Global Chemical Mechanical Planarization Market - Key Trends and Drivers Summarized

What Is Chemical Mechanical Planarization and Why Is It Essential for Semiconductor Manufacturing?

Chemical Mechanical Planarization (CMP) is a critical process in semiconductor manufacturing, essential for achieving the ultra-flat surfaces required in the production of microchips. CMP involves the simultaneous application of both chemical slurry and mechanical polishing to remove excess material and flatten the wafer surface. This process is fundamental to creating the multiple layers of circuitry found in modern microprocessors, memory chips, and other integrated circuits (ICs). Without CMP, it would be impossible to build the complex, multilayered structures needed to meet the ever-growing demands for smaller, faster, and more energy-efficient electronic devices. In the semiconductor industry, where dimensions are measured in nanometers, any unevenness in the wafer surface can lead to defects, reducing yield and performance. CMP enables manufacturers to achieve precise topography control, ensuring that each layer of materials, such as copper, tungsten, or dielectric insulators, is perfectly level before the next layer is added. This process is vital in producing the high-density chips required for advanced technologies such as smartphones, data centers, and AI applications, where performance and power efficiency are paramount.How Has CMP Evolved to Meet the Challenges of Advanced Node Technologies?

As the semiconductor industry has progressed towards smaller and more complex nodes, Chemical Mechanical Planarization has evolved to meet the new challenges associated with these advancements. With the introduction of 7nm, 5nm, and 3nm technologies, the requirements for surface planarity and defect control have become more stringent. Earlier iterations of CMP focused on standard materials like silicon dioxide or aluminum, but today's advanced node technologies require polishing processes tailored for more exotic materials, such as low-k dielectrics, copper interconnects, and even advanced materials used in 3D NAND and FinFET structures. One of the significant innovations in CMP technology is the development of customized slurries and polishing pads that are specifically formulated to handle these new materials while minimizing defects like dishing, erosion, or scratching. Moreover, endpoint detection technologies have improved dramatically, allowing for real-time monitoring of the CMP process, ensuring that the material removal stops precisely at the desired thickness. As chip designs become denser and more complicated, CMP has had to adapt by offering greater precision, reduced variability, and lower defect rates, all while maintaining cost efficiency. This technological evolution has been critical for keeping pace with the semiconductor industry's relentless drive towards smaller, faster, and more efficient chips.What Are the Key Challenges Facing CMP and How Are They Being Addressed?

Despite its importance, CMP faces several challenges that must be carefully managed to ensure optimal performance and yield in semiconductor fabrication. One of the most significant challenges is managing defectivity during the CMP process. Particles from the slurry or the polishing pad can cause scratches or pits in the wafer surface, leading to defects that compromise the final product. To mitigate this, manufacturers are investing in cleaner slurries and improved filtration systems to reduce the likelihood of particle contamination. Another challenge is the variability of the CMP process, as it can be difficult to achieve uniform material removal across the entire wafer, especially as wafer sizes increase. This variability can lead to over-polishing in some areas and under-polishing in others, resulting in yield loss. To address this issue, advances in real-time process control and automation have been implemented, allowing for more consistent and precise polishing outcomes. Additionally, the increasing complexity of device architectures, such as 3D stacking and high-aspect-ratio features, adds new difficulties in maintaining uniform planarization across different layers. New polishing materials and techniques are being developed to handle these intricate structures while maintaining the integrity of the wafer. Ultimately, overcoming these challenges is crucial for ensuring that CMP continues to enable the production of high-performance semiconductor devices.What Are the Factors Fueling Expansion of the Chemical Mechanical Planarization Market?

The growth in the Chemical Mechanical Planarization market is driven by several factors closely linked to advancements in semiconductor manufacturing, increasing demand for consumer electronics, and the ongoing development of next-generation technologies. One of the primary drivers is the continued scaling of semiconductor nodes, with manufacturers pushing toward smaller geometries. These advanced nodes require highly precise CMP processes to ensure defect-free surfaces as multiple layers of materials are deposited and patterned. Another significant growth driver is the rising demand for high-performance computing (HPC) and artificial intelligence (AI) chips, which require advanced packaging techniques, including 3D stacking and heterogeneous integration, all of which rely heavily on CMP for surface planarity. The growing adoption of 5G technologies and the expansion of data centers are also creating increased demand for CMP, as these applications require more sophisticated semiconductors with higher processing speeds and lower power consumption. Furthermore, the rise in electric vehicles (EVs) and autonomous driving systems is contributing to market growth, as these industries require complex, high-reliability chips, which rely on CMP for their fabrication. Lastly, the continuous innovation in CMP slurries and consumables, driven by the need for greater precision and lower defectivity, is propelling market expansion. These factors, combined with the growing complexity of semiconductor designs, are fueling the demand for advanced CMP technologies across multiple industries, ensuring the continued growth of the CMP market.Report Scope

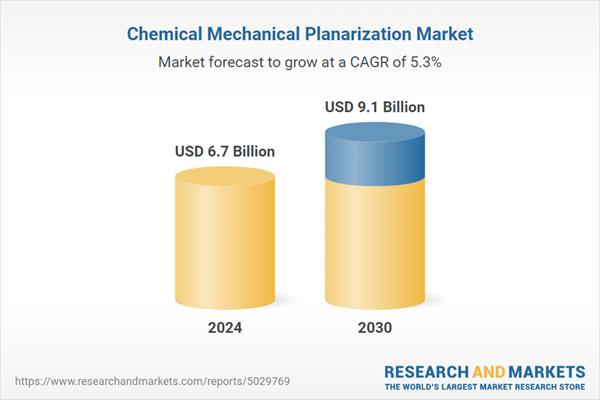

The report analyzes the Chemical Mechanical Planarization market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Consumables, Equipment); Application (IC Manufacturing, MEMS & NEMS, Compound Semiconductors, Optics, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the IC Manufacturing Application segment, which is expected to reach US$2.8 Billion by 2030 with a CAGR of 5.6%. The MEMS & NEMS Application segment is also set to grow at 5.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 8% CAGR to reach $2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chemical Mechanical Planarization Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chemical Mechanical Planarization Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chemical Mechanical Planarization Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Products and Chemicals, Inc., Applied Materials, Inc., Cabot Microelectronics, Dow Electronic Materials, EBARA Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Chemical Mechanical Planarization market report include:

- Air Products and Chemicals, Inc.

- Applied Materials, Inc.

- Cabot Microelectronics

- Dow Electronic Materials

- EBARA Corporation

- Fujimi Incorporated

- Hitachi Chemical Co., Ltd.

- Lam Research Corporation

- Lapmaster Wolters GmbH

- Okamoto Machine Tool Works, Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Products and Chemicals, Inc.

- Applied Materials, Inc.

- Cabot Microelectronics

- Dow Electronic Materials

- EBARA Corporation

- Fujimi Incorporated

- Hitachi Chemical Co., Ltd.

- Lam Research Corporation

- Lapmaster Wolters GmbH

- Okamoto Machine Tool Works, Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.7 Billion |

| Forecasted Market Value ( USD | $ 9.1 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |