Global Glucose, Dextrose, and Maltodextrin Market - Key Trends and Drivers Summarized

Why Are Glucose, Dextrose, and Maltodextrin Critical Ingredients in Food, Pharmaceuticals, and Industrial Applications?

Glucose, dextrose, and maltodextrin are pivotal ingredients in various industries, playing essential roles in food production, pharmaceuticals, and even industrial processes. But why are these carbohydrate-based ingredients so crucial today? Glucose, commonly referred to as blood sugar, is a simple sugar that serves as the body's primary source of energy. Dextrose, a form of glucose derived from starches, is chemically identical to glucose but is more often used in food and medical applications. Maltodextrin, on the other hand, is a polysaccharide produced from starch and is commonly used as a thickener or filler in food products.In the food industry, glucose, dextrose, and maltodextrin are used as sweeteners, stabilizers, and energy sources in a wide variety of products, from candies and baked goods to sports drinks and processed foods. Dextrose is often favored in food production for its ability to enhance flavor, improve texture, and act as a preservative. Maltodextrin, with its mild sweetness and excellent solubility, is frequently added to sports supplements, snacks, and beverages to improve mouthfeel and provide quick-digesting carbohydrates. Additionally, these ingredients are essential in pharmaceuticals, where they are used as carriers, stabilizers, or fillers in tablets, powders, and intravenous solutions. Their versatility and wide range of applications make glucose, dextrose, and maltodextrin indispensable to multiple industries.

How Are Technological Advancements Improving the Production and Applications of Glucose, Dextrose, and Maltodextrin?

Technological advancements are significantly improving the efficiency, scalability, and sustainability of glucose, dextrose, and maltodextrin production, while also expanding their applications. One of the most important innovations in this field is the development of enzymatic hydrolysis for starch conversion. Traditionally, glucose and dextrose were produced using acid hydrolysis, which was energy-intensive and less efficient. With the advent of enzymatic processes, starches from corn, wheat, and other sources can now be broken down into glucose, dextrose, and maltodextrin more efficiently, resulting in higher yields, lower energy consumption, and fewer byproducts. This enzymatic approach is not only more cost-effective but also aligns with the increasing demand for environmentally friendly production methods.In food technology, advancements in the modification of maltodextrin and dextrose have expanded their functional applications. Modified maltodextrin, for example, is designed to improve water solubility, stability, and heat resistance, making it suitable for use in a broader range of products such as instant soups, sauces, and beverages. Additionally, advancements in microencapsulation techniques have allowed manufacturers to use maltodextrin as a carrier for flavors, vitamins, and other sensitive ingredients, protecting them from degradation and extending product shelf life. This has opened up new possibilities in the creation of fortified and functional foods that meet consumer demand for enhanced nutrition and convenience.

In the pharmaceutical sector, innovations in glucose and dextrose formulation are enhancing their use in medical treatments. For instance, dextrose solutions are widely used in intravenous (IV) therapy to provide immediate energy to patients and to manage blood sugar levels. Technological improvements in purification processes ensure that these dextrose solutions are of the highest purity, minimizing the risk of impurities that could interfere with patient care. Similarly, glucose is increasingly being used in diagnostic testing kits, particularly for managing diabetes, where its rapid measurement is crucial for blood sugar control.

The development of bio-based processing technologies has further improved the sustainability of glucose, dextrose, and maltodextrin production. These processes utilize renewable plant-based feedstocks and efficient fermentation techniques to produce these ingredients with lower carbon footprints. This aligns with the growing consumer and regulatory focus on sustainability in the food and pharmaceutical industries, driving demand for cleaner, greener production methods. As advancements in biotechnology and enzyme engineering continue, the production of glucose, dextrose, and maltodextrin is expected to become even more efficient, environmentally sustainable, and adaptable to new applications.

Why Are Glucose, Dextrose, and Maltodextrin Critical for Energy, Stability, and Functional Benefits in Food and Pharmaceuticals?

Glucose, dextrose, and maltodextrin are critical in providing energy, stability, and functional benefits in food and pharmaceutical products due to their unique properties as carbohydrate-based ingredients. In the realm of nutrition, glucose and dextrose are vital because they are easily metabolized by the body to provide a quick and reliable source of energy. This makes them especially important in products designed for athletes, individuals recovering from illness, and people who need a rapid energy boost. Sports drinks, energy gels, and recovery supplements often contain dextrose or glucose due to their ability to be rapidly absorbed, helping to replenish glycogen stores and maintain endurance.Maltodextrin, although less sweet than glucose and dextrose, plays a key role in energy delivery as well. It is a polysaccharide that is broken down into glucose during digestion, providing a sustained release of energy over time. This property makes it an ideal ingredient in carbohydrate-based supplements and meal replacement products, where steady energy is required without the sharp spike in blood sugar levels that comes with simpler sugars. Maltodextrin's slow-digesting nature also makes it valuable in weight management and sports nutrition, providing a balance between quick and prolonged energy supply.

In food production, these ingredients contribute to the texture, stability, and shelf life of products. Glucose and dextrose are used as sweeteners and preservatives in confectioneries, baked goods, and processed foods, helping to maintain moisture and prevent spoilage. Their ability to act as humectants means they keep products soft and moist, enhancing the texture of items like cakes, cookies, and candies. Additionally, dextrose is often used in fermentation processes in baked goods, supporting yeast activation and improving the volume and texture of bread and pastries.

Maltodextrin is particularly prized for its functional benefits as a stabilizer, thickener, and filler in food products. Its neutral taste and solubility allow it to be used in a wide range of applications, from enhancing the texture of sauces and dressings to acting as a carrier for powdered flavors and nutrients. In processed foods, maltodextrin is used to bulk up products without significantly altering the flavor, making it an economical and versatile ingredient. Additionally, maltodextrin's ability to enhance mouthfeel and improve the consistency of liquids and semi-solids makes it a key ingredient in sauces, soups, and snacks.

In pharmaceuticals, glucose and dextrose are essential as excipients - substances used to stabilize active ingredients in medications. They are used in the formulation of tablets, syrups, and powders, helping to deliver active ingredients in a stable and easily absorbable form. Dextrose solutions are commonly used in IV fluids to provide quick energy and maintain hydration in patients, especially in medical situations requiring blood sugar management or rehydration therapy. Glucose also plays a critical role in oral rehydration salts (ORS), used to treat dehydration from illnesses such as diarrhea and vomiting, further underscoring its importance in medical care.

What Factors Are Driving the Growth of the Glucose, Dextrose, and Maltodextrin Market?

Several key factors are driving the rapid growth of the glucose, dextrose, and maltodextrin market, including increasing demand for processed and convenience foods, the rise of the sports nutrition and health supplement industries, advancements in pharmaceutical formulations, and the growing trend toward sustainable and plant-based ingredients. First, the rising consumption of processed and convenience foods is a major driver of the market for glucose, dextrose, and maltodextrin. These ingredients are essential in improving the taste, texture, and shelf life of processed foods, making them staples in the production of candies, snacks, baked goods, and beverages. As urbanization and fast-paced lifestyles drive demand for quick, ready-to-eat food products, the use of these carbohydrate-based ingredients continues to expand.Second, the rapid growth of the sports nutrition and health supplement industries is fueling demand for dextrose and maltodextrin. Athletes and fitness enthusiasts seek energy-boosting supplements to enhance performance, and products containing dextrose and maltodextrin offer the quick and sustained energy needed for endurance and recovery. The expanding focus on fitness, wellness, and active lifestyles is increasing the consumption of energy drinks, protein powders, and sports gels, all of which rely on these ingredients for energy delivery and improved texture.

Third, advancements in pharmaceutical formulations are contributing to the increased use of glucose and dextrose in medical applications. The pharmaceutical industry uses these ingredients to stabilize drugs, create easily digestible supplements, and provide energy in clinical settings through intravenous solutions. With the rising prevalence of diabetes and the growing demand for oral rehydration solutions, glucose and dextrose play an essential role in managing blood sugar levels and ensuring effective hydration.

The shift toward sustainable and plant-based ingredients is also a key factor driving the market. Glucose, dextrose, and maltodextrin are derived from renewable plant sources, such as corn and wheat, making them more environmentally friendly compared to synthetic alternatives. As consumers and manufacturers prioritize sustainability, the demand for plant-based, biodegradable ingredients like glucose, dextrose, and maltodextrin is rising, especially in food, beverage, and pharmaceutical applications. This aligns with the increasing interest in clean-label products, where consumers prefer minimally processed, recognizable ingredients in their food and supplements.

Finally, the global focus on reducing food waste and improving food security is boosting the demand for ingredients like maltodextrin, which extends the shelf life of food products and improves their stability. Maltodextrin is used to reduce the moisture content in perishable foods, helping to preserve their quality during transportation and storage. As the global population grows and the need for efficient food production and distribution increases, ingredients that enhance food preservation, such as maltodextrin, are becoming more valuable.

In conclusion, the growth of the glucose, dextrose, and maltodextrin market is being driven by increasing demand for processed foods, the rise of the sports nutrition industry, advancements in pharmaceutical applications, and the trend toward sustainability. As industries continue to innovate and consumers demand healthier, more sustainable products, glucose, dextrose, and maltodextrin will remain essential ingredients across a wide range of food, pharmaceutical, and industrial applications.

Report Scope

The report analyzes the Glucose, Dextrose, and Maltodextrin market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Glucose, Dextrose, Maltodextrin); Application (Food & Beverage, Personal Care Products, Pharmaceuticals, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Glucose segment, which is expected to reach US$32.3 Billion by 2030 with a CAGR of 5.9%. The Dextrose segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $12.1 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $14.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Glucose, Dextrose, and Maltodextrin Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Glucose, Dextrose, and Maltodextrin Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Glucose, Dextrose, and Maltodextrin Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGRANA Beteiligungs AG, Archer Daniels Midland Company, Avebe Group, Cargill, Inc., Fooding Group Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 157 companies featured in this Glucose, Dextrose, and Maltodextrin market report include:

- AGRANA Beteiligungs AG

- Archer Daniels Midland Company

- Avebe Group

- Cargill, Inc.

- Fooding Group Limited

- Global Sweeteners Holdings Ltd.

- Grain Processing Corporation

- Gulshan Polyols Ltd.

- Henan Feitian Agricultural Development Co., Ltd

- Ingredion, Inc.

- Luzhou Bio-Chem Technology Ltd.

- Matsutani Chemical industry Co,. Ltd.

- Qinhuangdao Lihua Starch Co Ltd

- Roquette

- Shandong Xiwang Sugar Industry Co., Ltd

- Shijiazhuang Huachen Starch Sugar Production Co., Ltd.

- Tate & Lyle PLC

- Tereos

- Zhucheng Dongxiao Biotechnology Co. Ltd.

- Zhucheng Xingmao Corn Developing Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGRANA Beteiligungs AG

- Archer Daniels Midland Company

- Avebe Group

- Cargill, Inc.

- Fooding Group Limited

- Global Sweeteners Holdings Ltd.

- Grain Processing Corporation

- Gulshan Polyols Ltd.

- Henan Feitian Agricultural Development Co., Ltd

- Ingredion, Inc.

- Luzhou Bio-Chem Technology Ltd.

- Matsutani Chemical industry Co,. Ltd.

- Qinhuangdao Lihua Starch Co Ltd

- Roquette

- Shandong Xiwang Sugar Industry Co., Ltd

- Shijiazhuang Huachen Starch Sugar Production Co., Ltd.

- Tate & Lyle PLC

- Tereos

- Zhucheng Dongxiao Biotechnology Co. Ltd.

- Zhucheng Xingmao Corn Developing Co., Ltd.

Table Information

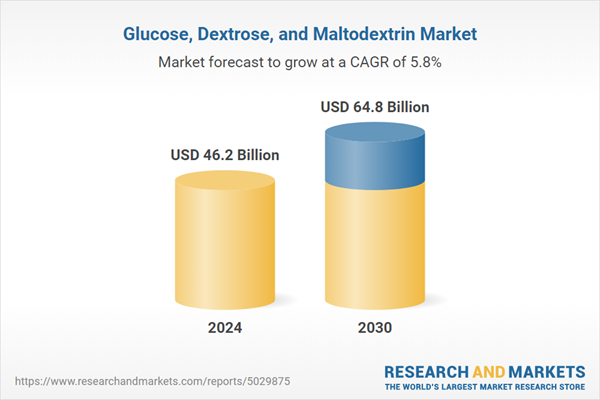

| Report Attribute | Details |

|---|---|

| No. of Pages | 383 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 46.2 Billion |

| Forecasted Market Value ( USD | $ 64.8 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |