Global Meat Substitutes Market - Key Trends & Drivers Summarized

What Are Meat Substitutes and Why Are They Gaining Popularity?

Meat substitutes, also known as meat analogues or plant-based meats, are products designed to mimic the taste, texture, and appearance of animal meat, catering primarily to vegetarians, vegans, and individuals looking to reduce their meat consumption due to health, environmental, or ethical reasons. These substitutes are typically made from ingredients like soy, peas, wheat, and mycoprotein, offering high protein content along with essential nutrients. The increasing awareness of the health risks associated with red and processed meats, such as heart disease and cancer, has significantly contributed to the growing popularity of meat substitutes. Additionally, environmental concerns related to animal farming - including greenhouse gas emissions and land use - further drive individuals towards plant-based diets, positioning meat substitutes as a sustainable and ethical choice that aligns with modern consumer values and lifestyle preferences.How Is Innovation Shaping the Meat Substitute Industry?

Innovation is at the heart of the meat substitute industry, with companies continuously developing new products that better replicate the sensory qualities of meat to appeal to a broader audience, including meat-eaters. Technological advancements in food science and texture engineering have led to the creation of products like Impossible Foods' and Beyond Meat's burgers, which sizzle, taste, and bleed like beef, thanks to the use of heme - an iron-containing molecule derived from plants. These products are not only designed to look and cook like meat but also to provide a comparable nutritional profile, which is key to attracting health-conscious consumers. Additionally, the emergence of fermentation technology and 3D food printing offers promising avenues to further enhance the texture and flavor of meat substitutes, making them more palatable to traditional meat consumers and ensuring a better integration into everyday cuisine.What Impact Are Meat Substitutes Having on the Food Industry and Agriculture?

The rise of meat substitutes is significantly impacting the food industry and agriculture, prompting a shift in resource allocation from traditional livestock farming to more sustainable crop production for plant-based proteins. As the demand for meat substitutes grows, there is an increasing need for crops such as soy, peas, and beans, which are primary ingredients in many plant-based products. This shift not only helps reduce the environmental footprint associated with animal agriculture but also opens up new opportunities for farmers and producers to diversify and innovate within their crop production strategies. Furthermore, the food industry sees a transformation in product offerings, with major food companies and restaurants incorporating meat substitutes into their menus to cater to the evolving consumer preferences. This integration challenges traditional food production and supply chain models, necessitating new strategies for sourcing, manufacturing, and distribution.What Are the Primary Drivers Behind the Expanding Market for Meat Substitutes?

The growth in the meat substitutes market is driven by several factors, notably the increasing consumer awareness of the health and environmental impacts of meat consumption. The burgeoning vegan and vegetarian population, alongside flexitarians seeking to reduce meat intake, significantly contributes to the demand. Technological innovations that enhance the taste and texture of plant-based products are making these substitutes more appealing to a broader demographic. Additionally, growing concerns over animal welfare encourage more consumers to turn to meat alternatives as a more ethical choice. Economic factors also play a role; as the cost of producing plant-based products decreases with advancements in agricultural practices and food processing technologies, these products become more accessible to the average consumer. Finally, the influence of social media and celebrity endorsements has heightened awareness and acceptance of meat substitutes, further propelling market growth and diversification into new regions and demographics.Report Scope

The report analyzes the Meat Substitutes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Tofu, Tempeh, Seitan, Quorn, Other Types); Source (Soy Protein, Wheat Protein, Pea Protein, Other Sources).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Tofu segment, which is expected to reach US$1.1 Billion by 2030 with a CAGR of 6.6%. The Tempeh segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $620.2 Million in 2024, and China, forecasted to grow at an impressive 5% CAGR to reach $497.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Meat Substitutes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Meat Substitutes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Meat Substitutes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amy's Kitchen, Inc., Archer Daniels Midland Company, Beyond Meat, Dow, Inc., DuPont de Nemours, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 58 companies featured in this Meat Substitutes market report include:

- Amy's Kitchen, Inc.

- Archer Daniels Midland Company

- Beyond Meat

- Dow, Inc.

- DuPont de Nemours, Inc.

- Gardein

- Meatless

- MGP Ingredients, Inc.

- Morningstar Farms L.C

- Quorn Foods

- Sonic Biochem Extraction Pvt., Ltd.

- The Nisshin OilliO Group Ltd.

- VBites Foods Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amy's Kitchen, Inc.

- Archer Daniels Midland Company

- Beyond Meat

- Dow, Inc.

- DuPont de Nemours, Inc.

- Gardein

- Meatless

- MGP Ingredients, Inc.

- Morningstar Farms L.C

- Quorn Foods

- Sonic Biochem Extraction Pvt., Ltd.

- The Nisshin OilliO Group Ltd.

- VBites Foods Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 331 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

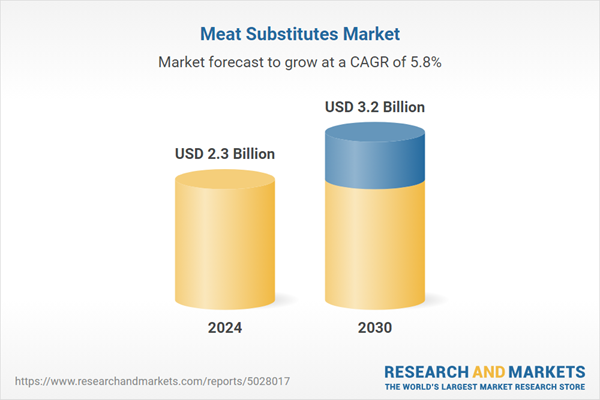

| Estimated Market Value ( USD | $ 2.3 Billion |

| Forecasted Market Value ( USD | $ 3.2 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |