Global Forging Market - Key Trends and Drivers Summarized

Why Is Forging Revolutionizing Manufacturing and Metalworking?

Forging is transforming industries that require durable, high-performance metal components, but why has it become such an essential process in modern manufacturing? Forging is a metalworking technique that involves shaping metal through the application of compressive forces, often by hammering or pressing. This process produces metal components that are stronger and more durable than those made through casting or machining. Forging is widely used in industries such as automotive, aerospace, defense, and construction, where the strength, reliability, and durability of metal parts are critical. Components like engine parts, gears, and aerospace fittings are commonly forged due to the enhanced mechanical properties this method imparts.One of the primary reasons forging is revolutionizing manufacturing is its ability to produce stronger and more reliable parts compared to other methods. During forging, the internal grain structure of the metal is refined and aligned with the shape of the part, improving its strength and fatigue resistance. This makes forged components ideal for applications that require parts to withstand high stress, impact, and wear over time. In industries like aerospace and automotive, where failure of a critical component could have catastrophic consequences, forging offers the reliability needed to ensure performance and safety.

How Does Forging Work, and What Makes It So Effective?

Forging plays a vital role in producing high-quality metal components, but how does it work, and what makes it so effective in creating durable parts? The forging process involves heating metal to a specific temperature (in hot forging) or working it at room temperature (in cold forging) and then applying compressive forces through hammering, pressing, or rolling to shape the material. There are various types of forging processes, including open-die forging, closed-die forging, and impression-die forging, each suited to different types of components and production volumes. Open-die forging is typically used for larger components, while closed-die forging is used to create more complex shapes with tight tolerances.What makes forging so effective is the mechanical strength and uniformity it imparts to the final product. As metal is compressed during the forging process, its internal grain structure is altered, becoming finer and more oriented in the direction of the applied forces. This alignment of the grain structure significantly increases the strength and fatigue resistance of the material, making forged parts less likely to crack or fail under stress. In addition to superior strength, forging can achieve high levels of precision and complexity, especially in closed-die forging, where metal is forced into a mold that defines the part's final shape. This allows manufacturers to produce parts with intricate geometries and tight tolerances, reducing the need for secondary machining and increasing efficiency.

Additionally, forging is highly versatile, able to work with a wide range of metals and alloys, including steel, aluminum, titanium, and nickel-based superalloys. This versatility makes forging suitable for a variety of industries and applications, from small precision components to large structural parts. The process can be tailored to meet specific performance requirements, such as high wear resistance, impact strength, or temperature tolerance, making it a go-to method for critical applications where failure is not an option. This combination of strength, precision, and versatility makes forging one of the most effective metalworking techniques available.

How Is Forging Shaping the Future of Manufacturing, Aerospace, and Automotive Industries?

Forging is not only advancing traditional manufacturing - it is also shaping the future of aerospace, automotive, and advanced material applications. One of the most significant trends in forging is the development of lightweight, high-strength materials for the aerospace and automotive sectors. As these industries strive to reduce weight for improved fuel efficiency and performance, the demand for forged components made from lightweight alloys like aluminum and titanium is growing. Forging allows manufacturers to produce these components with the high strength-to-weight ratio necessary for demanding applications, such as aircraft structures, engine parts, and automotive chassis components.In addition to supporting lightweight designs, forging is driving innovation in advanced materials and superalloys. In aerospace, where components are exposed to extreme temperatures and stress, forging is used to produce parts from high-performance materials like nickel-based superalloys. These alloys are critical for components like turbine blades and engine parts, where maintaining strength and stability at high temperatures is essential for safety and efficiency. Forging enhances the mechanical properties of these materials, improving their resistance to heat, corrosion, and wear, which is vital for both aerospace and power generation applications. As new materials are developed for next-generation aircraft and engines, forging will continue to be a critical process in shaping these advanced components.

Forging is also advancing the automotive industry, where it plays a key role in producing components that meet the demands of electric vehicles (EVs) and fuel-efficient designs. As automakers shift toward lighter, more efficient vehicles, forged parts made from high-strength alloys are being used to reduce the weight of critical components like suspension systems, transmission gears, and electric motor housings. These parts must withstand high levels of stress and heat while maintaining durability, making forged metal components the preferred choice for performance and safety. Moreover, the rise of electric vehicles is driving innovation in forging techniques and materials, as manufacturers seek to optimize parts for higher efficiency and reduced emissions.

Furthermore, forging is contributing to the future of sustainability in manufacturing. The forging process generates less material waste compared to other manufacturing methods like casting or machining, where large amounts of material are often removed during shaping. In forging, the material is compressed into the desired shape with minimal waste, making it a more sustainable option. Additionally, forging's ability to produce stronger parts means that components have a longer service life, reducing the need for replacements and lowering overall material consumption. As industries continue to prioritize sustainability, forging will play an increasingly important role in producing high-performance components with reduced environmental impact.

What Factors Are Driving the Growth of the Forging Industry?

Several key factors are driving the rapid growth of the forging industry, reflecting broader trends in automotive, aerospace, and advanced material demands. One of the primary drivers is the increased demand for lightweight, high-strength components in industries such as aerospace and automotive. As manufacturers seek to improve fuel efficiency and reduce emissions, forged components made from lightweight alloys like aluminum and titanium are in high demand. These materials offer the strength and durability needed for critical applications, while their lighter weight helps reduce the overall mass of vehicles and aircraft, contributing to better performance and fuel economy.Another significant factor contributing to the growth of the forging industry is the expansion of the aerospace sector. The need for aircraft that can operate more efficiently and withstand extreme conditions has led to increased demand for forged components, particularly in the production of jet engines, landing gear, and structural parts. Forging's ability to enhance the properties of superalloys, which are used in high-temperature applications, makes it an essential process in aerospace manufacturing. With the continued growth of air travel and the development of more advanced aircraft designs, the demand for forged parts in the aerospace industry is expected to rise steadily.

The shift toward electric vehicles (EVs) is also fueling demand for forged components in the automotive industry. As automakers work to reduce vehicle weight and improve efficiency, forged parts offer the combination of strength and lightweight properties needed to support this transition. EVs require components that can handle the high stresses associated with electric motors and batteries, making forging a critical process in producing parts that meet these requirements. Additionally, the growth of EV production is leading to innovations in forging techniques, as manufacturers seek to optimize components for improved range and performance.

Finally, technological advancements in forging processes are driving further growth in the industry. Innovations such as precision forging and isothermal forging allow manufacturers to produce parts with greater accuracy, complexity, and consistency, reducing the need for additional machining and lowering production costs. Advances in computer-aided design (CAD) and simulation technologies are also improving the efficiency of the forging process, allowing for more accurate predictions of material behavior and reducing material waste. These innovations are making forging more accessible and cost-effective for a wider range of industries, driving further expansion of the market as manufacturers look for high-performance, durable solutions for their components.

As industries continue to demand stronger, lighter, and more reliable components, forging will remain a key process, driving advancements in performance, sustainability, and innovation across a wide range of applications.

Report Scope

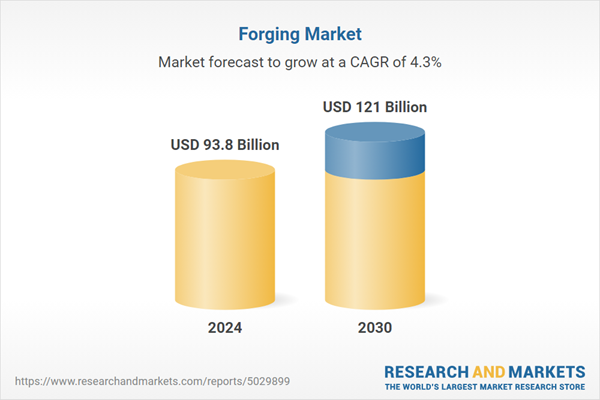

The report analyzes the Forging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Open Die, Impression Die, Rolled Rings); Application (Automotive, Oil & Gas, Aerospace, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Open Die Forging segment, which is expected to reach US$48.3 Billion by 2030 with a CAGR of 4.5%. The Impression Die Forging segment is also set to grow at 3.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $25 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $25.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Forging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Forging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Forging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allegheny Technologies, Inc. (ATI), American Axle & Manufacturing Inc., Arconic, Inc., Aubert & Duval S.A., Bharat Forge Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 163 companies featured in this Forging market report include:

- Allegheny Technologies, Inc. (ATI)

- American Axle & Manufacturing Inc.

- Arconic, Inc.

- Aubert & Duval S.A.

- Bharat Forge Ltd.

- Ellwood Group Inc.

- Hinduja Foundries

- Kalyani Forge Ltd.

- KITZ Corporation

- Nippon Steel & Sumitomo Metal Corporation

- Precision Castparts Corporation

- ThyssenKrupp AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allegheny Technologies, Inc. (ATI)

- American Axle & Manufacturing Inc.

- Arconic, Inc.

- Aubert & Duval S.A.

- Bharat Forge Ltd.

- Ellwood Group Inc.

- Hinduja Foundries

- Kalyani Forge Ltd.

- KITZ Corporation

- Nippon Steel & Sumitomo Metal Corporation

- Precision Castparts Corporation

- ThyssenKrupp AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 253 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 93.8 Billion |

| Forecasted Market Value ( USD | $ 121 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |