Global GigE Camera Market - Key Trends and Drivers Summarized

Why Are GigE Cameras Transforming Industrial Automation and High-Speed Imaging?

GigE cameras are revolutionizing industrial automation, machine vision, and high-speed imaging applications by providing powerful, high-resolution imaging capabilities over standard Ethernet networks. But why are GigE cameras so essential today? GigE (Gigabit Ethernet) cameras utilize the Gigabit Ethernet standard to transfer data at speeds of up to 1 Gbps, enabling high-resolution images to be transmitted over long distances with low latency. These cameras are widely used in industries such as manufacturing, robotics, healthcare, and security, where precision, speed, and reliability are critical.The key advantage of GigE cameras is their ability to transmit large amounts of data quickly and efficiently, making them ideal for high-speed inspection, quality control, and automation tasks. In manufacturing environments, GigE cameras are used to monitor production lines, identify defects, and ensure product quality at high speeds without compromising accuracy. Their long cable length capability (up to 100 meters) provides flexibility in system design, allowing cameras to be placed at various points within a facility without the need for complex wiring setups. With the combination of high-resolution imaging, long-distance transmission, and ease of integration, GigE cameras are reshaping how industries approach automation, inspection, and monitoring tasks.

How Are Technological Advancements Enhancing the Performance of GigE Cameras?

Technological advancements are significantly enhancing the performance, resolution, and versatility of GigE cameras, making them even more effective for industrial and scientific applications. One of the most impactful advancements is the development of high-resolution sensors that allow GigE cameras to capture ultra-high-definition images with precision. Modern GigE cameras can now achieve resolutions of up to 100 megapixels, providing the detailed imagery required for applications such as semiconductor inspection, medical diagnostics, and quality control in advanced manufacturing. These sensors are also capable of high frame rates, allowing cameras to capture fast-moving objects without motion blur.Another important advancement is the implementation of advanced image processing capabilities directly within the camera. Some GigE cameras are equipped with onboard processing units that handle tasks such as image filtering, noise reduction, and color correction, reducing the need for external processing and streamlining data flow. This is particularly valuable in real-time applications, such as machine vision systems, where split-second decision-making is critical. Additionally, advancements in compression algorithms allow for efficient data transmission without sacrificing image quality, ensuring smooth operation in high-speed environments.

The integration of Power over Ethernet (PoE) technology is another game-changing advancement for GigE cameras. PoE enables both power and data to be transmitted over a single Ethernet cable, simplifying installation by eliminating the need for separate power sources. This not only reduces wiring complexity but also lowers installation costs, making GigE cameras more accessible for a variety of industrial and commercial applications. Furthermore, multi-camera systems benefit from this simplification, as multiple GigE cameras can be easily connected and powered through a single network switch.

In addition to these hardware advancements, software and firmware improvements are enhancing the performance and functionality of GigE cameras. Many GigE cameras now support advanced image analysis and AI algorithms, enabling them to perform complex tasks such as object recognition, pattern detection, and anomaly identification in real-time. These smart features make GigE cameras highly versatile, adaptable to various industrial, medical, and scientific applications. As technology continues to evolve, GigE cameras are becoming even more powerful, reliable, and efficient for a wide range of imaging and automation tasks.

Why Are GigE Cameras Critical for Industrial Automation and Precision Imaging?

GigE cameras are critical for industrial automation and precision imaging because they provide high-speed, high-resolution imaging capabilities that enable real-time decision-making and quality control. In industries such as manufacturing, automotive, and pharmaceuticals, where precision and efficiency are paramount, GigE cameras play a key role in optimizing production processes and ensuring product quality. With the ability to capture detailed images at high speeds, GigE cameras are used for tasks like inspecting assembly lines, detecting defects, and measuring dimensional accuracy, all while keeping pace with fast-moving production lines.In machine vision systems, GigE cameras are essential for tasks such as object tracking, barcode reading, and robotic guidance. These systems rely on the fast data transfer rates and low latency provided by GigE cameras to process information in real time and enable automated machinery to react quickly to changes on the production line. For example, in a packaging facility, a GigE camera might detect a faulty package and trigger a robotic arm to remove it from the line before it reaches the end of the process. This level of automation not only improves operational efficiency but also reduces waste and enhances overall product quality.

Beyond industrial automation, GigE cameras are also critical in scientific and medical imaging applications. In the medical field, GigE cameras are used in diagnostic equipment, such as endoscopy and microscopy systems, where high-resolution imagery is necessary for accurate diagnosis and treatment planning. Their ability to transmit detailed images in real time allows medical professionals to make informed decisions quickly. Similarly, in scientific research, GigE cameras are used in experiments requiring precise imaging, such as particle tracking, fluid dynamics studies, and high-speed observations of biological processes.

GigE cameras are also increasingly important in the security and surveillance industry, where high-resolution footage is essential for monitoring large areas, identifying individuals, and ensuring public safety. With their ability to transmit data over long distances without the need for repeaters or complex wiring systems, GigE cameras are ideal for large-scale surveillance networks. In security settings, they provide the clarity and speed required to detect potential threats, monitor critical infrastructure, and ensure rapid response to emergencies. Overall, GigE cameras are critical tools for improving accuracy, speed, and efficiency in a wide variety of industrial, medical, and security applications.

What Factors Are Driving the Growth of the GigE Camera Market?

Several key factors are driving the rapid growth of the GigE camera market, including the increasing demand for high-speed imaging, advancements in industrial automation, the rise of machine vision systems, and the growing adoption of AI and data analytics in manufacturing. First, the increasing need for high-speed imaging in industries such as automotive, electronics, and pharmaceuticals is a major driver of the GigE camera market. These industries require fast, accurate image capture to maintain quality control, streamline operations, and detect defects in real time. GigE cameras, with their ability to transfer large amounts of data quickly over standard Ethernet networks, are perfectly suited for these applications.Second, the growing use of industrial automation and robotics in manufacturing is driving demand for GigE cameras. As companies seek to optimize production and reduce costs, they are increasingly turning to automated systems that rely on machine vision and imaging technologies. GigE cameras are essential components of these systems, providing the high-resolution imaging needed for tasks like robotic assembly, sorting, and inspection. The ability of GigE cameras to deliver real-time data with minimal latency is critical for ensuring the accuracy and efficiency of automated processes.

Third, the rise of machine vision systems in sectors such as logistics, agriculture, and food processing is contributing to the expansion of the GigE camera market. Machine vision systems use cameras to analyze visual information, enabling automated machinery to perform tasks that require high precision, such as sorting items, inspecting products, or navigating environments. GigE cameras are ideal for these systems due to their high data transfer speeds, long cable lengths, and ability to integrate seamlessly with existing Ethernet networks. As more industries adopt machine vision technology to improve productivity, the demand for GigE cameras continues to grow.

The increasing adoption of artificial intelligence (AI) and data analytics in manufacturing and other industries is also driving market growth. AI-powered imaging systems require high-quality visual data to train algorithms and make accurate predictions. GigE cameras, with their ability to capture detailed images and transmit them in real time, provide the necessary data for these systems to function effectively. AI-driven applications such as predictive maintenance, automated defect detection, and smart quality control are becoming more widespread, fueling demand for GigE cameras as essential components in these intelligent systems.

Finally, the expansion of the security and surveillance industry is boosting demand for GigE cameras. As cities, governments, and businesses invest in surveillance infrastructure to enhance public safety and monitor critical assets, GigE cameras are being deployed in large-scale surveillance networks due to their high-resolution imaging capabilities and ability to transmit data over long distances. These cameras are particularly well-suited for monitoring large areas, such as airports, industrial facilities, and public spaces, where detailed, real-time footage is essential for security operations.

In conclusion, the GigE camera market is experiencing significant growth due to the increasing demand for high-speed imaging, the rise of industrial automation, the expansion of machine vision systems, and the adoption of AI in manufacturing. As industries continue to prioritize efficiency, precision, and real-time data, GigE cameras will play a crucial role in transforming industrial processes, medical diagnostics, and security systems around the world.

Report Scope

The report analyzes the GigE Camera market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Area Scan, Line Scan); Technology (Complementary Metal Oxide Semiconductor (CMOS), Charge Coupled Device (CCD)); End-Use (Security & Surveillance, Industrial, Automotive, Pharmaceuticals, Military & Defense, Medical, Food & Packaging, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Area Scan Camera segment, which is expected to reach US$1.2 Billion by 2030 with a CAGR of 9.1%. The Line Scan Camera segment is also set to grow at 9.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $344.6 Million in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $336.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global GigE Camera Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global GigE Camera Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global GigE Camera Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adimec Advanced Image Systems BV, Allied Vision Technologies GmbH, Alrad Instruments Ltd., Atmel Corporation, Basler AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 14 companies featured in this GigE Camera market report include:

- Adimec Advanced Image Systems BV

- Allied Vision Technologies GmbH

- Alrad Instruments Ltd.

- Atmel Corporation

- Basler AG

- Baumer Group

- Bytronic Automation Ltd.

- FLIR Integrated Imaging Solutions, Inc.

- JAI A/S

- Matrox Electronic Systems Ltd.

- Pleora Technologies Inc.

- Qualitas Technologies Pvt Ltd.

- Sony Electronics, Inc.

- Teledyne DALSA, Inc.

- Toshiba Teli Corporation

- Vision Components GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adimec Advanced Image Systems BV

- Allied Vision Technologies GmbH

- Alrad Instruments Ltd.

- Atmel Corporation

- Basler AG

- Baumer Group

- Bytronic Automation Ltd.

- FLIR Integrated Imaging Solutions, Inc.

- JAI A/S

- Matrox Electronic Systems Ltd.

- Pleora Technologies Inc.

- Qualitas Technologies Pvt Ltd.

- Sony Electronics, Inc.

- Teledyne DALSA, Inc.

- Toshiba Teli Corporation

- Vision Components GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

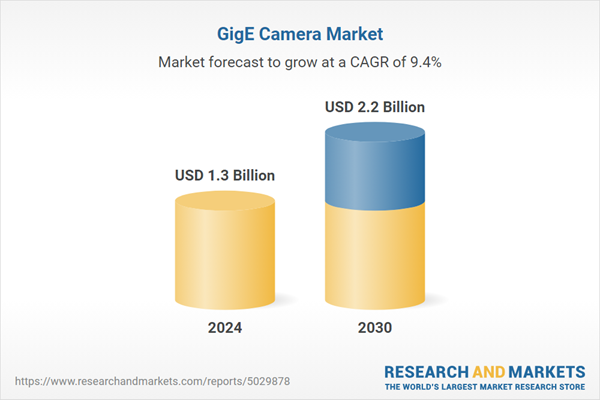

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 2.2 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |