Global Foot and Ankle Devices Market - Key Trends and Drivers Summarized

How Are Foot and Ankle Devices Revolutionizing Orthopedic Care and Mobility Solutions?

Foot and ankle devices are transforming the field of orthopedic care, but why are they so crucial in improving mobility and enhancing quality of life for millions? These devices include a wide range of medical tools and implants designed to treat injuries, deformities, and diseases affecting the foot and ankle. Common devices include braces, prosthetics, joint implants, plates, screws, and other fixation devices that support rehabilitation and recovery. With the increasing prevalence of foot and ankle conditions due to aging populations, sports injuries, and diabetes-related complications, the demand for these devices has grown significantly, making them essential in modern orthopedic care.One of the primary reasons foot and ankle devices are revolutionizing the industry is their ability to restore mobility and alleviate pain. Conditions such as fractures, arthritis, tendon injuries, and deformities can severely impact a person's ability to walk and perform daily activities. Foot and ankle devices, such as ankle braces, foot orthotics, and surgical implants, provide the structural support needed to stabilize the affected area, reduce pain, and enhance mobility. With advancements in materials and design, these devices are now more effective, durable, and customizable, offering patients greater comfort and improved recovery outcomes.

How Do Foot and Ankle Devices Work, and What Makes Them So Effective?

Foot and ankle devices play a critical role in orthopedic care, but how do they work, and what makes them so effective in treating a wide range of conditions? These devices are designed to support, stabilize, or replace damaged bones, joints, tendons, or ligaments in the foot and ankle region. Orthotic devices, such as foot insoles and ankle braces, work by providing external support to correct alignment, distribute pressure, and reduce strain on injured or weakened areas. These devices are commonly used for patients with flat feet, plantar fasciitis, Achilles tendonitis, and other musculoskeletal conditions to help alleviate pain and promote healing.What makes foot and ankle devices so effective is their ability to offer personalized and targeted treatment. For instance, orthopedic implants, such as plates, screws, and joint replacements, are used in surgical procedures to repair fractures, correct deformities, or replace damaged joints with artificial ones. These implants are often made from high-grade materials like titanium and stainless steel, ensuring durability and biocompatibility. Post-surgery, patients may be fitted with external fixation devices or braces to support the foot and ankle during the recovery process, promoting proper healing and preventing further injury. The combination of surgical precision and customized post-operative care makes these devices essential in restoring function and mobility.

Additionally, advancements in biomechanics and materials science have significantly improved the performance and comfort of foot and ankle devices. Modern braces and orthotics are designed to be lightweight, breathable, and easy to adjust, providing a more comfortable fit for patients. Prosthetics for foot and ankle amputees have also seen dramatic improvements, with the development of energy-storing prosthetic feet that allow for a more natural gait and greater mobility. These innovations have made it possible for patients with severe injuries or disabilities to regain much of their independence and physical activity, significantly improving their quality of life.

How Are Foot and Ankle Devices Shaping the Future of Orthopedic Surgery, Rehabilitation, and Sports Medicine?

Foot and ankle devices are not only enhancing current treatment options - they are also shaping the future of orthopedic surgery, rehabilitation, and sports medicine. One of the most significant trends in this area is the development of minimally invasive surgical techniques that utilize advanced fixation devices. These techniques allow surgeons to make smaller incisions, leading to faster recovery times, reduced pain, and lower risk of infection. For example, in cases of ankle fractures or ligament reconstruction, surgeons can use specialized plates and screws to stabilize the joint with minimal tissue damage. This is particularly important in sports medicine, where athletes require quick recovery to return to their sport as soon as possible.In addition to advancing surgical procedures, foot and ankle devices are driving innovations in rehabilitation and post-surgery care. After surgery or injury, patients often require rehabilitation to regain strength, flexibility, and range of motion. Orthotic devices, braces, and physical therapy aids are critical in this process. Wearable technology, such as smart braces, is becoming increasingly popular in rehabilitation. These devices are equipped with sensors that monitor movement and provide real-time feedback to both patients and physical therapists, allowing for more precise and effective rehabilitation plans. By tracking progress and ensuring that patients are performing exercises correctly, these devices can accelerate recovery times and reduce the risk of re-injury.

Foot and ankle devices are also making significant strides in sports medicine, where athletes are particularly prone to foot and ankle injuries due to high-impact activities. Customizable braces, orthotics, and surgical implants are helping athletes recover from conditions like sprains, stress fractures, and Achilles tendon injuries more effectively. Moreover, innovations in dynamic prosthetics are enabling amputee athletes to compete at elite levels by offering greater energy return and flexibility, mimicking natural movement more closely than ever before. These advancements in sports medicine are enabling athletes to return to peak performance while minimizing the long-term impact of their injuries.

Moreover, foot and ankle devices are contributing to the development of preventive care solutions. As awareness grows around the importance of early intervention in preventing more serious foot and ankle conditions, more individuals are using custom orthotics and braces as preventive measures. These devices help maintain proper alignment, reduce the risk of injury, and alleviate discomfort for individuals who spend long hours on their feet, such as athletes, healthcare workers, and laborers. This focus on prevention is not only reducing the incidence of injuries but also improving long-term health outcomes for individuals at risk of developing chronic foot and ankle issues.

What Factors Are Driving the Growth of the Foot and Ankle Devices Market?

Several key factors are driving the rapid growth of the foot and ankle devices market, reflecting broader trends in aging populations, increased sports participation, and advancements in medical technology. One of the primary drivers is the rising incidence of foot and ankle injuries among both the aging population and active individuals. As the global population ages, conditions such as arthritis, osteoporosis, and diabetic foot complications are becoming more prevalent, leading to an increased demand for foot and ankle devices that can manage these conditions effectively. Similarly, with more people participating in sports and physical activities, there is a higher incidence of injuries such as sprains, fractures, and tendonitis, creating a growing need for supportive and rehabilitative devices.Another significant factor contributing to the growth of the foot and ankle devices market is the advancement of minimally invasive surgical techniques. With innovations in orthopedic implants and fixation devices, surgeons can now perform complex procedures with fewer complications and faster recovery times. This has expanded the use of foot and ankle devices in treating fractures, deformities, and joint replacements, making these procedures more accessible to patients and improving overall outcomes. As minimally invasive techniques become more widely adopted, the demand for high-quality, durable implants and supportive devices is expected to rise.

The increased focus on rehabilitation and preventive care is also driving demand for foot and ankle devices. With the growing recognition of the importance of post-surgery rehabilitation, there is a rising demand for orthotic devices, braces, and smart rehabilitation tools that can aid in recovery and prevent future injuries. Wearable technology, in particular, is playing a significant role in this area, offering patients the ability to monitor their progress and receive real-time feedback during their recovery. These innovations are making rehabilitation more personalized and effective, driving further adoption of foot and ankle devices in both clinical and home settings.

Finally, technological advancements in materials and design are expanding the possibilities for foot and ankle devices. New materials, such as lightweight composites and biocompatible metals, are making implants and braces more durable, comfortable, and effective. Additionally, 3D printing technology is allowing for the creation of custom-designed orthotics and prosthetics tailored to the specific needs of each patient. These personalized devices offer better fit, support, and function, leading to improved patient outcomes. As technology continues to advance, the foot and ankle devices market is expected to grow significantly, driven by innovations that enhance mobility, comfort, and recovery.

Report Scope

The report analyzes the Foot and Ankle Devices market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Orthopedic Implants & Devices, Prostheses, Bracing & Support Devices); Application (Trauma, Neurological Disorders, Diabetes, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Orthopedic Implants & Devices segment, which is expected to reach US$4.4 Billion by 2030 with a CAGR of 5.7%. The Prostheses segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 8% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Foot and Ankle Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Foot and Ankle Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Foot and Ankle Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acumed LLC, Arthrex, Inc., Biopro, Inc., Extremity Medical LLC, Integra LifeSciences Holdings Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Foot and Ankle Devices market report include:

- Acumed LLC

- Arthrex, Inc.

- Biopro, Inc.

- Extremity Medical LLC

- Integra LifeSciences Holdings Corporation

- Ossur

- Smith & Nephew PLC

- Stryker Corporation

- Wright Medical Technology, Inc.

- Zimmer Biomet Holdings, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acumed LLC

- Arthrex, Inc.

- Biopro, Inc.

- Extremity Medical LLC

- Integra LifeSciences Holdings Corporation

- Ossur

- Smith & Nephew PLC

- Stryker Corporation

- Wright Medical Technology, Inc.

- Zimmer Biomet Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | February 2026 |

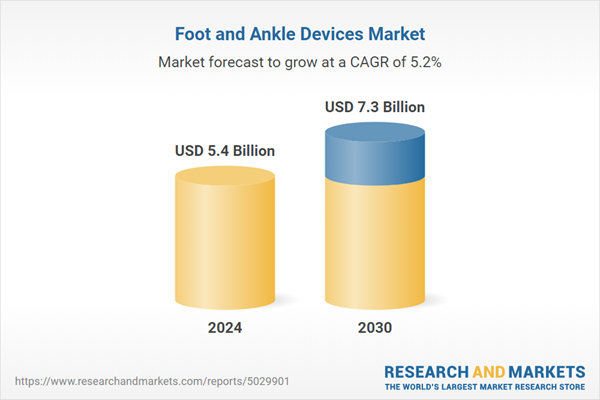

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.4 Billion |

| Forecasted Market Value ( USD | $ 7.3 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |