Global Flashlights Market - Key Trends and Drivers Summarized

Why Are Flashlights More Essential Than Ever in Today's World?

Flashlights have long been a staple in everyday life, but why are they becoming even more essential in modern times? Flashlights, portable devices that emit light through the use of batteries and electric bulbs (typically LEDs today), serve a wide range of purposes, from household utility to outdoor adventures and emergency situations. Over the years, the technology behind flashlights has evolved significantly, making them brighter, more efficient, and more durable. In an age where preparedness and personal safety are increasingly prioritized, having a reliable source of light is crucial for a variety of scenarios, from power outages to outdoor expeditions.Modern flashlights are also more versatile than ever before, thanks to advancements in LED technology and battery efficiency. They offer high-intensity lighting, longer runtimes, and compact designs, making them ideal for both everyday carry (EDC) and specialized tasks like search-and-rescue operations, camping, hiking, and tactical uses by military and law enforcement. The rise of LED technology has also dramatically reduced power consumption, allowing for extended use without frequent battery changes. This combination of reliability, portability, and versatility is why flashlights continue to be indispensable tools for personal safety, emergency preparedness, and outdoor activities.

How Do Flashlights Work, and What Makes Modern Models So Effective?

Flashlights might seem simple, but the technology inside has evolved significantly - so how exactly do they work, and what makes modern models so effective? At the core of every flashlight is a power source (usually batteries), a light source (traditionally incandescent bulbs, but now almost universally LEDs), and a switch that controls the flow of electricity. When the switch is activated, electrical energy from the battery flows to the light source, emitting light. The reflector and lens inside the flashlight focus and direct the light beam, creating the desired intensity and range. In modern flashlights, the LED (light-emitting diode) serves as the light source, offering better efficiency, brightness, and durability compared to traditional bulbs.The effectiveness of modern flashlights is largely driven by the adoption of LED technology. LEDs consume far less power than incandescent bulbs while producing significantly more light, resulting in longer battery life and brighter output. They are also much more durable - able to withstand shocks, drops, and extreme conditions - which is particularly important for tactical, outdoor, or emergency-use flashlights. Moreover, modern batteries, such as rechargeable lithium-ion cells, have enhanced the performance of flashlights by providing higher energy density and faster recharge times, making them more reliable for extended use.

Another feature of modern flashlights is their multiple lighting modes, such as high, low, strobe, and SOS. These modes allow users to adjust brightness levels based on the situation, conserve battery life, or use the flashlight as a signaling device in emergencies. Many high-end models also feature waterproof or impact-resistant designs, making them suitable for use in harsh environments. Together, these innovations have made flashlights more efficient, adaptable, and rugged, meeting the demands of a wide variety of users from casual consumers to professionals in challenging industries.

How Are Flashlights Shaping the Future of Personal Safety and Outdoor Exploration?

Flashlights are not just tools for illumination; they are shaping the way we approach personal safety and outdoor exploration, but how are they driving these changes? In terms of personal safety, flashlights have become an essential tool for both everyday users and professionals. For individuals, a compact, reliable flashlight is a key part of emergency preparedness kits, offering peace of mind during power outages, roadside emergencies, or personal defense situations. Tactical flashlights, often used by law enforcement and military personnel, are designed with blinding brightness, sturdy construction, and strobe modes for disorienting attackers, highlighting their role in personal security.In outdoor exploration, flashlights are revolutionizing the way people experience the wilderness. Whether for camping, hiking, or mountaineering, modern flashlights provide dependable light sources in remote locations where natural lighting is scarce. With rechargeable batteries, high-lumen outputs, and rugged designs, today's flashlights can withstand the elements and deliver powerful illumination for long periods. This makes them essential for navigation, setting up camp, or conducting search-and-rescue operations in challenging environments. Additionally, headlamp models and wearable lights have made it easier for adventurers to keep their hands free while ensuring they have a reliable source of light during nighttime activities.

Furthermore, as people engage more in outdoor activities such as night hiking, cycling, or adventure racing, the need for long-lasting, high-performance flashlights becomes even more pressing. Flashlights with smart technology - featuring power-saving modes, solar charging options, and automatic brightness adjustments based on ambient light - are paving the way for smarter, more efficient outdoor tools. As more individuals prioritize outdoor exploration and personal safety, flashlights continue to play a key role in enhancing both experience and security in these areas.

