Global Packaging Robots Market - Key Trends & Drivers Summarized

Why Are Packaging Robots Important for Modern Manufacturing?

Packaging robots, designed to automate various packaging processes such as picking, placing, sorting, packing, and palletizing, have become essential in modern manufacturing. These robots provide speed, precision, and flexibility, enabling companies to optimize production lines, reduce labor costs, and improve overall efficiency. Packaging robots are widely used in industries such as food and beverages, pharmaceuticals, electronics, and consumer goods, where consistency and high-speed packaging are critical. The ability of packaging robots to work continuously with minimal supervision allows businesses to meet high production demands while ensuring accuracy and reducing human error. The adoption of packaging robots also enhances workplace safety by automating tasks that could be hazardous to human workers.How Are Technological Advancements Shaping the Packaging Robots Market?

Technological advancements in robotics, artificial intelligence (AI), and machine vision have significantly transformed the packaging robots market. Robots equipped with advanced sensors and vision systems can identify, sort, and handle products with greater accuracy, even in complex or high-speed environments. The integration of AI and machine learning algorithms enables robots to adapt to different product types and sizes, allowing for greater flexibility in packaging lines. Collaborative robots, or cobots, are also becoming more common in packaging applications, as they are designed to work alongside human operators, enhancing efficiency and safety. Additionally, advancements in robotic grippers and end-of-arm tooling have expanded the range of products that packaging robots can handle, from fragile items to heavy, bulky goods.How Are Industry Demands and Labor Shortages Driving the Packaging Robots Market?

The increasing demand for automation in manufacturing, driven by the need for higher production speeds, consistency, and cost reduction, has been a significant factor in the growth of the packaging robots market. Many industries are turning to robots to address labor shortages and rising labor costs, especially in regions where finding skilled workers for repetitive and physically demanding packaging tasks is challenging. Packaging robots offer a solution to these issues by providing 24/7 operation and minimizing the reliance on human labor. Additionally, the growing complexity of packaging, particularly with the rise of e-commerce and personalized packaging solutions, requires the precision and adaptability that robots can offer. These industry demands are propelling the adoption of packaging robots across various sectors.What Is Driving Growth in the Packaging Robots Market?

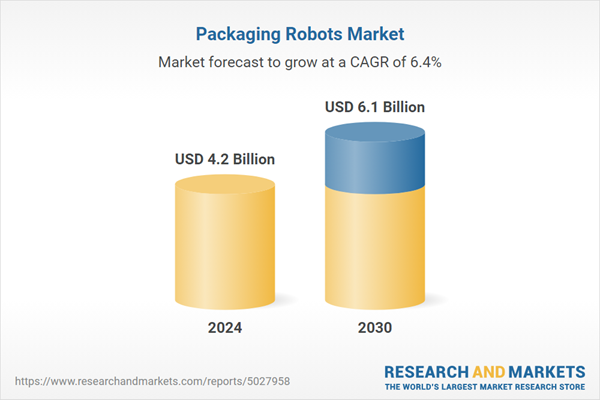

The growth in the packaging robots market is driven by several factors. The need for automation in industries such as food and beverages, pharmaceuticals, and consumer goods has significantly boosted demand for packaging robots, as companies seek to optimize production efficiency and reduce labor costs. Technological advancements, particularly in AI, machine vision, and collaborative robots, have enhanced the capabilities and flexibility of packaging robots, making them suitable for a wider range of applications. Labor shortages and the increasing complexity of packaging requirements, particularly in e-commerce, have further fueled the adoption of robotic automation in packaging processes. As companies continue to invest in smart factories and automated solutions, the global packaging robots market is expected to grow steadily.Report Scope

The report analyzes the Packaging Robots market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Gripper Type (Claw, Clamp, Vacuum, Other Gripper Types); Application (Packing, Palletizing, Pick & Place); End-Use (Food & Beverage, Pharmaceuticals, Consumer Products, Logistics, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Claw Gripper segment, which is expected to reach US$3 Billion by 2030 with a CAGR of 6.7%. The Clamp Gripper segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 10.4% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Packaging Robots Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Packaging Robots Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Packaging Robots Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Group, Bosch Packaging Technology, Bosch Rexroth AG, Brenton, LLC., Comau SpA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 13 companies featured in this Packaging Robots market report include:

- ABB Group

- Bosch Packaging Technology

- Bosch Rexroth AG

- Brenton, LLC.

- Comau SpA

- DENSO Robotics

- FANUC Corporation

- Krones AG

- KUKA Aktiengesellschaft

- Mitsubishi Electric Corporation

- Remtec Automation, LLC.

- Schneider Electric SA

- Universal Robots A/S

- Yaskawa America Inc.

- Yaskawa Motoman

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Group

- Bosch Packaging Technology

- Bosch Rexroth AG

- Brenton, LLC.

- Comau SpA

- DENSO Robotics

- FANUC Corporation

- Krones AG

- KUKA Aktiengesellschaft

- Mitsubishi Electric Corporation

- Remtec Automation, LLC.

- Schneider Electric SA

- Universal Robots A/S

- Yaskawa America Inc.

- Yaskawa Motoman

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 6.1 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |