in emerging markets, especially in the Asia-Pacific region. Rapid urbanization and infrastructural development in these regions are driving the need for high-quality construction materials that can withstand the demands of modern architecture.

The rising demand for coil and extrusion coatings in the construction industry is a clear indicator of their influential role in shaping market dynamics. As the construction industry continues to evolve and embrace innovative techniques, the coil and extrusion coating market will undoubtedly see further advancements to cater to the evolving needs of the industry.

Key Market Drivers

Growing Demand of Coil & Extrusion Coating in Construction Industry

The growing demand for coil and extrusion coatings within the construction industry is a key driver accelerating the expansion of the Global Coil & Extrusion Coating Market. This trend is primarily fueled by the increasing focus on durable, aesthetically appealing, and energy-efficient building materials. Urbanization is accelerating globally, with more than 50% of the world’s population already concentrated in urban centers. This demographic shift is projected to intensify, with urban dwellers expected to comprise nearly 70% of the global population by 2050.This structural transformation is reshaping demand patterns across infrastructure, housing, and commercial real estate creating sustained opportunities for industries aligned with urban development, including construction materials, coatings, and architectural solutions. With rising environmental awareness and stringent regulatory norms around building sustainability, demand has surged for coatings that improve energy efficiency. Coil and extrusion coatings can incorporate solar-reflective pigments and thermal barriers, reducing heat absorption and improving building insulation. This feature is especially valued in green building certifications such as LEED and BREEAM, thereby positioning these coatings as critical components in sustainable architecture.

The construction industry increasingly prioritizes architectural flexibility and aesthetic appeal. Coil and extrusion coatings enable a wide range of colors, textures, and finishes, allowing architects and designers to achieve both functional durability and high-end visual impact. The coatings’ resistance to UV radiation, chemicals, and extreme weather conditions further enhances the value proposition for façade panels, roofing systems, window frames, and curtain walls. The rising adoption of prefabricated and modular construction techniques has accelerated demand for pre-coated materials that reduce on-site finishing time and labor costs. Coil and extrusion coatings are typically applied in controlled environments using automated processes, ensuring consistency, quality, and faster project turnaround times all critical in prefabricated construction.

Key Market Challenges

Volatility in Prices of Raw Materials

The global coil and extrusion coating market is currently experiencing significant growth, driven primarily by increasing demand from industries like construction and automotive. This growth can be attributed to several factors, including the need for protective coatings in construction projects and the rising adoption of coil and extrusion coatings in the automotive sector.One major challenge that could potentially hamper this growth trajectory is the volatility in raw material prices. Raw materials are the backbone of the coil and extrusion coating industry, playing a crucial role in the production process. The process requires a range of materials, including resins, pigments, and solvents, each contributing to the final quality and performance of the coatings.

Any fluctuation in the prices of these materials directly impacts the cost of production, thereby affecting the overall profitability of companies operating in this sector. Instability in raw material prices can pose a significant challenge for companies in terms of cost control and planning. Rising prices can squeeze profit margins if companies are unable to pass these costs onto their customers. A sudden drop in prices can lead to overstocking and wastage, as companies may have procured materials at higher prices. This not only leads to financial losses but also raises concerns about sustainability and environmental impact. Moreover, price volatility also complicates supply chain dynamics, as companies need to constantly monitor market trends and adjust their procurement strategies accordingly.

This constant monitoring of raw material prices can be resource-intensive and may divert focus from core business activities. Companies need to invest time and resources in analyzing market trends, negotiating with suppliers, and managing inventory levels. This can be particularly challenging for smaller companies with limited resources. Fluctuations in raw material prices can lead to scarcity or oversupply, impacting the availability and quality of coatings. In situations of scarcity, companies may struggle to meet the demand from their customers, which can strain relationships and potentially lead to loss of business. On the other hand, oversupply can result in excess inventory and wastage, further affecting the overall efficiency of the supply chain.

While the coil and extrusion coating market is experiencing growth, the volatility in raw material prices poses significant challenges for companies in terms of cost control, supply chain management, and overall profitability. Companies must carefully navigate these challenges by implementing effective procurement strategies, closely monitoring market trends, and investing in sustainable practices to ensure long-term success in the industry.

Key Market Trends

Growing Focus on Sustainability

Sustainability is not just a passing trend but an increasingly significant consideration for businesses worldwide. The coil and extrusion coating industry is no exception, as companies now prioritize the development of coatings that are not only durable and high-performing but also environmentally friendly.One of the ways in which the industry is achieving this is by reducing the volatile organic compounds (VOCs) present in their products. These compounds not only contribute to air pollution but also pose potential risks to human health. As a result, low-VOC or VOC-free coatings are gaining popularity, aligning with the industry's commitment to sustainability.

The shift towards sustainability in the coil and extrusion coating industry is also driven by regulations. Governments worldwide are implementing stricter environmental standards and guidelines, compelling companies to adopt more sustainable practices. These regulations act as a catalyst for the development and usage of green coatings that are less harmful to the environment.

The focus on sustainability not only serves environmental purposes but also makes good business sense. With consumers becoming increasingly environmentally conscious, they actively seek out eco-friendly products. Companies that offer sustainable solutions are poised to attract these conscious consumers, gaining a competitive edge in the market.

Embracing sustainable practices can yield significant cost savings in the long run. For instance, substituting solvent-based coatings with water-based or powder coatings can effectively reduce waste and lower disposal costs. The emphasis on sustainability is a defining trend within the global coil and extrusion coating market. As environmental concerns continue to escalate, this trend is expected to gain further momentum, shaping the future trajectory of the industry with a commitment to sustainability.

Key Market Players

- Akzo Nobel NV

- PPG Industries Ltd

- BASF SE

- Wacker Chemie AG

- Kansai Paints Company Limited

- RPM Performance Coatings Group

- Nippon Paint Holdings Co. Ltd

- Merck KGaA

- Allnex Netherlands B.V.

- Exxon Mobil Corporation

Report Scope:

In this report, the Global Coil & Extrusion Coating Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Coil & Extrusion Coating Market, By Type:

- Topcoats

- Primers

- Backing Coats

- Specialties

Coil & Extrusion Coating Market, By Resin:

- Polyester

- Silicone Modifier Polyester

- Fluorocarbon (PVDF)

- Polyurethane

- Plastisol

- Epoxy

- Others

Coil & Extrusion Coating Market, By End User:

- Architecture

- Automobile

- Consumer Durables

- Furniture

- Others

Coil & Extrusion Coating Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Coil & Extrusion Coating Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Akzo Nobel NV

- PPG Industries Ltd

- BASF SE

- Wacker Chemie AG

- Kansai Paints Company Limited

- RPM Performance Coatings Group

- Nippon Paint Holdings Co. Ltd

- Merck KGaA

- Allnex Netherlands B.V.

- Exxon Mobil Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

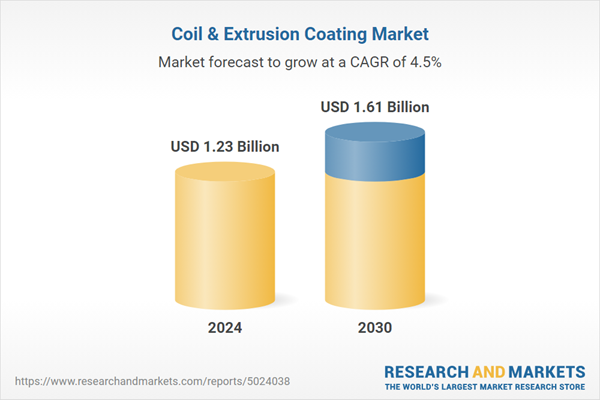

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.23 Billion |

| Forecasted Market Value ( USD | $ 1.61 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |