Global Ceramic Matrix Composites Market - Key Trends and Drivers Summarized

Why Are Ceramic Matrix Composites the Future of High-Performance Materials?

Ceramic Matrix Composites (CMCs) have emerged as a revolutionary material, pushing the boundaries of what is achievable in extreme environments where conventional materials fall short. CMCs are made by embedding ceramic fibers within a ceramic matrix, which drastically enhances their mechanical properties compared to traditional ceramics. This unique composition allows them to retain ceramics' natural strengths, such as resistance to corrosion, oxidation, and extreme temperatures, while overcoming their inherent brittleness. Traditional ceramics tend to fracture under stress due to their rigid atomic structure, but the reinforcement of ceramic fibers in CMCs provides a structural toughness that prevents catastrophic failure. One of the most crucial advantages of CMCs is their ability to withstand temperatures in excess of 1300°C while maintaining structural integrity, something metals and superalloys struggle to achieve. In high-temperature environments, metals lose strength, and their performance degrades, but CMCs remain stable, making them indispensable in applications where heat and stress are intense. This combination of thermal stability, mechanical strength, and durability makes CMCs ideal for use in aerospace, energy, defense, and even medical fields. As industries push for higher performance, efficiency, and sustainability, the intrinsic benefits of CMCs position them as a material of the future, capable of outperforming many established materials under extreme conditions.How Are Ceramic Matrix Composites Transforming Key Industries?

The transformative potential of ceramic matrix composites is perhaps most evident in industries that operate at the frontier of technological demands. In aerospace, CMCs have been rapidly adopted for use in critical components such as turbine blades, combustor liners, and exhaust nozzles in jet engines. Their ability to perform at higher temperatures allows engines to operate more efficiently, translating into improved fuel efficiency, reduced emissions, and increased overall performance. The lighter weight of CMCs compared to traditional metal alloys further enhances this efficiency by reducing the overall mass of aircraft, which in turn lowers fuel consumption and operating costs. These advantages are particularly significant in the ongoing push for greener aviation technologies. Similarly, in the energy sector, CMCs are playing an increasingly important role in gas turbines, particularly those used in power generation. Higher operating temperatures in these turbines lead to greater thermal efficiency, which is crucial for reducing emissions and lowering operational costs. Additionally, the automotive industry is exploring CMCs for components like brake discs and turbocharger rotors, which are subject to high levels of wear and heat. The use of CMCs in these applications promises longer lifespans, reduced maintenance, and better overall performance. In defense, space exploration, and even in biomedical devices, the unique properties of CMCs - such as their thermal shock resistance, lightweight nature, and durability - are finding niche but growing applications, further highlighting their versatility across sectors that require reliability in harsh environments.What Challenges Are Limiting the Full Adoption of Ceramic Matrix Composites?

Despite the many advantages that Ceramic Matrix Composites offer, their widespread adoption is hampered by several significant challenges, most notably the high cost of production. The manufacturing process for CMCs is highly complex, requiring specialized equipment and expertise. This begins with the production of the ceramic fibers themselves, which are expensive to produce and require precision engineering. The subsequent processes of embedding these fibers into the ceramic matrix and sintering the final composite product are both time-consuming and costly. As a result, the cost per unit of CMCs remains much higher than traditional materials like metals and superalloys, making them less accessible for cost-sensitive industries and mass-market applications. Another hurdle is the difficulty in machining and repairing CMCs. Their extreme hardness and resistance to wear, while beneficial in service, make them difficult to cut, shape, or repair once installed. This adds to the lifecycle costs of using CMCs, as the components often cannot be modified or repaired with conventional techniques. Furthermore, there is still a lack of standardization across the industry, with different manufacturers producing CMCs with varying performance characteristics. As such, more extensive testing and validation are required to ensure consistency and reliability in critical applications. Research is ongoing to address these issues, with innovations in production techniques, such as additive manufacturing, showing promise in lowering costs and improving the scalability of CMC production. However, until these advancements become mainstream, the high cost and technical challenges remain key barriers to broader adoption.What Factors Are Driving the Growth of the Ceramic Matrix Composites Market?

The growth in the ceramic matrix composites market is driven by several factors. One of the primary drivers is the increasing emphasis on improving fuel efficiency and reducing emissions in the aerospace and automotive sectors. As global regulations around emissions tighten, manufacturers are seeking materials that enable engines to run hotter and more efficiently, with CMCs providing the solution due to their high-temperature resistance and lightweight nature. In the aerospace industry, for example, the push for more fuel-efficient aircraft is leading to a growing demand for CMC components that can withstand the extreme temperatures inside jet engines, enabling them to operate at higher efficiencies. In parallel, the automotive industry's interest in lightweight materials is driving demand for CMCs in performance-critical areas, particularly in electric vehicles, where reducing weight is crucial for extending range and improving overall vehicle efficiency. Another factor propelling the growth of the CMC market is the expansion of the renewable energy and power generation sectors. Gas turbines used in power plants are being pushed to operate at higher temperatures to increase efficiency, and CMCs are becoming an integral part of this shift. Their ability to withstand the intense heat generated in turbines without compromising durability or efficiency makes them a material of choice for improving thermal efficiency and reducing greenhouse gas emissions. Additionally, advances in manufacturing technologies, such as 3D printing and automated fiber placement, are helping to lower production costs, making CMCs more accessible across various industries. These technologies are enabling more complex and precise designs that were previously difficult or impossible to achieve, broadening the range of applications for CMCs. Lastly, there is increasing demand for CMCs in defense, space exploration, and biomedical applications, where their unique combination of lightweight, strength, and heat resistance is critical for mission success.Report Scope

The report analyzes the Ceramic Matrix Composites market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Matrix Type (Oxide/Oxide, C/C, C/SiC, Other Matrix Types); Application (Aerospace & Defense, Automotive, Electricals & Electronics, Energy & Power, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Aerospace & Defense Application segment, which is expected to reach US$9.4 Billion by 2030 with a CAGR of 10.6%. The Automotive Application segment is also set to grow at 10.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.6 Billion in 2024, and China, forecasted to grow at an impressive 12.9% CAGR to reach $5.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ceramic Matrix Composites Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ceramic Matrix Composites Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ceramic Matrix Composites Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Applied Thin Films, Inc., CeramTec GmbH, COI Ceramics, Inc., Composites Horizons (CHI), CoorsTek, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Ceramic Matrix Composites market report include:

- Applied Thin Films, Inc.

- CeramTec GmbH

- COI Ceramics, Inc.

- Composites Horizons (CHI)

- CoorsTek, Inc.

- General Electric Company

- Lancer Systems

- Pyromeral Systems S.A.

- SGL Group - The Carbon Company

- Starfire Systems, Inc.

- Ultramet

- United Technologies Corporation (UTC)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Applied Thin Films, Inc.

- CeramTec GmbH

- COI Ceramics, Inc.

- Composites Horizons (CHI)

- CoorsTek, Inc.

- General Electric Company

- Lancer Systems

- Pyromeral Systems S.A.

- SGL Group - The Carbon Company

- Starfire Systems, Inc.

- Ultramet

- United Technologies Corporation (UTC)

Table Information

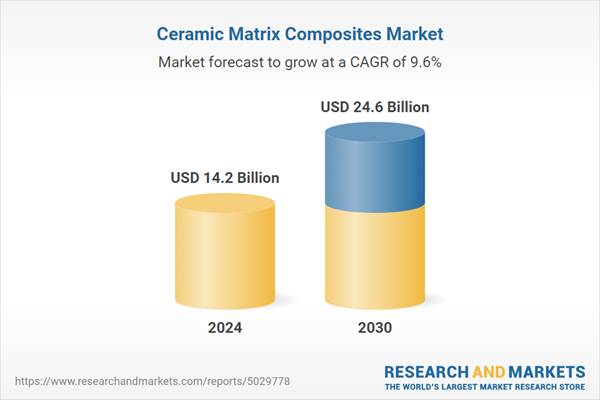

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.2 Billion |

| Forecasted Market Value ( USD | $ 24.6 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |