Key Highlights

- The offshore sector is expected to dominate the Thai oil and gas upstream market due to new discoveries and investments.

- The oil and gas demand is expected to increase over the forecast period. The government is considering investments in numerous exploration and production projects, which can render opportunities for the growth of the market over the forecast period.

- Thailand is increasing investments in the oil and gas sector, which is expected to drive the country's oil and gas market during the forecast period.

Key Market Trends

Offshore Sector to Dominate the Market

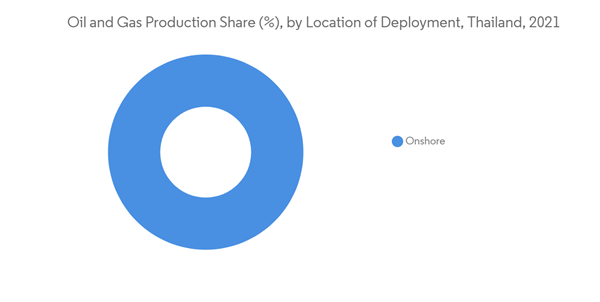

- The offshore segment accounted for 90% of Thailand's oil and gas production. With substantial investment and discoveries, various offshore projects are expected to come up during the forecast maintaining the dominance of the offshore segment.

- The majority of Thailand's oil production comes from offshore fields: Erawan, Tantawan, Jasmine, and Bualuang fields, the majority of them located in the Gulf of Thailand. The country is highly dependent on oil and gas imports to meet its domestic demand due to a lack of domestic oil and gas production. In 2020, the country imported 48,685 million liters of crude oil to meet its domestic demand, mainly from the Middle East.

- Thailand's upstream oil and gas production is predominately sourced from two offshore areas in the Gulf of Thailand, namely the Pattani Basin and the Malay Basin. Due to the fractured nature of offshore geology, Thailand's reserves and production are provided by many separate but relatively homogenous reservoirs spread across the two basins.

- In December 2021, PTT Exploration and Production (PTTEP) unveiled its investment plan for next year and its five-year program for 2022-2026. The company will allocate USD 3.217 billion for capex and USD 2.449 billion for opex in 2022.

- In February 2022, the Director-General of the Department of Mineral Fuels (DMF) stated that the DMF is planning to request the Deputy Prime Minister and the Minister of Energy to sign an invitation to open bids for offshore petroleum exploration and production licenses in the Gulf of Thailand for the first time in 15 years.

- Therefore, owing to the above points, the offshore sector is expected to witness dominant growth during the forecast period.

Increasing Investment in the Oil and Gas Sector Expected to Drive the Market

- Thailand established its National Economic and Social Development Board in the 1960s to prepare development plans for the country's economic growth. Industrial sector growth with R&D facilities was promoted, thus increasing the quality of the Thai people.

- PTT Exploration and Production (PTTEP), the national petroleum exploration and production company based in Thailand, has a five-year investment plan (2019-2023) worth a combined USD 16.105 billion to support its business expansion both domestically and overseas.

- Following its five-year plan, PTTEP planned to invest USD 3.256 billion in 2019, USD 2.946 billion in 2020, USD 3.479 billion in 2021, USD 3.56 billion in 2022, and USD 2.864 in 2023.

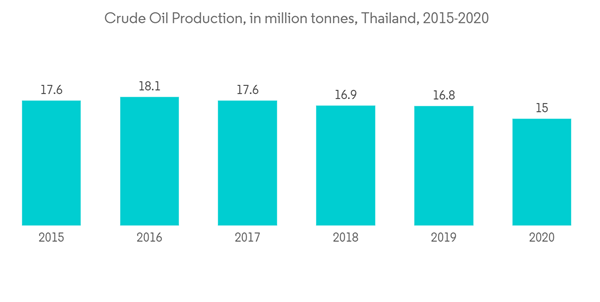

- Oil production accounted for 15.0 million tons in 2020. This is expected to grow over the forecast period with increasing investments in oil exploration and production projects.

- In January 2020, the Mineral Fuels Department announced new bidding rounds for offshore petroleum exploration and production (E & E&P) activities in April 2020. The 23rd round of bidding involved three exploration blocks - G1/63, G2/63, and G3/63 - totaling more than 34,000 sq. km. located in the Gulf of Thailand. G1/63 is near the Erawan field, G2/63 is close to the Pailin field, and G3/63 is south of the Bongkot field.

- In December 2021, PTT Exploration and Production (PTTEP) planned to invest more than USD 27 billion over the coming five years with the main aims of maintaining production and boosting reserves. Three major projects feature in PTTEP's 2022-2026 are Lang Lebah on Block SK 410B offshore Sarawak, Malaysia; the Mozambique Area 1 project, and phase two of the Hassi Bir Rekaiz field development in Algeria.

- The government is revising its policies to attract foreign investments. The government awarded a production sharing contract for the first time in 2018. The PSC contract is expected to boost investor confidence and attract more investment over the forecast period.

- Therefore, factors such as increasing investment and policy revamp are likely to drive the market during the forecast period.

Competitive Landscape

The Thai oil and gas upstream market is moderately consolidated. The key players in the market include Bangchak Corporation Public Company Limited, Exxon Mobil Corporation, PTT Public Company Limited, Chevron Corporation, and TotalEnergies SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Chevron Corporation

- PTT Public Company Limited

- Exxon Mobil Corporation

- PT Pertamina

- Schlumberger Limited

- TotalEnergies SE

- Bangchak Corporation Public Company Limited