Global Cast Polymers Market - Key Trends and Drivers Summarized

How Are Cast Polymers Transforming Modern Manufacturing?

Cast polymers are a class of engineered materials used to create highly durable and aesthetically versatile products in a variety of industries. These materials are created by combining natural or synthetic stone-like components with a polymer resin, which is then cast into molds to produce solid surfaces, countertops, sinks, bathtubs, and more. Cast polymers offer numerous advantages over natural stone and other traditional materials, including cost-effectiveness, enhanced durability, and design flexibility. Unlike natural stone, which can have inconsistencies in color and texture, cast polymers allow for consistent, customized finishes, making them highly desirable for both residential and commercial applications. They also offer resistance to stains, scratches, and moisture, which makes them ideal for use in kitchens, bathrooms, and high-traffic areas. The ability to mold these materials into a wide range of shapes and sizes, coupled with the variety of colors and finishes available, has allowed cast polymers to replace traditional materials in many applications, significantly impacting the construction, home improvement, and interior design industries.Why Are Cast Polymers Preferred Over Natural Stone and Traditional Materials?

Cast polymers have gained preference over natural stone and other traditional materials due to their superior performance, design flexibility, and lower costs. One of the main reasons for their popularity is their uniformity in color and texture, which is difficult to achieve with natural stone. This consistency is crucial for large-scale projects, such as countertops and flooring in commercial spaces, where seamless finishes are a key aesthetic requirement. Cast polymers can be designed to mimic the appearance of materials like granite, marble, or quartz while offering greater resilience to damage. They are non-porous, which gives them an inherent resistance to moisture, stains, and bacteria, making them especially suitable for kitchen and bathroom applications where hygiene is a concern. Additionally, cast polymers are much lighter than natural stone, making them easier and more cost-effective to transport and install. This combination of aesthetics, durability, and practical benefits has led to the widespread adoption of cast polymers in residential homes, commercial buildings, and public spaces. Their ability to withstand wear and tear, without the need for frequent maintenance or repairs, offers long-term cost savings for consumers and businesses alike.How Are Technological Advancements Shaping the Production of Cast Polymers?

The production of cast polymers has been significantly enhanced by technological advancements in material science and manufacturing processes. Modern production techniques allow for greater precision in molding and casting, resulting in higher quality products with improved mechanical properties and surface finishes. One notable innovation is the development of high-performance resins and additives that increase the strength, heat resistance, and UV stability of cast polymers. These materials can now be formulated to withstand extreme conditions, such as outdoor weather exposure or high temperatures, expanding their use in industries like construction, automotive, and aerospace. Advances in automation and computer-aided design (CAD) have also played a crucial role in streamlining the production process. Manufacturers can now design highly customized molds and prototypes with greater efficiency, reducing material waste and speeding up production times. Another important trend is the increasing use of eco-friendly resins and recycled materials in cast polymer production, aligning with the growing consumer demand for sustainable products. This push towards sustainability is helping cast polymers maintain their competitive edge in the market, as industries move toward greener practices.What Factors Are Propelling Expansion of the Cast Polymers Market?

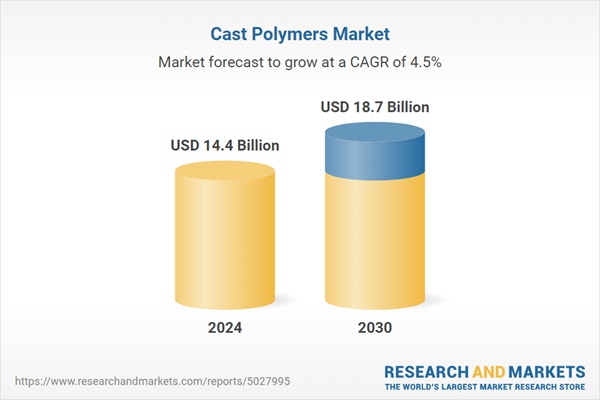

The growth in the cast polymers market is driven by several factors, particularly the rising demand for durable, aesthetically versatile, and cost-effective building materials. The construction and home improvement sectors are major contributors to this growth, as cast polymers have become a popular choice for countertops, vanities, and decorative surfaces in both residential and commercial projects. The shift towards modern, customizable design solutions is fueling demand for cast polymers, which offer a wide range of colors, patterns, and finishes that can be tailored to meet specific architectural and design preferences. In addition, the durability and low-maintenance nature of cast polymers are appealing to homeowners and businesses alike, as they offer long-lasting solutions without the need for frequent upkeep. The growing emphasis on sustainable building materials has also driven interest in cast polymers, as manufacturers increasingly offer products made from recycled or eco-friendly materials. Moreover, technological innovations in production processes have reduced the cost of manufacturing cast polymers, making them a more affordable alternative to natural stone while maintaining a high-end appearance. Consumer behavior is also playing a role, with more buyers seeking out materials that combine both functionality and design appeal. As a result, the cast polymers market is expected to continue expanding as more industries recognize the benefits of using these versatile materials in construction, interior design, and industrial applications.Report Scope

The report analyzes the Cast Polymers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Solid Surface, Engineered Stone, Cultured Marble); Material (Alumina Trihydrate, Calcium Carbonate, Resins, Natural Stone / Quartz, Other Materials); End-Use (Non-Residential, Residential).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solid Surface Cast Polymers segment, which is expected to reach US$9.2 Billion by 2030 with a CAGR of 4.5%. The Engineered Stone Cast Polymers segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.8 Billion in 2024, and China, forecasted to grow at an impressive 6.7% CAGR to reach $4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cast Polymers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cast Polymers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cast Polymers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGCO Corporation, Aristech Surfaces LLC, Bradley Corporation, Breton S.P.A., CaesarStone and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Cast Polymers market report include:

- AGCO Corporation

- Aristech Surfaces LLC

- Bradley Corporation

- Breton S.P.A.

- CaesarStone

- California Crafted Marble, Inc.

- Central Marble Products, Inc.

- Compac Sorting Equipment

- Coritec Solid Surface Manufacturers

- Cosentino SA

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastern Surfaces

- EOS Surfaces, LLC

- Hanwha Surfaces

- Huber Engineered Materials

- Kingkonree International China Surface Industrial Co., Ltd.

- Lehigh Surfaces

- Meganite Inc.

- Oppein Home Group Inc.

- Royal Stone Industries, Inc.

- Swan Surfaces, LLC

- Technistone, a.s.

- The R.J. Marshall Company

- US Marble, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGCO Corporation

- Aristech Surfaces LLC

- Bradley Corporation

- Breton S.P.A.

- CaesarStone

- California Crafted Marble, Inc.

- Central Marble Products, Inc.

- Compac Sorting Equipment

- Coritec Solid Surface Manufacturers

- Cosentino SA

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastern Surfaces

- EOS Surfaces, LLC

- Hanwha Surfaces

- Huber Engineered Materials

- Kingkonree International China Surface Industrial Co., Ltd.

- Lehigh Surfaces

- Meganite Inc.

- Oppein Home Group Inc.

- Royal Stone Industries, Inc.

- Swan Surfaces, LLC

- Technistone, a.s.

- The R.J. Marshall Company

- US Marble, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.4 Billion |

| Forecasted Market Value ( USD | $ 18.7 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |