Global Fifth Wheel Coupling Market - Key Trends and Drivers Summarized

How Is Fifth Wheel Coupling Revolutionizing Heavy-Duty Transportation and Logistics?

Fifth wheel coupling is transforming the heavy-duty transportation and logistics sectors by providing a reliable, secure, and efficient means of connecting tractors to trailers. This coupling mechanism, often found on large trucks and semi-trailers, consists of a horizontal plate with a kingpin on the trailer, allowing the tractor to tow the trailer with ease while enabling a wide range of motion. Fifth wheel couplings are essential in the transport of goods across long distances, ensuring that trailers remain securely connected to the tractor while providing the necessary flexibility for smooth maneuvering, even in tight spaces or challenging terrains.The ability of fifth wheel coupling to provide a stable connection between the towing vehicle and trailer while accommodating the forces encountered during driving makes it indispensable in the logistics industry. This technology is widely used in trucking, freight hauling, construction, and agriculture, where the need to transport heavy loads efficiently and safely is paramount. Fifth wheel coupling allows for quicker attachment and detachment of trailers, improving operational efficiency and reducing downtime. As demand for freight transportation grows globally, this coupling mechanism plays a crucial role in enhancing the reliability and efficiency of logistics operations, particularly in long-haul trucking.

Why Is Fifth Wheel Coupling Critical for Enhancing Safety and Efficiency in Heavy-Duty Transport?

Fifth wheel coupling is critical for enhancing safety and efficiency in heavy-duty transport because it provides a strong, stable connection between the tractor and trailer while ensuring smooth movement and maneuverability. Safety is a top priority in the logistics industry, especially when transporting large and heavy loads. The fifth wheel coupling system is engineered to withstand the stresses of highway driving, sudden stops, and tight turns, ensuring that the trailer remains securely attached to the tractor at all times. This reduces the risk of accidents caused by trailer detachment or instability, making it a key component in maintaining road safety.Additionally, fifth wheel coupling enhances the efficiency of transport operations by simplifying the process of coupling and uncoupling trailers. This ease of operation allows drivers to quickly switch between trailers, reducing downtime and improving overall fleet productivity. In long-haul trucking, where time is often a critical factor, the ability to quickly and safely couple or decouple trailers is essential for maintaining tight delivery schedules. The fifth wheel's pivoting mechanism also provides greater flexibility, allowing trailers to follow the movement of the tractor smoothly, even on sharp turns or uneven roads, thereby reducing wear and tear on both the truck and trailer and improving fuel efficiency.

Fifth wheel coupling systems are also designed with durability in mind, capable of withstanding the heavy loads and rough conditions encountered in industries such as construction, mining, and agriculture. Their robust construction ensures they can handle high weight capacities while maintaining stability, even in off-road conditions. This makes them critical in applications where heavy-duty equipment and materials need to be transported over rough terrain. As the logistics and transportation industries continue to prioritize both safety and operational efficiency, the reliability of fifth wheel coupling systems remains fundamental to the smooth operation of these sectors.

What Are the Expanding Applications and Innovations in Fifth Wheel Coupling Across Industries?

The applications of fifth wheel coupling are expanding across various industries, driven by innovations that enhance durability, safety, and adaptability to different types of trailers and vehicles. In the freight and logistics industry, fifth wheel couplings are essential for transporting goods across long distances, enabling the movement of a wide range of cargo types, from consumer goods to industrial machinery. With the increasing global demand for e-commerce and the expansion of supply chains, fifth wheel coupling systems are playing a vital role in ensuring timely and efficient delivery of goods. Innovations such as automated coupling systems are streamlining operations, reducing the need for manual labor, and improving safety by ensuring that trailers are securely connected every time.In the construction and agricultural sectors, fifth wheel couplings are being used to transport heavy equipment and materials. Trucks equipped with fifth wheel couplings are capable of towing large machinery, such as excavators, bulldozers, and tractors, between job sites. The versatility and strength of these couplings allow them to handle the heavy loads required in these industries, while their flexibility makes maneuvering trailers in challenging environments, such as construction sites or agricultural fields, easier. Additionally, innovations in off-road fifth wheel coupling systems, designed to handle the stresses of uneven terrain, are expanding their use in these demanding industries.

In the automotive and RV (recreational vehicle) sectors, fifth wheel coupling is used for towing large travel trailers and campers. RV enthusiasts and travelers benefit from the stability and control provided by fifth wheel couplings, which allow for smoother towing of large trailers over long distances. The enhanced stability and safety features of fifth wheel couplings make them a popular choice for RV owners who want to tow larger, heavier trailers with confidence. Additionally, advancements in lightweight materials and improved locking mechanisms are making fifth wheel couplings more user-friendly, easier to install, and more adaptable to a wider range of vehicles.

Innovations in fifth wheel coupling technology are also driving improvements in safety and maintenance. For example, automated fifth wheel coupling systems use sensors and cameras to assist drivers in aligning and connecting the tractor to the trailer more easily. These systems reduce the risk of human error during the coupling process, ensuring a secure and proper connection. Some advanced coupling systems are also equipped with electronic monitoring features that alert the driver if the connection becomes compromised during transit, further enhancing safety. Additionally, self-lubricating fifth wheel plates are reducing the need for regular maintenance, improving the longevity of the coupling system and reducing downtime for fleet operators.

Another significant innovation is the development of fifth wheel couplings with increased load capacities and enhanced corrosion resistance, making them more suitable for extreme environments and heavier loads. These advanced couplings are particularly useful in industries such as mining, oil and gas, and heavy construction, where equipment and materials often exceed the weight limits of standard couplings. As industries continue to evolve and demand more specialized transportation solutions, fifth wheel couplings are being adapted to meet the unique requirements of each sector.

What Factors Are Driving the Growth of the Fifth Wheel Coupling Market?

Several key factors are driving the growth of the fifth wheel coupling market, including the increasing demand for heavy-duty transportation solutions, the expansion of global supply chains, and advancements in coupling technology. One of the primary drivers is the rising demand for freight transportation, fueled by the growth of e-commerce, industrial development, and international trade. As more goods are transported across long distances, the need for reliable and efficient coupling systems to handle the connection between tractors and trailers is critical. Fifth wheel couplings provide the strength and stability needed to manage these heavy loads, making them essential for the smooth operation of the logistics and freight industries.The expansion of infrastructure and industrial projects, particularly in developing regions, is another significant factor contributing to the growth of the fifth wheel coupling market. As construction, mining, and oil and gas projects grow in scale, the need for transporting heavy equipment and materials over long distances is increasing. Fifth wheel couplings are being used in these sectors to ensure that trucks can safely and efficiently tow the large machinery and materials needed for these projects. The durability and high load capacity of fifth wheel couplings make them a preferred choice for industries that require heavy-duty transportation solutions.

Technological advancements in fifth wheel coupling design are also driving market growth by improving safety, ease of use, and adaptability to different types of trailers and vehicles. Innovations such as automated coupling systems, which reduce the need for manual intervention, are increasing the efficiency of transportation operations and reducing the risk of human error. Additionally, advancements in materials, such as corrosion-resistant metals and self-lubricating surfaces, are extending the lifespan of fifth wheel couplings, reducing maintenance requirements, and lowering operational costs. These technological improvements are making fifth wheel couplings more attractive to fleet operators and industries that prioritize safety, reliability, and efficiency.

The increasing focus on safety in the transportation industry is another factor driving the growth of the fifth wheel coupling market. Regulatory bodies around the world are implementing stricter safety standards for commercial vehicles, particularly those involved in the transport of heavy loads. Fifth wheel couplings, with their advanced locking mechanisms and safety features, are designed to meet these regulatory requirements, ensuring that trailers remain securely attached during transit. The development of monitoring systems that alert drivers to potential coupling issues also enhances safety, further increasing the demand for high-quality fifth wheel couplings.

Additionally, the growth of the recreational vehicle (RV) market is contributing to the demand for fifth wheel couplings. As more people invest in RVs for travel and leisure, the need for secure and reliable towing systems has increased. Fifth wheel couplings are widely used in the RV industry due to their stability, ease of use, and ability to tow large trailers safely. The growing popularity of RV travel, particularly in North America and Europe, is expected to boost the demand for fifth wheel couplings in this segment.

Report Scope

The report analyzes the Fifth Wheel Coupling market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Semi-Oscillating, Compensating, Fully Oscillating); Operation (Pneumatic, Mechanical, Hydraulic); Distribution Channel (OEM, Aftermarket).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pneumatic Operation segment, which is expected to reach US$318.8 Million by 2030 with a CAGR of 3.9%. The Mechanical Operation segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $181.9 Million in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $189.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fifth Wheel Coupling Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fifth Wheel Coupling Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fifth Wheel Coupling Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Fontaine Fifth Wheel, Foshan Yonglitai Axles Co., Ltd., Guangdong Fuwa Engineering Group Co., Ltd., JOST Werke AG, Land Transport Equipment Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 16 companies featured in this Fifth Wheel Coupling market report include:

- Fontaine Fifth Wheel

- Foshan Yonglitai Axles Co., Ltd.

- Guangdong Fuwa Engineering Group Co., Ltd.

- JOST Werke AG

- Land Transport Equipment Co., Ltd.

- Rsb Group

- SAF-HOLLAND SA

- Shandong Fuhua Axle Co., Ltd.

- Sohshin Co. Ltd.

- TITGEMEYER (UK) Limited

- Tulga Fifth Wheel Co.

- Walter Hunger International GmbH

- Xiamen Wondee Autoparts Co., Ltd.

- Zhenjiang Baohua Semi-Trailer Parts Co. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Fontaine Fifth Wheel

- Foshan Yonglitai Axles Co., Ltd.

- Guangdong Fuwa Engineering Group Co., Ltd.

- JOST Werke AG

- Land Transport Equipment Co., Ltd.

- Rsb Group

- SAF-HOLLAND SA

- Shandong Fuhua Axle Co., Ltd.

- Sohshin Co. Ltd.

- TITGEMEYER (UK) Limited

- Tulga Fifth Wheel Co.

- Walter Hunger International GmbH

- Xiamen Wondee Autoparts Co., Ltd.

- Zhenjiang Baohua Semi-Trailer Parts Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 231 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

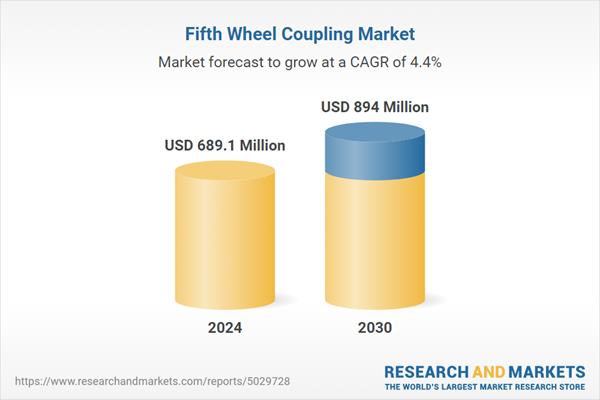

| Estimated Market Value ( USD | $ 689.1 Million |

| Forecasted Market Value ( USD | $ 894 Million |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |