North America boasts a well-developed healthcare infrastructure, advanced medical facilities, and a high level of technological adoption. Therefore, the North American region captured $1,147.2 million revenue in the market in 2023. This creates a conducive environment for the adoption of advanced surgical lighting systems. The region has witnessed an increasing preference for minimally invasive surgical techniques, which require specialized lighting solutions for precise visualization. Moreover, total consumption of these lights in the US was 3,732.5 Hundred Units in 2023.

Energy-efficient lighting, such as LED technology, consumes less energy than traditional lighting sources like incandescent or halogen bulbs. This translates into cost savings for healthcare facilities over the long term, as they can reduce electricity bills and operational expenses associated with lighting. Energy-efficient lighting solutions offer significant long-term savings due to their longer lifespan and lower energy consumption.

Additionally, as the healthcare sector expands, the number of surgical procedures performed worldwide increases. Urbanization, economic advancement, and escalating investments in healthcare infrastructure present substantial growth prospects for the market in regions experiencing economic expansion. Thus, the expansion of the global healthcare sector creates a favourable environment for the growth of the market.

However, a common limitation is the lack of adjustability, particularly in light intensity and color temperature. Surgeons require precise control over these parameters to optimize visibility during different surgeries. For example, during delicate procedures that require high precision, such as neurosurgery, the ability to adjust the light intensity and color temperature can help reduce glare and shadows, improving the surgeon's visibility and accuracy.

The COVID-19 pandemic reshaped healthcare practices globally, impacting various aspects of medical equipment use, including surgical lights. As hospitals and healthcare facilities navigated the challenges posed by the pandemic, the utilization of these lights witnessed fluctuations. During the initial phases of the pandemic, many elective surgical procedures were postponed or canceled to conserve resources and reduce the risk of COVID-19 transmission. Thus, the pandemic had an overall moderate impact on the market.

Driving and Restraining Factors

Drivers- Rising preference for energy-efficient lighting

- Expansion of the healthcare sector globally

- Increasing prevalence of surgical procedures

- Technological limitations in traditional surgical lights

- High cost of surgical lighting and budget constraints

- Rapid growth of ambulatory surgical centers (ASCs)

- Advancements in digital imaging technology

- Shortages of adequate infrastructure due to limited resources

- Obsolescence of rapidly evolving technologies

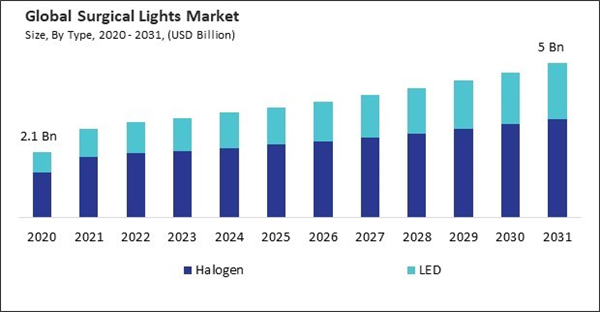

Type Outlook

Based on type, the market is characterized into halogen and LED. The halogen segment garnered 67.1% revenue share in the market in 2023. Halogen lights are vital in providing reliable and cost-effective solutions for healthcare facilities worldwide, ensuring optimal visibility and precision during surgical procedures. Moreover, in terms of volume, the halogen segment registered 10,368.7 Hundred Units in the market in 2023.End Use Outlook

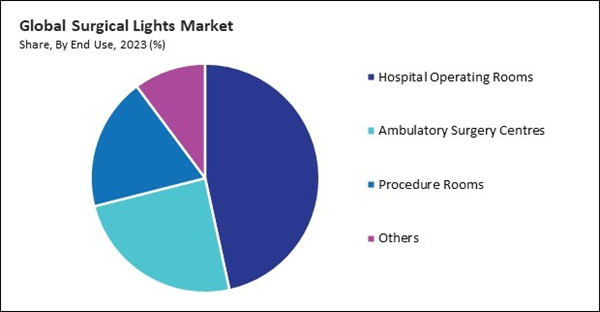

By end use, the market is divided into hospital operating rooms, ambulatory surgery centres, procedure rooms, and others. The ambulatory surgery centres segment procured 24.5% revenue share in the market in 2023. Ambulatory surgery centers (ASCs) are healthcare facilities that offer same-day surgical care, including diagnostic and preventive procedures. Moreover, in terms of volume, the ambulatory surgery centres segment attained 3,484.6 Hundred Units in the market in 2023.Application Outlook

On the basis of application, the market is classified into cardiac surgery, gynecological surgery, neurosurgery, ENT surgery, and others. The ENT surgery segment recorded 15.0% revenue share in the market in 2023. Surgical lights used in ENT procedures typically feature adjustable intensity and color temperature settings. Moreover, in terms of volume, the ENT surgery segment attained 2,366.3 Hundred Units in the market in 2023.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment held 29.8% revenue share in the market in 2023. The number of surgical procedures performed in Europe has been on the rise, driven by factors such as an aging population, increasing prevalence of chronic diseases, and advancements in surgical techniques. Moreover, in terms of volume, the Germany Market utilized 939.35 Hundred Units of these lights in 2022.List of Key Companies Profiled

- Baxter International, Inc

- Koninklijke Philips N.V

- Integra LifeSciences Holdings Corporation

- Steris PLC

- Herbert Waldmann GmbH & Co. KG

- Skytron, LLC

- Getinge AB

- Stryker Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- S.I.M.E.O.N. Medical GmbH & Co. KG

Market Report Segmentation

By Type (Volume, Hundred Units, USD Billion, 2020-2031)- Halogen

- LED

- Hospital Operating Rooms

- Ambulatory Surgery Centres

- Procedure Rooms

- Others

- Cardiac Surgery

- Gynecological Surgery

- Neurosurgery

- ENT Surgery

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Baxter International, Inc

- Koninklijke Philips N.V

- Integra LifeSciences Holdings Corporation

- Steris PLC

- Herbert Waldmann GmbH & Co. KG

- Skytron, LLC

- Getinge AB

- Stryker Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- S.I.M.E.O.N. Medical GmbH & Co. KG