Global Secure Sockets Layer (SSL) Certification Market - Key Trends and Drivers Summarized

Secure Sockets Layer (SSL) Certification: Why Is It Indispensable for Web Security?

Secure Sockets Layer (SSL) certification is a critical component of web security that ensures encrypted communication between a web server and a user's browser, safeguarding sensitive information such as login credentials, credit card details, and personal data. SSL certificates are essential for establishing trust and credibility for websites, as they authenticate the identity of the website owner and provide a secure browsing experience. The market for SSL certification is expanding due to the rising awareness about data privacy and security, the increasing incidence of cyberattacks, and the regulatory requirements for data protection. Organizations across various sectors, including e-commerce, banking, healthcare, and government, are adopting SSL certification to ensure secure online transactions, protect customer data, and comply with data privacy laws.How Are Technological Advancements Enhancing SSL Certification?

Technological advancements are significantly enhancing SSL certification, making it more secure and easier to manage for businesses of all sizes. Innovations in encryption algorithms, such as Elliptic Curve Cryptography (ECC), are providing stronger encryption with lower computational overhead, improving website performance without compromising security. The development of automated SSL management tools and Certificate Management Systems (CMS) is simplifying the process of certificate issuance, renewal, and revocation, reducing the administrative burden for IT teams. The introduction of free and automated SSL services by certificate authorities (CAs) is expanding access to SSL certificates for small and medium-sized enterprises (SMEs), driving wider adoption. These technological advancements are strengthening the market for SSL certification, ensuring robust web security and compliance with evolving cyber threats.What Market Trends Are Driving the Adoption of SSL Certification?

Several market trends are driving the adoption of SSL certification, reflecting the growing importance of secure web communications and data protection. The increasing focus on HTTPS and secure browsing is expanding the market for SSL certificates, as websites that do not use HTTPS are flagged as 'Not Secure' by major web browsers, affecting their reputation and SEO rankings. The rise of e-commerce and online banking is spurring demand for Extended Validation (EV) and Organization Validated (OV) SSL certificates that provide enhanced security and trust. The growing emphasis on securing Internet of Things (IoT) devices and mobile applications is further expanding the use of SSL certificates to ensure end-to-end data encryption. Additionally, the trend of integrating SSL certificates with Secure Access Service Edge (SASE) frameworks is driving the adoption of SSL for securing remote access and cloud applications.What Drives the Growth in the Secure Sockets Layer (SSL) Certification Market?

The growth in the Secure Sockets Layer (SSL) certification market is driven by several factors, including the rising awareness about data security and privacy, the increasing incidence of cyberattacks, and the growing adoption of e-commerce and online services. The need for regulatory compliance with data protection laws, such as GDPR, CCPA, and HIPAA, is driving organizations to adopt SSL certificates that ensure secure web communications and data privacy. The expansion of cloud-based applications and remote work environments is creating new opportunities for SSL certification to provide secure access and protect against cyber threats. The development of AI-powered security solutions for SSL vulnerability management and the rise of automated SSL services are further supporting market growth, ensuring robust web security and easy management for organizations.Report Scope

The report analyzes the Secure Sockets Layer (SSL) Certification market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (OV SSL Certificate, DV SSL Certificate, EV SSL Certificate); End-Use (SMEs, Large Enterprises, Government Agencies, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the OV SSL Certificate segment, which is expected to reach US$10.6 Billion by 2030 with a CAGR of 23.2%. The DV SSL Certificate segment is also set to grow at 20.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 20.3% CAGR to reach $2.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Secure Sockets Layer (SSL) Certification Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Secure Sockets Layer (SSL) Certification Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Secure Sockets Layer (SSL) Certification Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Actalis S.p.A., Certum, Comodo Security Solutions, Inc, DigiCert, Inc., Entrust Datacard Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Secure Sockets Layer (SSL) Certification market report include:

- Actalis S.p.A.

- Certum

- Comodo Security Solutions, Inc

- DigiCert, Inc.

- Entrust Datacard Corporation

- GlobalSign, Inc.

- GoDaddy, Inc.

- IdenTrust, Inc.

- Network Solutions LLC

- Secure Sockets Layer (SSL) Certification

- Symantec Corporation

- Trustwave Holdings, Inc.

- T-Systems International GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Actalis S.p.A.

- Certum

- Comodo Security Solutions, Inc

- DigiCert, Inc.

- Entrust Datacard Corporation

- GlobalSign, Inc.

- GoDaddy, Inc.

- IdenTrust, Inc.

- Network Solutions LLC

- Secure Sockets Layer (SSL) Certification

- Symantec Corporation

- Trustwave Holdings, Inc.

- T-Systems International GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

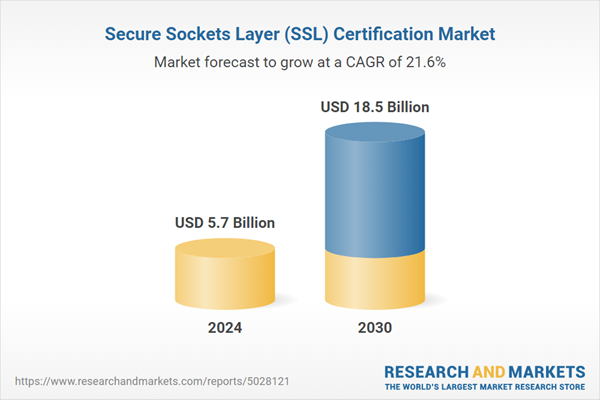

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 18.5 Billion |

| Compound Annual Growth Rate | 21.6% |

| Regions Covered | Global |