Global Cloud API Market - Key Trends and Drivers Summarized

Why Are Cloud APIs Critical to Digital Transformation?

Cloud APIs have become a crucial component in the digital transformation strategies of businesses across all industries. As organizations increasingly move their operations to the cloud, APIs (Application Programming Interfaces) enable the seamless integration of cloud services with existing applications, allowing businesses to leverage the full power of cloud computing without major overhauls to their infrastructure. Cloud APIs provide the necessary interfaces for connecting diverse software systems, enabling them to communicate, share data, and perform tasks across different platforms and environments. This capability is especially vital in today's multi-cloud and hybrid cloud landscapes, where businesses use a mix of public and private clouds alongside on-premises systems. Cloud APIs streamline processes, making it easier for developers to access cloud resources, automate workflows, and build scalable applications that can grow with the business. From enhancing customer experiences through API-driven services to facilitating internal collaboration, cloud APIs are key enablers of the innovation and agility that digital transformation demands.How Are Technological Advancements Enhancing Cloud API Capabilities?

Technological advancements are constantly enhancing the capabilities of cloud APIs, enabling businesses to do more with less effort. One of the most transformative innovations has been the development of RESTful APIs (Representational State Transfer), which allow for more lightweight, flexible, and scalable interactions between cloud services and applications. REST APIs are designed to be stateless and easily integrate with web services, making them ideal for cloud environments. Another major advancement is the rise of API gateways and management platforms, which provide organizations with the tools to secure, monitor, and scale their API usage effectively. These platforms offer critical functionalities such as rate limiting, access control, and analytics, helping businesses manage their API ecosystem with greater efficiency and security. Furthermore, serverless computing has enhanced the way APIs function in cloud environments by eliminating the need for traditional server management. Serverless architectures allow APIs to trigger functions and execute tasks dynamically, without the need for provisioning or maintaining infrastructure, making them highly cost-effective and scalable. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into cloud APIs is enabling advanced features like predictive analytics, natural language processing, and automated decision-making, further expanding their potential applications.Where Are Cloud APIs Making the Biggest Impact?

Cloud APIs are making a significant impact across multiple industries, transforming how businesses operate and deliver services. In the financial services sector, APIs are crucial for enabling open banking, where financial institutions share data with third-party providers to offer personalized financial products and services. This has led to the development of new fintech solutions, such as mobile banking apps and robo-advisors, that rely heavily on cloud APIs to access data and perform transactions securely. In the healthcare industry, cloud APIs are streamlining the integration of electronic health records (EHRs) with other healthcare applications, enabling better patient care coordination and real-time data sharing among providers. Cloud APIs are also being used to integrate telemedicine platforms with healthcare systems, providing seamless access to patient data during virtual consultations. In e-commerce, APIs play a key role in connecting online stores with payment gateways, logistics providers, and customer service platforms, ensuring smooth end-to-end operations. Moreover, in the field of IoT (Internet of Things), cloud APIs are vital for connecting and managing the vast number of devices and sensors that generate data, allowing businesses to analyze and act on that data in real time. Across these industries, cloud APIs are facilitating innovation, improving operational efficiency, and driving new business models by enabling seamless connectivity between different systems and applications.What Are the Factors Propelling Growth of the Cloud API Market?

The growth in the cloud API market is driven by several key factors, starting with the increasing reliance on cloud services and the growing need for interoperability between various applications and platforms. As businesses adopt multi-cloud and hybrid cloud strategies, the demand for APIs that can integrate disparate systems and services is rising sharply. Cloud APIs offer the flexibility and scalability needed to manage complex infrastructures, making them essential for businesses looking to stay competitive in an increasingly digital world. Another significant driver is the rise of microservices architecture, which allows organizations to build applications as a collection of loosely coupled services. Cloud APIs enable these microservices to communicate efficiently, improving the speed of application development and deployment. Additionally, the increasing emphasis on digital customer experiences is pushing companies to adopt APIs that can connect front-end applications, such as mobile apps and websites, with back-end systems in the cloud, enabling faster and more personalized services. Security is also a major factor driving growth, as modern cloud API solutions come with built-in encryption, authentication, and monitoring capabilities, ensuring that data exchanges are secure and compliant with industry regulations. Lastly, the rise of API-first development strategies, where APIs are designed and implemented before the rest of the application, is accelerating the adoption of cloud APIs. This approach allows for faster integration and more flexible development, meeting the needs of businesses looking to innovate quickly and efficiently. These factors collectively are fueling the robust expansion of the cloud API market as organizations increasingly depend on APIs to optimize their cloud environments and streamline digital operations.Report Scope

The report analyzes the Cloud API market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (SaaS APIs, PaaS APIs, IaaS APIs, Cross-Platform APIs); Organization Size (Large Enterprises, SMEs); Vertical (Healthcare, Media & Entertainment, IT & Telecom, BFSI, Manufacturing, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the SaaS APIs segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of 16%. The PaaS APIs segment is also set to grow at 22.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $560.4 Million in 2024, and China, forecasted to grow at an impressive 19.8% CAGR to reach $942.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cloud API Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cloud API Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cloud API Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amazon Web Services, Inc., CA Technologies, Inc., Citrix Systems, Inc., Google, Inc., IBM Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Cloud API market report include:

- Amazon Web Services, Inc.

- CA Technologies, Inc.

- Citrix Systems, Inc.

- Google, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Rackspace US, Inc.

- Red Hat, Inc.

- Rogue Wave Software, Inc.

- TIBCO Software, Inc.

- Vmware, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amazon Web Services, Inc.

- CA Technologies, Inc.

- Citrix Systems, Inc.

- Google, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Rackspace US, Inc.

- Red Hat, Inc.

- Rogue Wave Software, Inc.

- TIBCO Software, Inc.

- Vmware, Inc.

Table Information

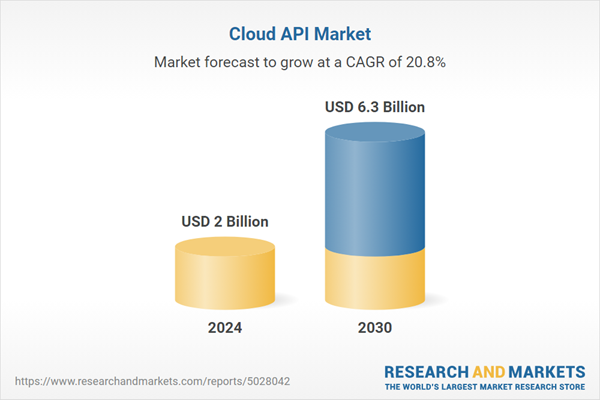

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 6.3 Billion |

| Compound Annual Growth Rate | 20.8% |

| Regions Covered | Global |