Global Teleradiology Market - Key Trends and Drivers Summarized

What Is Teleradiology and Why Is It Important in Modern Healthcare?

Teleradiology is the process of transmitting radiological images, such as X-rays, CT scans, and MRIs, from one location to another for interpretation by a radiologist. It is a vital component of modern healthcare, especially in regions where access to radiology services is limited. Teleradiology enables hospitals, clinics, and diagnostic centers to provide round-the-clock radiology services by outsourcing image interpretation to remote radiologists. This technology is critical in reducing diagnostic delays, ensuring timely treatment, and addressing the shortage of radiologists in various parts of the world. By leveraging teleradiology, healthcare providers can extend their reach, improve patient outcomes, and reduce the need for patients to travel for expert diagnostic services, particularly in rural and underserved areas.How Is Teleradiology Being Implemented Across Healthcare Systems?

Teleradiology is widely adopted in hospitals, diagnostic imaging centers, and specialized telehealth services. Large hospitals and healthcare systems often use teleradiology to maintain 24/7 radiology coverage by outsourcing night-time readings to external radiologists. Smaller clinics and rural healthcare facilities use teleradiology to access specialized radiology services, allowing them to offer high-quality diagnostic imaging without the need for an in-house radiologist. In addition to routine diagnostic services, teleradiology is being increasingly used in emergency settings where rapid image interpretation is crucial, such as in trauma or stroke care. With advancements in secure cloud-based platforms, healthcare providers are now able to store, share, and access diagnostic images more efficiently, enhancing collaboration between radiologists and referring physicians.What Are the Key Market Segments in Teleradiology?

Modalities include X-rays, computed tomography (CT) scans, magnetic resonance imaging (MRI), ultrasound, and nuclear medicine. CT scans and MRIs are the largest segments due to their critical role in diagnosing a wide range of medical conditions. Components of the market include hardware, software, and services, with cloud-based software solutions seeing rapid growth. End-users of teleradiology services include hospitals, diagnostic centers, ambulatory surgical centers, and mobile imaging facilities. Geographically, North America leads the market due to the presence of advanced healthcare infrastructure and regulatory support for telehealth services, while Asia-Pacific is experiencing significant growth as healthcare providers in the region adopt telemedicine to address the growing demand for radiology services in rural and remote areas.The Growth in the Teleradiology Market Is Driven by Several Factors

The growth in the teleradiology market is driven by several factors, including the increasing demand for remote diagnostic services, the shortage of radiologists, and advancements in imaging technology and cloud-based platforms. The need for 24/7 access to radiology services is a key driver, as healthcare providers seek to ensure continuous diagnostic support across different time zones. The integration of AI and machine learning in image analysis is further enhancing the efficiency and accuracy of teleradiology, while the adoption of 5G technology is enabling faster transmission of large imaging files, improving real-time diagnostics. Additionally, the regulatory push toward telehealth and the growing demand for second opinions are contributing to the rapid expansion of the teleradiology market.Report Scope

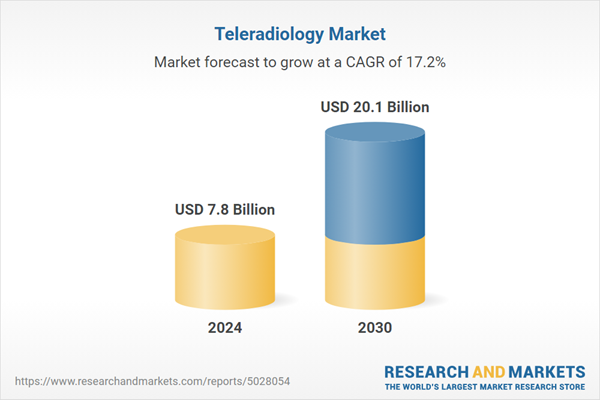

The report analyzes the Teleradiology market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (X-ray, Computed Tomography, Ultrasound, Nuclear Imaging, Magnetic Resonance Imaging).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the X-ray segment, which is expected to reach US$5.2 Billion by 2030 with a CAGR of a 15.7%. The Computed Tomography segment is also set to grow at 18% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.1 Billion in 2024, and China, forecasted to grow at an impressive 22.6% CAGR to reach $4.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Teleradiology Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Teleradiology Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Teleradiology Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 4ways Healthcare Ltd., Agfa HealthCare, Argus Radiology, Cybernet Manufacturing, Inc., Everlight Radiology and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Teleradiology market report include:

- 4ways Healthcare Ltd.

- Agfa HealthCare

- Argus Radiology

- Cybernet Manufacturing, Inc.

- Everlight Radiology

- Fujifilm Medical Systems USA, Inc.

- GE Healthcare

- HealthWatch TeleDiagnostics Pvt., Ltd.

- Medica Reporting Limited

- Merge Healthcare, Inc.

- NightHawk Radiology

- ONRAD, Inc.

- Philips Healthcare

- Radisphere National Radiology Group, Inc.

- RamSoft, Inc.

- Sectra AB

- Siemens Healthineers

- StatRad, LLC

- TeleDiagnosys LLC

- Telemedicine Clinic SL

- Teleradiology Solutions

- USARAD Holdings, Inc.

- Virtual Radiologic (vRad)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 4ways Healthcare Ltd.

- Agfa HealthCare

- Argus Radiology

- Cybernet Manufacturing, Inc.

- Everlight Radiology

- Fujifilm Medical Systems USA, Inc.

- GE Healthcare

- HealthWatch TeleDiagnostics Pvt., Ltd.

- Medica Reporting Limited

- Merge Healthcare, Inc.

- NightHawk Radiology

- ONRAD, Inc.

- Philips Healthcare

- Radisphere National Radiology Group, Inc.

- RamSoft, Inc.

- Sectra AB

- Siemens Healthineers

- StatRad, LLC

- TeleDiagnosys LLC

- Telemedicine Clinic SL

- Teleradiology Solutions

- USARAD Holdings, Inc.

- Virtual Radiologic (vRad)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.8 Billion |

| Forecasted Market Value ( USD | $ 20.1 Billion |

| Compound Annual Growth Rate | 17.2% |

| Regions Covered | Global |