Key Highlights

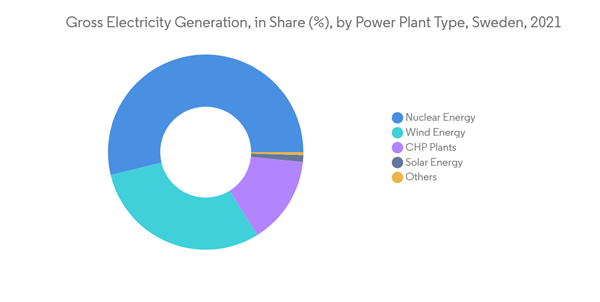

- Hydro energy remained the major source of power generation in Sweden in 2021, and it is likely to dominate the market.

- Sweden targets to achieve 100% renewable energy power generation by 2040 and reduce the emissions of greenhouse gases to 0% by 2045. These targets are likely to act as an opportunity for the Swedish renewable energy market in the future.

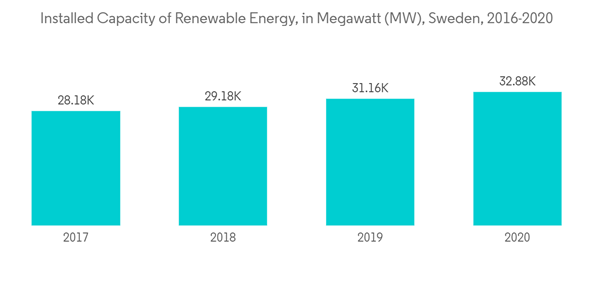

- Increasing renewable energy installed capacity and upcoming projects in the country are likely to drive the Swedish renewable energy market. The Europen Union has set targets to reduce its carbon footprint, for which Sweden is increasing its renewable installation capacity.

Key Market Trends

Hydro Energy is Expected to Dominate the Market

- Hydropower has traditionally been one of the biggest sources of energy in Sweden, and in 2020, approximately 44.1% of Sweden's total energy generation was from hydro energy, producing approximately 72,290 Gigawatt-Hour (GWh) of electricity. This makes hydro energy the largest source of energy generation in the country.

- Due to the maturity of the country's hydropower sector, many of Sweden's dams have already been operating for a significant share of their design lives. Due to concerns about dam safety, many hydropower plant operators have invested in the revamp and reinforcement of older dams.

- In March 2021, Fortum Oyj, the largest electricity retail company in Sweden, announced plans to invest nearly EUR 45 million for a rebuild of the 100-year-old Forshuvud hydropower plan. Fortum is collaborating with the Swedish construction company NCC in this project, and the project, which is expected to be completed by 2025, will consist of a completely new power station, as well as upgrades to the extension dam.

- In August 2020, Veo signed contracts for the modernization of two dams, the Uniper hydropower plant owned by Fortum and Skellefteå Kraft’s Rengård hydropower plant. The Untra project's renovation consists of building an automation system that will cover all voltage levels. For the Rengård hydropower plant, Skellefteå Kraft invested in a new turbine and generator system while upgrading the existing electrification and automation systems to more advanced versions.

- Additionally, to improve the reliability of the power supply, many hydropower plant operators in Sweden are adding battery energy storage systems to store excess energy during high production periods.

- In October 2021, Uniper SE announced that it was investing in battery systems for hydropower at its Bodum and Fjällsjö hydropower plants in Jämtland, Sweden, with a total capacity of about 12 MW. Earlier in 2021, Uniper had commissioned two battery energy storage systems with a net installed capacity of 21 MW at the Lövön power plant in Jämtland and the Edsele power plant in Ångermanland. Similarly, Fortum Oyj has also invested in battery storage systems in its hydropower plants at Forshuvudforsen and Landaforsen, with a net capacity of 6 MW.

- Therefore, despite the lack of new large-scale hydroelectric projects, the upgradation, refurbishment, and expansion of existing hydro energy plants and the integration of battery energy storage systems for excess energy storage in hydropower plants are likely to drive the market during the forecast period.

Increasing Renewable Energy Installations are Expected to Drive the Market

- In 2020, approximately 61.7% of the energy generated in the country was from renewable energy sources, amounting to 1,01,000 gigawatt-hours (GWh). Further, the Government of Sweden has planned to double its renewable energy generation by 2030.

- In 2020, the total renewable energy power generation plant's installed capacity was 32,883 megawatt (MW), which was 5.5% higher than the installed renewable capacity of 2019 (31,156 MW).

- In December 2021, Siemens Gamesa announced that it had won a contract from Eolus and Hydro REIN to supply wind turbines for the Stor-Skälsjön project located in the Timrå and Sundsvall municipalities in Central Sweden. Siemens Gamesa will supply 42 SG 6.6-170 turbines with hub heights of between 115-123 meters. The turbines are due to be installed in 2023, and the scope of the contract includes a 25-year full-scope service agreement.

- To achieve its renewable energy targets, the Swedish government has identified offshore wind energy as a viable solution. In January 2022, the Swedish government unveiled plans to develop 120 TWh offshore wind energy in the coming few years and intends to sanction the full 120 TW plan by December 2024. The Swedish Energy Agency has also identified three zones in the Gulf of Bothnia, the Baltic Sea, and the North Sea, with an aggregate wind potential of 30 TWh per annum.

- In February 2022, Sweden-based renewable project developer OX2 submitted a permit application to construct the 1.8 GW Triton Offshore Wind Farm. The wind farm, which will be located 30km south of Ystad, will consist of 129 bottom-fixed wind turbines, with a maximum height of 370 meters.

- The largest source of bioenergy in Sweden is the forest. Sweden has more forest coverage than most other countries, with 63% of land cover. Bioenergy is primarily used for heating, both in private homes and in district heating, as well as for electricity production and industrial processes. This shows a huge potential for bioenergy in the country, which is likely to increase the installed renewable energy capacity in the country.

- Therefore, the growing demand for clean energy and government initiatives to achieve renewable energy targets are expected to drive the Swedish renewable energy market during the forecast period.

Competitive Landscape

The Swedish renewable energy market is moderately fragmented. Some of the key players in this market include Vattenfall AB, Fortum Oyj, Swedish Biofuels AB, General Electric Company, and RES Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Vattenfall AB

- Fortum Oyj

- Swedish Biofuels AB

- General Electric Company

- InnoVentum AB

- Axpo Holding AG

- RES Group6.3.8 Siemens Gamesa Renewable Energy SA