Global Ammonium Sulfate Market - Key Trends and Drivers Summarized

Why Is Ammonium Sulfate Essential in Modern Agriculture?

Ammonium sulfate, a widely utilized chemical compound in agriculture, plays a crucial role in providing essential nutrients to crops. Comprising nitrogen and sulfur, this fertilizer is particularly beneficial for soils deficient in these elements. Nitrogen is fundamental for plant growth, enhancing foliage development, while sulfur is vital for protein synthesis and enzyme function. With the global push towards higher agricultural productivity to meet the increasing food demand, ammonium sulfate has become indispensable. Its application ensures improved soil fertility and healthier crops, making it a staple in both conventional and sustainable farming practices. Farmers around the world depend on ammonium sulfate to enhance crop yields, thereby supporting food security on a global scale.What Technological Advances Are Shaping Ammonium Sulfate Production?

Technological advancements have significantly enhanced the production efficiency and environmental sustainability of ammonium sulfate. Modern manufacturing processes have optimized the utilization of raw materials and energy, reducing the environmental footprint of production. Additionally, the development of advanced application technologies, such as precision farming tools, has allowed for more accurate and efficient use of ammonium sulfate in the field. Precision agriculture, which employs GPS and IoT technologies, ensures that fertilizers are applied in the right amounts at the right time, minimizing waste and environmental impact. These innovations not only improve the effectiveness of ammonium sulfate but also contribute to more sustainable agricultural practices, aligning with global efforts to reduce environmental degradation.How Are Environmental Regulations and Sustainability Trends Impacting the Market?

The ammonium sulfate market is increasingly influenced by stringent environmental regulations and a growing emphasis on sustainability. Governments worldwide are implementing stricter regulations to control the use and production of fertilizers to mitigate their environmental impact. This regulatory landscape drives the adoption of more sustainable and environmentally friendly agricultural practices. Additionally, there is a rising trend towards organic farming and the use of bio-based fertilizers, which poses both challenges and opportunities for the ammonium sulfate market. Manufacturers are investing in research and development to create formulations that meet regulatory standards while addressing environmental concerns. These efforts are crucial in ensuring that ammonium sulfate remains a viable and environmentally responsible option for modern agriculture.What Factors Are Propelling the Growth of the Ammonium Sulfate Market?

The growth in the ammonium sulfate market is driven by several factors. Advances in production technologies have made the manufacturing process more efficient and cost-effective, expanding market accessibility. The increasing global demand for food, driven by population growth and changing dietary preferences, has significantly boosted the need for effective fertilizers like ammonium sulfate. Precision farming techniques and advanced agricultural machinery have facilitated the targeted application of fertilizers, improving crop yields and driving market adoption. Government policies and subsidies supporting sustainable agriculture practices have also played a crucial role in propelling market growth. The heightened awareness of soil health and the benefits of sulfur in crop nutrition have encouraged farmers to use ammonium sulfate. Furthermore, the development of innovative fertilizer formulations tailored to specific crop and soil needs has opened new market opportunities. These factors collectively ensure the sustained growth and relevance of the ammonium sulfate market in addressing the challenges of modern agriculture.Report Scope

The report analyzes the Ammonium Sulfate market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Solid, Liquid); Application (Fertilizers, Pharmaceuticals, Food & Feed Additives, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fertilizers Application segment, which is expected to reach US$3.7 Billion by 2030 with a CAGR of 5.4%. The Pharmaceuticals Application segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $973.5 Million in 2024, and China, forecasted to grow at an impressive 8.1% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ammonium Sulfate Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ammonium Sulfate Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ammonium Sulfate Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzo Nobel NV, ArcelorMittal, Arkema Group, BASF Antwerpen NV, Domo Chemicals NV and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 12 companies featured in this Ammonium Sulfate market report include:

- Akzo Nobel NV

- ArcelorMittal

- Arkema Group

- BASF Antwerpen NV

- Domo Chemicals NV

- Evonik Industries AG

- Helm AG

- Honeywell International, Inc.

- LANXESS AG

- Nutrien Ltd.

- Rentech, Inc.

- Royal DSM NV

- SABIC (Saudi Basic Industries Corporation)

- Sumitomo Chemical Co., Ltd.

- Tereos

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel NV

- ArcelorMittal

- Arkema Group

- BASF Antwerpen NV

- Domo Chemicals NV

- Evonik Industries AG

- Helm AG

- Honeywell International, Inc.

- LANXESS AG

- Nutrien Ltd.

- Rentech, Inc.

- Royal DSM NV

- SABIC (Saudi Basic Industries Corporation)

- Sumitomo Chemical Co., Ltd.

- Tereos

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

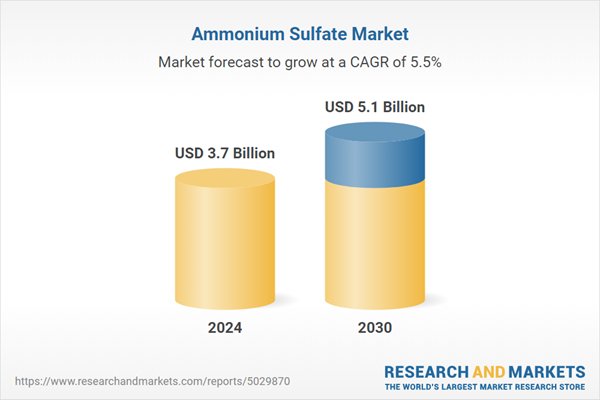

| Estimated Market Value ( USD | $ 3.7 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |