Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

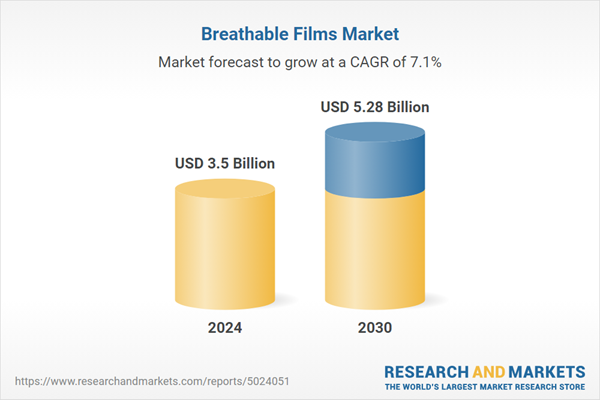

This upward trajectory is reinforced by ongoing technological advancements, evolving consumer expectations for performance and convenience, and a growing emphasis on sustainable and compliant materials across industries. As manufacturers seek to enhance product differentiation and meet stringent regulatory standards, breathable films are becoming integral to the development of next-generation solutions in both consumer and commercial markets. With expanding use cases and continued material innovation, the Global Breathable Films Market is well-positioned for long-term growth, playing a vital role in enabling functionality, efficiency, and environmental responsibility across a diverse range of applications.

Key Market Drivers

Growing Demand of Breathable Films in Food and Beverage Industry

The rising demand for breathable films in the food and beverage industry is playing a pivotal role in driving the growth of the Global Breathable Films Market. This growth is primarily fueled by the increasing consumer preference for extended shelf-life, freshness, and sustainability in packaged food products. Breathable films are engineered to allow controlled transmission of gases and moisture, which is particularly advantageous in food packaging applications. In fresh produce packaging, these films help regulate oxygen and carbon dioxide exchange, preventing condensation and microbial growth, thereby maintaining product quality and appearance over longer periods. This aligns with the food industry's growing focus on reducing food spoilage and waste across the supply chain.The rising adoption of ready-to-eat and convenience food products, especially in urbanized and high-income regions, has significantly increased the need for high-performance packaging solutions that can preserve taste, texture, and safety. Breathable films, when used in combination with modified atmosphere packaging (MAP) technologies, cater to these requirements effectively, thus gaining traction among food manufacturers and packaging converters. The shift toward eco-friendly and recyclable packaging materials is reinforcing the demand for polyethylene- and polypropylene-based breathable films. These films not only provide the necessary barrier properties but also meet regulatory and sustainability goals set by major food companies and retailers.

From a supply chain perspective, leading film producers are investing in advanced co-extrusion and micro-perforation technologies to enhance the functionality and consistency of breathable films tailored for food applications. This technological progress, combined with strong end-user demand, is accelerating product innovation and boosting market competitiveness. The integration of breathable films into the food and beverage industry's packaging practices is no longer optional but a necessity driven by quality assurance, compliance, and sustainability mandates. This is expected to continue as a key growth lever for the Global Breathable Films Market in the foreseeable future.

Key Market Challenges

Rise in Environmental Regulations

Breathable films, primarily made from highly filled polyethylene, are known for their exceptional ability to allow the passage of water vapor while effectively blocking liquids or other contaminants. Their unique properties make them indispensable in various industries, including food and beverage, medical, and personal care. However, concerns about the environmental impact of these films have been raised due to their non-biodegradable nature, which can contribute to pollution if not disposed of correctly.Recognizing the urgent need to address environmental pollution, governments worldwide are implementing stringent regulations on plastic use. These regulations often encompass restrictions on the production, use, and disposal of plastic products, including breathable films. For example, the European Union has introduced the Single-Use Plastics Directive, a comprehensive initiative aimed at minimizing the environmental impact of specific plastic items. As a result, manufacturers of breathable films face significant challenges as they endeavor to adapt their production processes to comply with these evolving rules and regulations.

By staying abreast of the ever-changing environmental landscape and embracing sustainable practices, manufacturers can navigate these challenges and contribute to a greener and more environmentally conscious future.

Key Market Trends

Growing Focus on Antimicrobial and Anti-Odor Properties

Antimicrobial properties are increasingly being incorporated into breathable films. These properties help kill or inhibit the growth of microorganisms, enhancing the hygiene quotient of the products made with these films. This is particularly important in industries such as medical and personal care, where maintaining hygiene is of utmost importance.Antimicrobial breathable films can be used in a wide range of applications, including wound dressings, surgical drapes, and personal care products. By incorporating antimicrobial properties into these films, they not only provide a protective barrier but also help prevent infections and promote faster healing in medical applications. Moreover, these films ensure freshness and cleanliness in personal care products, elevating the overall user experience.

Furthermore, the inclusion of anti-odor properties in breathable films is an emerging trend that addresses the need for odor control in various industries. Breathable films with anti-odor properties effectively inhibit the growth of bacteria and fungi on fabrics, ensuring that apparel remains odor-free for extended periods. This has significant implications for the textile industry, where these films can be utilized in the production of sportswear, footwear, and other clothing items that require effective odor management.

With the continuous advancements in technology and innovative use of breathable films, the possibilities for enhancing product performance and improving user satisfaction are expanding. The integration of antimicrobial and anti-odor properties into breathable films is revolutionizing the hygiene and odor control capabilities of various products, making them more effective, reliable, and appealing to consumers.

Key Market Players

- Schweitzer-Mauduit International, Inc.

- Arkema SA

- Berry Global, Inc

- Fatra, a.s.

- Nitto Denko Corporation

- Rahil Foam Pvt. Ltd.

- RKW North America, Inc.

- SILON s.r.o

- Mitsui Chemicals, Inc.

- Omya AG

Report Scope:

In this report, the Global Breathable Films Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Breathable Films Market, By Raw Material:

- Polyethylene

- Polypropylene

- Polyurethane

- Polyester

- PTFE

- Others

Breathable Films Market, By Technology:

- Microporous

- Monolithic

Breathable Films Market, By End User:

- Hygiene

- Medical

- Food Packaging

- Construction

- Fabric

Breathable Films Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Breathable Films Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Schweitzer-Mauduit International, Inc.

- Arkema SA

- Berry Global, Inc

- Fatra, a.s.

- Nitto Denko Corporation

- Rahil Foam Pvt. Ltd.

- RKW North America, Inc.

- SILON s.r.o

- Mitsui Chemicals, Inc.

- Omya AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.5 Billion |

| Forecasted Market Value ( USD | $ 5.28 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |