Global Flexible Food Packaging Market - Key Trends and Drivers Summarized

Why Is Flexible Food Packaging Revolutionizing the Food Industry?

Flexible food packaging has become a game-changer in the food industry, but why is it transforming how we package and consume food? Flexible food packaging refers to a variety of materials such as plastic, paper, aluminum, and bio-based films that are used to create lightweight, adaptable packaging solutions. Unlike rigid packaging options, flexible packaging can be easily molded, folded, and sealed, making it ideal for protecting food products while minimizing material use and waste. With the growing demand for convenience, sustainability, and food safety, flexible packaging is increasingly preferred by food manufacturers and consumers alike.One of the main reasons flexible food packaging is revolutionizing the food industry is its ability to extend the shelf life of products. Many flexible packaging solutions incorporate advanced barrier technologies that protect food from moisture, oxygen, and contaminants, ensuring freshness for longer periods. This is particularly valuable for perishable goods like snacks, frozen foods, ready-to-eat meals, and dairy products. In addition to enhancing shelf life, flexible packaging is also lightweight and space-efficient, which reduces transportation costs and lowers the overall environmental impact of packaging. These benefits make flexible food packaging a crucial tool for both manufacturers aiming to optimize efficiency and consumers seeking longer-lasting, fresher products.

How Is Flexible Food Packaging Manufactured, and What Makes It So Versatile?

Flexible food packaging is highly adaptable to various food products, but how is it made, and what gives it such versatility? Flexible packaging is typically produced using multi-layer films made from materials like polyethylene, polypropylene, and foil. These films are engineered to provide specific properties, such as barrier protection, heat resistance, and flexibility, depending on the food product's requirements. Manufacturers often combine several layers of different materials to achieve optimal performance in terms of durability, protection, and functionality. This multi-layer construction allows flexible packaging to maintain the integrity of the food while being easy to store, transport, and open.One of the key factors that make flexible food packaging so versatile is its ability to be customized to suit different types of food products and packaging needs. For instance, resealable pouches, vacuum-sealed bags, stand-up pouches, and snack wrappers are just a few of the formats that can be made using flexible packaging materials. These packaging types can accommodate various food categories, from dry goods like cereals and snacks to liquids like sauces and juices. Additionally, flexible packaging is printable, allowing for vibrant graphics and branding that enhance shelf appeal. Its ability to provide excellent protection while adapting to a variety of shapes and sizes makes flexible food packaging one of the most versatile and efficient solutions in the food industry.

Moreover, the ability of flexible packaging to reduce food waste and spoilage contributes to its increasing popularity. With features like vacuum sealing and modified atmosphere packaging (MAP), flexible packaging can remove oxygen from the package, slowing the growth of bacteria and mold. This is especially beneficial for products like meats, cheeses, and fresh produce, which are prone to spoilage. The versatility in design, protection, and preservation offered by flexible packaging materials makes it a valuable innovation for both food manufacturers and retailers seeking to improve product quality and reduce waste.

How Is Flexible Food Packaging Shaping the Future of Sustainability and Convenience?

Flexible food packaging is not just enhancing product protection - it is driving key trends in sustainability and consumer convenience, but how is it shaping the future of these areas? One of the most significant ways flexible packaging is influencing the industry is by contributing to sustainability efforts. Flexible packaging uses far less material than traditional rigid packaging, resulting in reduced raw material consumption and lower carbon footprints. This reduction in packaging material also translates into lighter loads for transportation, decreasing fuel use and emissions during distribution. In the context of increasing environmental awareness, flexible food packaging offers manufacturers a way to meet sustainability goals without sacrificing product protection or consumer appeal.In addition to material efficiency, flexible food packaging is playing a critical role in minimizing food waste. By extending the shelf life of food products through advanced sealing and barrier technologies, flexible packaging helps reduce the amount of food that spoils before reaching the consumer. Food waste is a major environmental issue, and flexible packaging solutions are designed to keep products fresh for longer, thus reducing waste at both the retailer and consumer levels. The development of recyclable and biodegradable flexible packaging is further enhancing its sustainability profile. As more companies seek eco-friendly packaging solutions, innovations like compostable films and plant-based plastics are positioning flexible packaging as a sustainable alternative that addresses both environmental and functional needs.

Consumer convenience is another area where flexible food packaging is making a major impact. The rise of on-the-go lifestyles has driven demand for easy-to-use, portable, and resealable packaging formats. Stand-up pouches with resealable zippers, snack bags with tear notches, and microwave-safe film packaging are all designed to cater to busy consumers who value convenience. Flexible packaging also provides portion control and portability, allowing consumers to enjoy their favorite snacks, beverages, or meals without hassle. As lifestyles become more fast-paced and consumers seek products that offer both convenience and sustainability, flexible food packaging is at the forefront of delivering solutions that meet these evolving needs.

What Factors Are Driving the Growth of the Flexible Food Packaging Market?

The growth in the flexible food packaging market is driven by several key factors, reflecting shifts in consumer behavior, advancements in packaging technology, and industry trends toward sustainability. One of the primary drivers is the increasing demand for convenience foods and ready-to-eat meals. As more consumers lead busy lifestyles, they are looking for packaging that is easy to open, portable, and resealable. Flexible packaging meets these needs by offering lightweight, durable, and functional options that make food products easier to consume on the go. This trend is especially prevalent in the snack, beverage, and frozen food markets, where flexible pouches, bags, and wraps have become the preferred packaging format.Another major factor contributing to the market's growth is the rising awareness of environmental sustainability. With growing consumer concern about plastic waste and its impact on the planet, companies are under pressure to adopt more sustainable packaging solutions. Flexible food packaging, which uses fewer materials and generates less waste compared to rigid packaging, is seen as a more eco-friendly option. Furthermore, innovations in recyclable, compostable, and biodegradable flexible packaging are helping manufacturers align with sustainability goals while maintaining product safety and shelf life. As governments implement stricter regulations on single-use plastics and waste reduction, the demand for sustainable flexible packaging is expected to rise.

Technological advancements in packaging materials and processes are also fueling the growth of flexible food packaging. New developments in barrier films, oxygen scavengers, and resealable technologies are enabling flexible packaging to offer superior protection and convenience. For example, vacuum-sealed bags and pouches with modified atmosphere packaging (MAP) help preserve the freshness of perishable foods, making them ideal for meats, dairy, and fresh produce. These innovations allow manufacturers to deliver longer-lasting, fresher products while reducing the need for preservatives. As the food industry continues to invest in packaging technologies that enhance both convenience and sustainability, the flexible food packaging market is poised for continued growth.

Lastly, the increasing focus on food safety and hygiene, particularly in the wake of the COVID-19 pandemic, has boosted the demand for flexible packaging. Consumers and retailers are seeking packaging solutions that protect food from contamination while ensuring freshness and quality. Flexible packaging, with its advanced sealing and barrier properties, offers the protection needed to maintain food safety throughout the supply chain. This heightened focus on hygiene, combined with the broader trends of convenience and sustainability, is driving the expansion of the flexible food packaging market and solidifying its role as a critical solution for the future of food packaging.

Report Scope

The report analyzes the Flexible Food Packaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Paperboard, Plastic, Aluminum Foil, Other Materials); Packaging Type (Films, Stand-Up Pouch, Bag-In-Box, Other Packaging Types); End-Use (Food & Beverage, Pharmaceuticals, Personal Care, Industrial, Household Care, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Paperboard Material segment, which is expected to reach US$142.8 Billion by 2030 with a CAGR of 5.2%. The Plastic Material segment is also set to grow at 4.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $75.3 Billion in 2024, and China, forecasted to grow at an impressive 4.4% CAGR to reach $56.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flexible Food Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flexible Food Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flexible Food Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AEP Industries, Inc., Amcor Ltd., American Packaging Corporation, Anchor Packaging, Inc., Ball Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Flexible Food Packaging market report include:

- AEP Industries, Inc.

- Amcor Ltd.

- American Packaging Corporation

- Anchor Packaging, Inc.

- Ball Corporation

- Bemis Co., Inc.

- Berry Plastics Corporation

- Coveris

- Coveris Holdings SA

- Hood Packaging Corporation

- Pactiv LLC

- Printpack, Inc.

- Sealed Air Corporation

- Sonoco Products Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AEP Industries, Inc.

- Amcor Ltd.

- American Packaging Corporation

- Anchor Packaging, Inc.

- Ball Corporation

- Bemis Co., Inc.

- Berry Plastics Corporation

- Coveris

- Coveris Holdings SA

- Hood Packaging Corporation

- Pactiv LLC

- Printpack, Inc.

- Sealed Air Corporation

- Sonoco Products Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 268 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

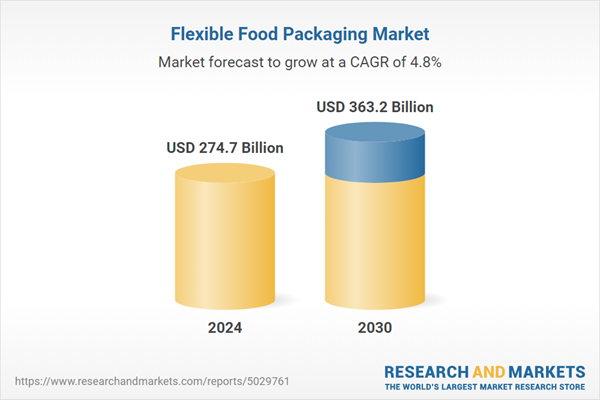

| Estimated Market Value ( USD | $ 274.7 Billion |

| Forecasted Market Value ( USD | $ 363.2 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |