The global alpha olefins market is projected to register a CAGR of more than 5% during the forecast period.

This product will be delivered within 2 business days.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The major factor driving the market is the growing demand from the paper and pulp industries. On the flip side, stringent environmental regulations due to the non-biodegradable nature of polyethylene are hindering the growth of the alpha olefins market.

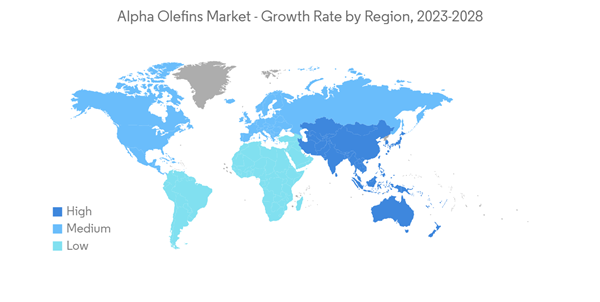

- Further, growing R&D Investments for the development of alpha olefins from various sources are expected to act as a market opportunity in the coming years. The Asia-Pacific region dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Alpha Olefins Market Trends

Increasing Usage in Surfactants Application

- Surfactants are present in a wide range of cleaning products, and one of the usual groups is anionic surfactants, which are particularly valued for their foaming ability. Many anionic surfactants are used in detergents, although the most commonly used today are the salts of dodecylbenzene sulfonic acid and ethoxylated sodium lauryl sulfate.

- Alpha olefin sulfonate is an anionic surfactant that has been used efficaciously for many years in laundry and personal care products but was gradually substituted by other low-cost products.

- The chief benefit of alpha olefin sulfonate in cleaning products is that it can form stable foams in diluted products, hard water, and at low temperatures. In addition, it has good cleaning properties, is useful in both detergents and cosmetics, has fast biodegradability, has good compatibility with the skin, and is highly soluble in water. Therefore, it is suitable for liquid or powder detergents and personal hygiene products, especially for dishwashers, laundry detergents, automotive cleaners, or bath gels.

- The most common alpha olefin sulfonate used in personal care is sodium C14-16 olefin sulfonate, which functions as a detergent, wetting agent, and emulsifier. When properly formulated, sodium C14-16 olefin sulfonate imparts viscosity, a consumer-acceptable foaming profile, and quick flash foam to produce a stable lather, among other benefits.

- The surfactants included in detergents and soaps mix with water and attach themselves to the dirt on clothes and other cleaning surfaces. This helps reduce surface tension and remove dirt from the concerned surface.

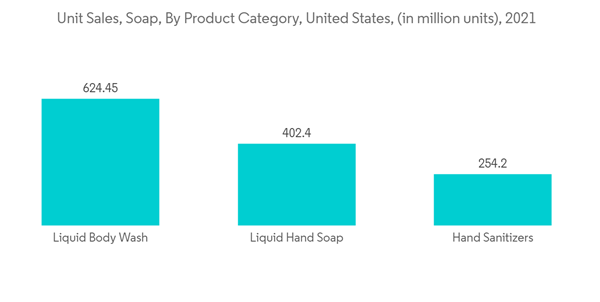

- In 2021, liquid body wash had the highest unit sales among soap products in the United States. In 2021, the liquid body wash category generated around 624 million units in multi-outlet sales in the United States. Also, it was followed by liquid hand soap and hand sanitizer, which sold about 402 million units and 254 million units, respectively, in 2021. This is expected to help the market grow steadily during the forecast period. Owing to all the abovementioned factors, the market is expected to grow during the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to be the dominant market in alpha olefins consumption. In countries like China, Japan, South Korea, India, and Southeast Asian nations, the demand for alpha olefins is increasing. China is also the largest producer of lubricants, oil field chemicals, plasticizers, etc., catering to the market worldwide.

- The consumption of soap and detergent witnessed a sharp increase in the country, owing to the hygiene awareness due to the COVID-19 pandemic. This consumption is expected to propel the demand for alpha olefins in the coming years.

- Alpha olefins are mostly used to manufacture polyethylene, such as linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), which are used in various applications ranging from packaging to pipes.

- According to the Packaging Industry Association of India (PIAI), the packaging industry is currently the fifth-largest economic sector in India. It is growing at a rate of 22-25% per year, making India a preferred hub for the packaging industry. This is expected to increase the demand for polyethylene, in turn, increasing the demand for alpha olefins in the market.

- Further, China has one of the world's largest pulp and paper industries. China is one of the top three producers of paper in the world. For instance, in September 2022, China's processed paper and cardboard manufacturing volume was roughly 11.6 million metric tonnes, which is expected to increase the demand for alpha olefins.

- Hence, due to the above-mentioned reasons, Asia-Pacific is anticipated to dominate the market studied during the forecast period.

Alpha Olefins Industry Overview

The alpha-olefin market is partially consolidated in nature. Some of the major players in the market include Chevron Phillips Chemical Company LLC, INEOS, SABIC, Sasol, and Shell plc, among othersAdditional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS

5 MARKET SEGMENTATION (Market Size in Value)

6 COMPETITIVE LANDSCAPE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Evonik Industries AG

- Idemitsu Kosan Co., Ltd.

- INEOS

- Kemipex

- LANXESS

- Qatar Chemical Company Ltd

- Shell plc

- SABIC

- Sasol