Global Cenospheres Market - Key Trends and Drivers Summarized

Why Are Cenospheres Gaining Attention Across Multiple Industries?

Cenospheres, hollow, lightweight microspheres derived from the combustion of coal in thermal power plants, have been gaining considerable traction across a wide range of industries. These tiny, buoyant spheres, primarily composed of silica and alumina, are a valuable byproduct of fly ash and are known for their unique physical properties such as low density, high strength, and excellent thermal and insulating capabilities. Cenospheres are particularly favored in industries where reducing weight without compromising strength is essential. Applications in sectors like construction, oil and gas, automotive, and aerospace are expanding rapidly, as industries increasingly prioritize materials that offer cost-effectiveness, durability, and environmental benefits. In addition to their use as fillers in composites, plastics, and concrete, cenospheres are being used in coatings, adhesives, and even in advanced technologies like 3D printing. Their ability to enhance material properties while reducing weight and cost makes them a highly sought-after component, driving growth in the global market.How Are Technological Innovations Expanding the Use of Cenospheres?

Technological advancements have significantly broadened the scope of applications for cenospheres, particularly in high-performance materials and innovative manufacturing processes. Improvements in the extraction and processing of cenospheres from fly ash have led to more efficient recovery and refinement techniques, allowing for higher purity and uniformity of the product. This has expanded their use in industries such as aerospace and automotive, where consistent quality and performance are critical. Furthermore, advancements in material science have enabled the integration of cenospheres into composite materials, creating stronger, lighter, and more durable products. In construction, cenospheres are increasingly being used in lightweight concrete and cement, reducing the overall weight of structures while maintaining strength and thermal insulation properties. In the oil and gas industry, cenospheres are used in drilling muds and cementing materials to reduce the density of the mixture, improving operational efficiency in drilling operations. The growing interest in 3D printing has also opened up new possibilities for using cenospheres in additive manufacturing, where their lightweight and insulating properties enhance the performance of printed materials. These technological advancements are driving new innovations and expanding the potential applications of cenospheres in various industrial sectors.How Are Market Dynamics and Sustainability Trends Influencing the Growth of Cenospheres?

The shift towards sustainable materials and the increasing demand for eco-friendly manufacturing processes are playing a major role in the growing adoption of cenospheres. As industries seek to minimize their environmental impact, the use of cenospheres, a byproduct of coal combustion, aligns with the broader goals of waste reduction and resource efficiency. Cenospheres offer an attractive alternative to traditional fillers and additives due to their ability to reduce the overall weight of materials, leading to lower transportation costs and improved energy efficiency. In industries like construction and automotive, the trend toward lightweight materials is driving demand for cenospheres, as they provide strength and durability while reducing material consumption. Additionally, as industries move toward greener alternatives, cenospheres are increasingly being adopted for their potential to lower the carbon footprint of products. The ability to repurpose a waste byproduct into valuable industrial applications further strengthens their appeal as a sustainable solution. Moreover, the global push for energy efficiency, particularly in sectors like aerospace and transportation, is accelerating the use of cenospheres as a means of reducing fuel consumption and emissions. These market dynamics, coupled with sustainability trends, are driving significant growth in the cenospheres market as industries increasingly look for greener, more efficient materials.What Are the Key Growth Drivers in the Cenospheres Market?

The growth of the cenospheres market is driven by several key factors that are shaping the demand for lightweight, high-performance materials across industries. First and foremost, the expanding applications of cenospheres in the construction industry are a major driver. Cenospheres are increasingly being used in lightweight concrete, cement, and insulation materials, where their properties of low density and high strength are critical. The global construction boom, particularly in emerging markets, is generating significant demand for materials that can reduce costs while improving structural efficiency. In the oil and gas industry, the need for lightweight drilling fluids and cementing solutions is spurring the adoption of cenospheres, as they help improve the efficiency of drilling operations. Additionally, advancements in manufacturing processes, such as additive manufacturing and 3D printing, are opening new opportunities for the use of cenospheres in producing lighter, stronger components. The automotive and aerospace industries are also key growth drivers, as the trend towards fuel-efficient, lightweight vehicles and aircraft is increasing the demand for materials that can reduce weight without sacrificing performance. Furthermore, the growing emphasis on sustainability and waste reduction is driving industries to explore the use of byproducts like cenospheres, which not only improve material properties but also contribute to environmental goals. These factors, combined with technological innovations and expanding industrial applications, are propelling the growth of the cenospheres market on a global scale.Report Scope

The report analyzes the Cenospheres market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Gray, White); End-Use (Oil & Gas, Refractory, Construction, Automotive, Paints & Coatings, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gray Cenospheres segment, which is expected to reach US$1.3 Billion by 2030 with a CAGR of 11.4%. The White Cenospheres segment is also set to grow at 9.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $267.9 Million in 2024, and China, forecasted to grow at an impressive 14.1% CAGR to reach $452.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cenospheres Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cenospheres Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cenospheres Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Iodine Company, Inc., Ashtech India Pvt. Ltd., Ceno Technologies Inc., Cenosphere India Pvt., Ltd., Cenospheres Trade & Engineering S.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Cenospheres market report include:

- American Iodine Company, Inc.

- Ashtech India Pvt. Ltd.

- Ceno Technologies Inc.

- Cenosphere India Pvt., Ltd.

- Cenospheres Trade & Engineering S.A.

- Delamin Ltd.

- Durgesh Merchandise Pvt. Ltd

- Envirospheres Pty Ltd.

- Ets Inc.

- Excellex Solutions

- Khetan Group (Nepal)

- Microspheres SA

- Omya AG (Omya Group)

- Petra India Group

- PR Ecoenergy Pvt. Ltd.

- Prakash MiCA Exports Pvt. Ltd.

- Qingdao Eastchem Inc.

- Reslab Microfiller

- ScotAsh, Limited

- Shanghai Green Sub-Nanoseale Material Co., Ltd

- SphereTek Ltd

- Vipra Ferro Alloys Pvt. Ltd.

- Wolkem Omega Minerals India Pvt Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Iodine Company, Inc.

- Ashtech India Pvt. Ltd.

- Ceno Technologies Inc.

- Cenosphere India Pvt., Ltd.

- Cenospheres Trade & Engineering S.A.

- Delamin Ltd.

- Durgesh Merchandise Pvt. Ltd

- Envirospheres Pty Ltd.

- Ets Inc.

- Excellex Solutions

- Khetan Group (Nepal)

- Microspheres SA

- Omya AG (Omya Group)

- Petra India Group

- PR Ecoenergy Pvt. Ltd.

- Prakash MiCA Exports Pvt. Ltd.

- Qingdao Eastchem Inc.

- Reslab Microfiller

- ScotAsh, Limited

- Shanghai Green Sub-Nanoseale Material Co., Ltd

- SphereTek Ltd

- Vipra Ferro Alloys Pvt. Ltd.

- Wolkem Omega Minerals India Pvt Ltd.

Table Information

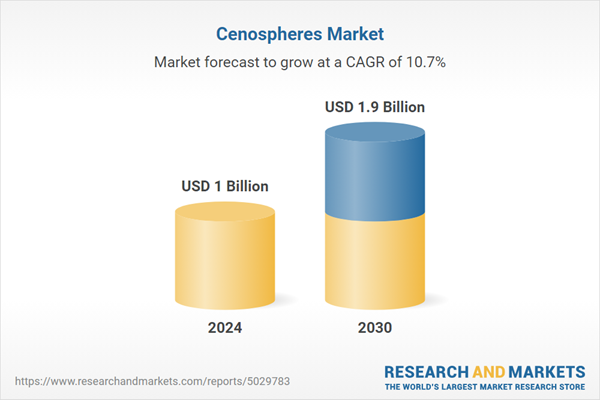

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | Global |