What Factors Are Driving the Growth of the Flashlight Market?

The growth in the flashlight market is driven by several key factors, reflecting advancements in technology, changing consumer demands, and increased emphasis on safety and preparedness. One of the main drivers is the rapid development of LED technology. LEDs are far more energy-efficient than traditional bulbs, consume less power, and offer brighter, more consistent light. The widespread adoption of LED flashlights has made them the standard choice for both personal and professional use, and their longer battery life, durability, and lower environmental impact have made them especially appealing to eco-conscious consumers.Another significant factor contributing to market growth is the rising demand for outdoor activities and adventure sports. As more people engage in hiking, camping, mountain climbing, and other outdoor pursuits, the need for reliable, long-lasting flashlights has grown. High-lumen models with extended battery life, multiple modes, and durable construction are becoming essential tools for outdoor enthusiasts. Flashlights that offer features such as waterproofing, impact resistance, and rechargeable batteries are especially popular in this sector, helping to meet the needs of those exploring challenging environments.

The increasing focus on personal safety and emergency preparedness is also driving the demand for flashlights. With natural disasters, power outages, and emergency situations becoming more frequent due to climate change and urbanization, individuals are prioritizing preparedness by investing in reliable tools like flashlights. Compact, everyday carry (EDC) flashlights, as well as tactical models with self-defense features, are gaining traction among consumers who want to be ready for unexpected situations. The growing awareness around the importance of personal safety, coupled with the convenience and affordability of modern flashlights, is boosting their adoption in homes, cars, and workplaces.

Lastly, technological advancements are making flashlights smarter and more efficient. Rechargeable models with USB or solar charging capabilities are reducing the need for disposable batteries, appealing to eco-conscious users while offering cost savings in the long run. Smart flashlights with built-in sensors, automatic brightness adjustments, and power-saving modes are also gaining popularity as they improve usability and convenience. As innovation continues to drive product development, the flashlight market is set for continued growth, with an increasing focus on functionality, sustainability, and safety. Together, these factors are ensuring that flashlights remain a critical tool for modern life, from daily use to specialized applications in emergency services and outdoor exploration.

Report Scope

The report analyzes the Flashlights market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Light Source (LED, Incandescent); End-Use (Government, Consumer, Industrial / Commercial, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Government End-Use segment, which is expected to reach US$2 Billion by 2030 with a CAGR of 5.2%. The Consumer End-Use segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.3 Billion in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $2.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Flashlights Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Flashlights Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Flashlights Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BAYCO Products, Inc., Browning Arms Company, Dorcy International, Energizer Holdings, Inc., Larson Electronics LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 223 companies featured in this Flashlights market report include:

- BAYCO Products, Inc.

- Browning Arms Company

- Dorcy International

- Energizer Holdings, Inc.

- Larson Electronics LLC

- Mag Instrument Inc.

- Nite Ize Inc.

- Pelican Products, Inc.

- Streamlight, Inc.

- SureFire LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BAYCO Products, Inc.

- Browning Arms Company

- Dorcy International

- Energizer Holdings, Inc.

- Larson Electronics LLC

- Mag Instrument Inc.

- Nite Ize Inc.

- Pelican Products, Inc.

- Streamlight, Inc.

- SureFire LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 314 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

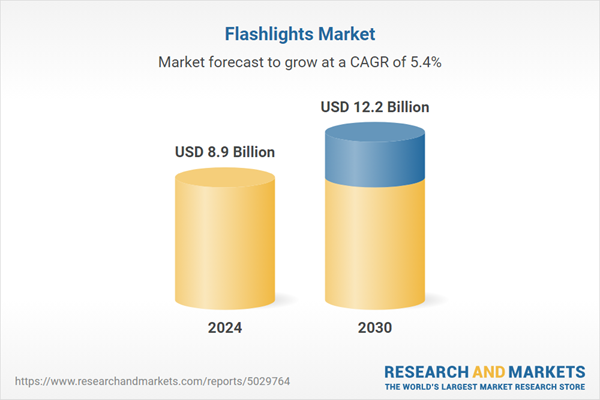

| Estimated Market Value ( USD | $ 8.9 Billion |

| Forecasted Market Value ( USD | $ 12.2 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |