COVID-19 impacted the growth of the pulmonary drug delivery systems market. Patients suffering from respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD) were at high risk of getting coronavirus infection. This has increased the demand for proper drug delivery systems for administering pulmonary drugs to patients. For instance, according to an article published in Pulmonary Medicine, in March 2022, it was observed that COPD patients have worse outcomes from the coronavirus infection. Also, due to biological factors, COPD patients are more likely to acquire viral infections and suffer from COVID-19's pathophysiological effects, such as micro thrombosis, intrapulmonary shunting, and subsequent bacterial infection. Thus, the increasing risk of developing COVID-19 infection among COPD patients increased the demand for inhalers and nebulizers, which impacted the demand for drug delivery systems during the pandemic. Hence, the COVID-19 pandemic had a favorable impact on the market initially; currently, as the pandemic has subsided, the market has lost some traction. However, it is expected to have stable growth during the forecast period.

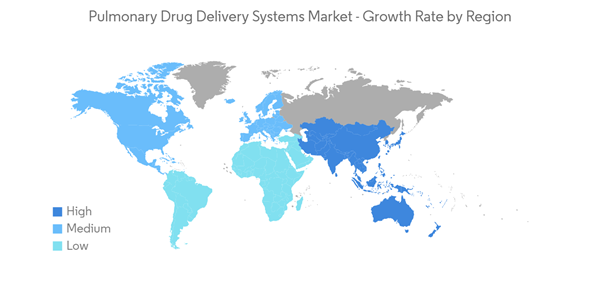

Factors such as the increasing incidence of respiratory diseases, growing technological advancements, and rising preference for pulmonary drug delivery as an alternate route of drug delivery are boosting market growth.

The prevalence and incidence of respiratory diseases such as asthma, chronic obstructive pulmonary diseases, and others among the population are increasing rapidly, which is anticipated to increase the demand for pulmonary drug delivery systems, hence propelling market growth. For instance, according to an article published in ERS Journal, in August 2022, it was projected that about 645.6 million people (454.4 million men and 191.2 million women) are expected to have COPD by 2050, representing a 36% relative increase in global prevalence as compared to the previous year. Thus, the prevalence of COPD, a serious public health issue, is expected to rise, especially in emerging countries which is anticipated to increase the demand for different drug delivery systems such as nebulizers and inhalers. This is expected to fuel the market growth over the forecast period.

In addition, pulmonary drug delivery methods are preferred to conventional drug administration approaches due to the large surface area of the alveolar sacs, the high drug loading efficiency, and the high vascularization of the lung, which makes it an ideal site for drug absorption.

Furthermore, the rising company activities in developing novel drug delivery systems and increasing product launches are also expected to increase the growth of the pulmonary drug delivery systems market over the forecast period. For instance, in June 2021, Glenmark Pharma launched Tiotropium Bromide Dry Powder Inhaler, Tiogiva, used in the treatment of chronic obstructive pulmonary disease (COPD) in the United Kingdom. Also, in March 2021, PARI Pharma GmbH received the market authorization of the LAMIRA Nebulizer System for the delivery of Insmed's drug product ARIKAYCE (amikacin liposome inhalation suspension) in Japan.

Therefore, owing to factors such as the high burden of respiratory diseases among the population and increasing product launches, the studied market is expected to grow over the forecast period. However, the regulatory issues regarding the approval for drug delivery systems are likely to hamper the growth of the pulmonary drug delivery systems market over the forecast period.

Pulmonary Drug Delivery Systems Market Trends

COPD Segment Expected to Register Significant Growth Over the Forecast Period

The chronic obstructive pulmonary diseases segment is expected to witness significant growth in the pulmonary drug delivery systems market over the forecast period. The factors attributing to the market growth are the increasing burden of COPD among the population and the growing demand for innovative drug delivery systems.In addition, the rising geriatric population who are more prone to develop chronic obstructive pulmonary disease diseases due to the age-associated changes in the structure and function of the lung is also expected to increase the demand for the COPD drug segment over the forecast period. For instance, according to the 2022 statistics published by the United Nations Population Fund, about 59% of the total population living in Japan was aged between 15 and 64 in 2022. In addition, as per the same source, 29% of the population was aged 65 years and above in 2022.

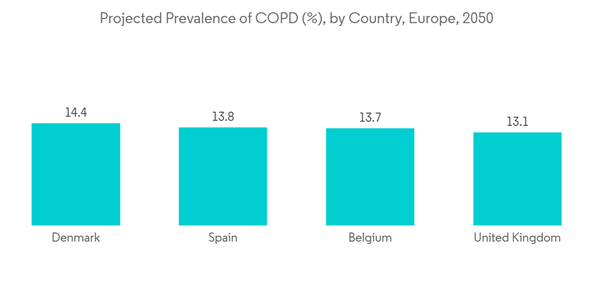

The increasing prevalence and incidence of COPD is the key factor driving the demand for pulmonary drug delivery systems, hence propelling the segment’s growth. According to a research study published in European Respiratory Journal in July 2021, it was found that the prevalence of chronic obstructive pulmonary disease (COPD) is anticipated to increase in Europe (including the Netherlands) due to rising risk factors like smoking and air pollution. Also, as per an article published in the European Respiratory Journal in November 2021, about 49,453,852 European are expected to suffer from COPD by 2050 as compared to 36,580,965 in 2020. This is expected to fuel the segment growth over the forecast period.

Moreover, the growing R&D activities and increasing product launches in the segment are expected to augment the growth of the chronic obstructive pulmonary diseases segment. For instance, in April 2022, GlaxoSmithKline Pharmaceuticals launched Trelegy Ellipta, a once-daily single-inhaler triple therapy (SITT) for treating patients suffering from chronic obstructive pulmonary diseases in India. Also, in October 2021, Glenmark launched a bioequivalent version of the Tiotropium Bromide dry powder inhaler (DPI) to treat chronic obstructive pulmonary disease (COPD) in Spain.

Therefore, owing to the factors such as the high burden of COPD and increasing product launches, the studied segment is expected to grow over the forecast period.

North America Holds Significant Share and Expected to do the Same in the Forecast Period

North America is expected to witness healthy growth in the pulmonary drug delivery systems over the forecast period owing to factors such as the increasing incidences of respiratory diseases such as asthma, allergic rhinitis, COPD, and others, the rising geriatric population, growing demand for diagnostic devices, increasing healthcare expenditure, and high disposable income.The rising burden of respiratory diseases among the population is the key factor driving the demand for drug-delivery systems for treating various conditions, hence boosting market growth. For instance, according to an article published by MDPI in November 2021, it was observed that children with asthma in Mexico City are significantly correlated with respiratory problems and traffic-related air pollution, worsening the asthmatic condition in patients. Also, per the data published by IQAir, in August 2021, the US AQI value for Mexico City was 74, indicating 'Moderate' levels of air pollution at the beginning of 2021. In addition, as per the same source, the components of 'photochemical oxidizing smog' are discharged into the atmosphere in substantial amounts, including carbon monoxide, hydrocarbons, and nitrogen oxides from the exhaust of automobiles. Thus, the increasing discharge of pollutants in the air is expected to cause various respiratory allergies such as asthma, allergic rhinitis, and others among the population. This is anticipated to propel the demand for innovative and effective pulmonary drug delivery systems such as metered dose inhalers or nebulizers, hence bolstering market growth.

Furthermore, the rise in the number of initiatives undertaken by government and non-government organizations is increasing the overall revenue. For instance, CDC's National Asthma Control Program (NACP) provides funds for educating asthma-affected patients. Such initiatives are likely to increase awareness about asthma, which will increase the demand as well as the adoption of inhalers treating asthma, thereby propelling market growth.

Moreover, the presence of key market players in the country focusing on the development of effective pulmonary drugs as well as the rising adoption of various business strategies such as agreements, acquisitions, partnerships, and increasing product launches, are likely to boost the growth of the market. For instance, in March 2022, the US FDA approved the first generic of Symbicort (budesonide and formoterol fumarate dihydrate) Inhalation Aerosol for the treatment of asthma in patients six years of age and older and the maintenance treatment of airflow obstruction and reducing exacerbations for patients with chronic obstructive pulmonary disease (COPD), including chronic bronchitis and/or emphysema.

Therefore, the rising burden of respiratory diseases and increasing company activities and product launches in the country will significantly drive the market in the North American region during the study period.

Pulmonary Drug Delivery Systems Market Competitor Analysis

The pulmonary drug delivery systems market is moderately competitive and consists of several major players. Some of the companies which are currently dominating the market are Koninklijke Philips NV, GlaxoSmithKline PLC, 3M, Novartis AG, Boehringer Ingelheim International GmbH, AstraZeneca, Cipla Inc., Merck & Co., and GF Health Products Inc.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Koninklijke Philips NV

- GlaxoSmithKline PLC

- 3M

- Novartis AG

- Boehringer Ingelheim International GmbH

- AstraZeneca

- Cipla Inc.

- Merck & Co.

- GF Health Products Inc.

- Aerogen

- PARI GmbH

- Gilbert Technologies