Global Extruded Plastics Market - Key Trends and Drivers Summarized

How Are Extruded Plastics Revolutionizing Manufacturing and Material Design?

Extruded plastics are transforming manufacturing and material design by offering versatile, cost-effective solutions across a wide range of industries, from construction to automotive, packaging, and consumer goods. The extrusion process involves melting raw plastic materials and forcing them through a die to create continuous shapes such as pipes, sheets, films, and profiles. This method allows for the production of complex designs with consistent quality and precision, making extruded plastics an essential material in modern manufacturing. Due to their durability, flexibility, and lightweight nature, extruded plastics have become integral in products ranging from everyday household items to critical industrial components.Extruded plastics are revolutionizing manufacturing by enabling mass production of standardized parts at lower costs compared to metal or other traditional materials. The ability to easily shape and mold plastics into custom profiles makes extrusion an ideal method for producing specialized components used in construction, such as window frames, pipes, insulation materials, and siding. In the automotive industry, extruded plastics are used for producing lightweight components that reduce vehicle weight, improving fuel efficiency without compromising strength. Additionally, in packaging, extruded plastic films and sheets offer superior protective qualities, preserving food, electronics, and pharmaceuticals. As industries increasingly turn to sustainable and high-performance materials, innovations in extruded plastics are driving efficiency, cost savings, and environmental benefits.

Why Are Extruded Plastics Essential for Efficient, Sustainable Manufacturing?

Extruded plastics are critical to efficient and sustainable manufacturing because they offer several advantages, including low production costs, design flexibility, and the ability to incorporate recycled materials. The extrusion process allows manufacturers to produce long, continuous shapes with minimal waste, making it highly efficient for high-volume production. Unlike other manufacturing processes that require complex molds or extensive machining, extrusion can create precise shapes with fewer steps, reducing both labor and material costs. This efficiency makes extruded plastics particularly attractive for industries that need to produce large quantities of standardized parts, such as construction, automotive, and packaging.One of the key benefits of extruded plastics is their potential for sustainability. Many types of plastic, including polyethylene (PE), polyvinyl chloride (PVC), and polypropylene (PP), used in extrusion are recyclable, and the extrusion process itself can incorporate recycled plastics without sacrificing product quality. This reduces the overall environmental impact by minimizing plastic waste and lowering the demand for virgin materials. In construction, for example, recycled PVC is often used in pipes, window frames, and other building materials, contributing to greener building practices. Additionally, the lightweight nature of extruded plastics reduces energy consumption during transportation, further enhancing their sustainability profile. As companies and consumers place greater emphasis on eco-friendly solutions, the use of recycled and recyclable extruded plastics is becoming an essential aspect of sustainable manufacturing practices, reducing the carbon footprint of various industries.

What Are the Expanding Applications and Innovations in Extruded Plastics Across Industries?

The applications of extruded plastics are rapidly expanding across numerous industries, driven by their versatility, durability, and ease of customization. In the construction sector, extruded plastics are widely used for producing pipes, window and door frames, insulation, and cladding. Materials like PVC and HDPE (high-density polyethylene) are favored for their resistance to corrosion, moisture, and UV radiation, making them ideal for long-lasting outdoor applications. In addition, extruded plastic profiles are used to create complex shapes and designs that meet the specific needs of construction projects, from water management systems to decorative architectural details.The automotive industry is another sector where extruded plastics are playing a transformative role. Automakers are increasingly turning to lightweight materials like extruded plastics to reduce vehicle weight, improve fuel efficiency, and lower emissions. Plastic components such as bumpers, dashboard panels, air ducts, and sealing strips are all produced through the extrusion process. Thermoplastics like polypropylene and thermoplastic elastomers (TPEs) are commonly used in automotive applications due to their flexibility, strength, and impact resistance. Furthermore, advancements in extrusion technology have allowed for the production of multi-layered or co-extruded plastics, which combine different materials into a single product to achieve enhanced performance, such as improved insulation, soundproofing, or fire resistance.

In the packaging industry, extruded plastic films and sheets are critical for creating flexible, durable packaging solutions. These materials are used to produce food packaging, shrink wrap, protective coverings, and blister packs for pharmaceuticals. The barrier properties of extruded plastics, such as polyethylene and polypropylene, help preserve product freshness, extend shelf life, and protect against contamination. Additionally, innovations in extrusion technology have led to the development of biodegradable and compostable plastic films, offering eco-friendly alternatives to traditional packaging materials. These sustainable packaging options are gaining traction in response to consumer demand for products with lower environmental impact. In the medical field, extruded plastics are used to manufacture tubing, catheters, and other devices that require high precision and biocompatibility, further highlighting the versatility and expanding applications of extruded plastics across industries.

Innovations in extrusion technology continue to push the boundaries of what extruded plastics can achieve. Advances such as 3D printing with extruded thermoplastics are opening new possibilities for rapid prototyping and customized manufacturing. In co-extrusion, multiple layers of different polymers can be extruded simultaneously, creating products with tailored properties such as improved barrier protection, enhanced flexibility, or increased strength. Additionally, the integration of nanomaterials and smart polymers into the extrusion process is leading to the development of high-performance plastics with specialized properties, such as increased conductivity, self-healing capabilities, or antibacterial surfaces. These innovations are expanding the potential applications of extruded plastics in industries ranging from electronics to aerospace, where high-performance materials are in high demand.

What Factors Are Driving the Growth of the Extruded Plastics Market?

Several key factors are driving the growth of the extruded plastics market, including increasing demand from construction, automotive, and packaging industries, advancements in extrusion technology, and the growing emphasis on sustainability. One of the most significant drivers is the construction sector's demand for durable, lightweight, and cost-effective materials. As urbanization continues to accelerate globally, the need for efficient building materials that offer long-term durability, weather resistance, and ease of installation is rising. Extruded plastics, particularly PVC and HDPE, are widely used in piping, windows, and insulation due to their low maintenance requirements and ability to withstand harsh environmental conditions. With governments and businesses investing in infrastructure development, especially in emerging markets, the demand for extruded plastics in construction is expected to increase.The automotive industry's focus on fuel efficiency and emissions reduction is another major factor contributing to the market's growth. Automakers are seeking lightweight materials to reduce vehicle weight and improve fuel economy, which has led to the increasing use of extruded plastics in vehicle components. Extruded plastics not only help reduce vehicle mass but also offer superior durability and cost savings compared to traditional materials like metal. As electric vehicles (EVs) become more prevalent, the demand for lightweight and high-performance plastic components is expected to grow, further boosting the extruded plastics market.

Sustainability is also a critical factor driving the growth of extruded plastics. With growing consumer awareness and regulatory pressures to reduce plastic waste, there is increasing demand for recyclable and eco-friendly materials. The extrusion process is well-suited for incorporating recycled plastic materials, reducing waste and contributing to a circular economy. In the packaging industry, manufacturers are turning to extruded plastic films and sheets to create sustainable packaging solutions, including biodegradable and compostable options. Additionally, technological advancements in extrusion processes are improving the energy efficiency of production lines, lowering the carbon footprint of plastic manufacturing. This focus on sustainability is encouraging further growth in the extruded plastics market as industries seek greener solutions without sacrificing performance or cost efficiency.

In conclusion, the extruded plastics market is poised for continued growth, driven by rising demand across key industries such as construction, automotive, and packaging, coupled with advancements in technology and a growing focus on sustainability. As manufacturers continue to innovate and improve the performance, efficiency, and environmental impact of extruded plastics, their applications will expand, offering solutions for modern manufacturing challenges. With their versatility, cost-effectiveness, and recyclability, extruded plastics will remain a critical material for industries looking to balance performance with sustainability and innovation.

Report Scope

The report analyzes the Extruded Plastics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Polyethylene, Polypropylene, Polyvinyl Chloride, Polystyrene, Other Types); End-Use (Packaging, Building & Construction, Industrial, Automotive, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polyethylene segment, which is expected to reach US$125.1 Billion by 2030 with a CAGR of 5.7%. The Polypropylene segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $60.7 Billion in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $70.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Extruded Plastics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Extruded Plastics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Extruded Plastics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AEP Industries, Inc., Arkema Group, Bemis Co., Inc., Berry Plastics Corporation, Chevron Phillips Chemical Company LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 132 companies featured in this Extruded Plastics market report include:

- AEP Industries, Inc.

- Arkema Group

- Bemis Co., Inc.

- Berry Plastics Corporation

- Chevron Phillips Chemical Company LLC

- Dow, Inc.

- DuPont de Nemours, Inc.

- Engineered Profiles LLC

- ExxonMobil Chemical Company

- Formosa Plastics Corporation

- JM Eagle

- SABIC (Saudi Basic Industries Corporation)

- Saint-Gobain SA

- Sealed Air Corporation

- Sigma Plastics Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AEP Industries, Inc.

- Arkema Group

- Bemis Co., Inc.

- Berry Plastics Corporation

- Chevron Phillips Chemical Company LLC

- Dow, Inc.

- DuPont de Nemours, Inc.

- Engineered Profiles LLC

- ExxonMobil Chemical Company

- Formosa Plastics Corporation

- JM Eagle

- SABIC (Saudi Basic Industries Corporation)

- Saint-Gobain SA

- Sealed Air Corporation

- Sigma Plastics Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 239 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

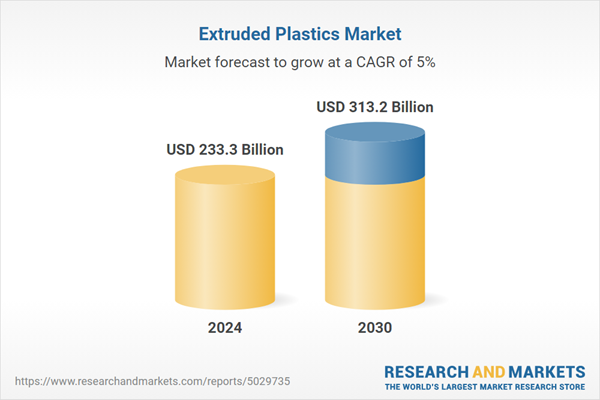

| Estimated Market Value ( USD | $ 233.3 Billion |

| Forecasted Market Value ( USD | $ 313.2 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |