Global Aircraft Windows and Windshields Market - Key Trends and Drivers Summarized

What Makes Aircraft Windows and Windshields So Critical?

Aircraft windows and windshields are not just essential for providing a view to passengers and pilots but also play a critical role in the structural integrity and safety of the aircraft. These components are designed to withstand extreme pressure differences, temperature fluctuations, and impact from airborne debris. Aircraft windows, typically made of multiple layers of acrylic and polycarbonate materials, ensure durability and clarity while preventing fogging and icing. The windshields, often constructed with multiple layers of glass and vinyl, include heating elements to maintain visibility in adverse weather conditions. These structural necessities underscore the importance of continual advancements in material science and engineering to enhance safety and performance standards in aviation.How Are Innovations Shaping the Future of Aircraft Windows and Windshields?

Innovations in materials and technology are continually transforming aircraft windows and windshields. Recent advancements include the use of stronger and lighter composite materials, which contribute to fuel efficiency by reducing overall aircraft weight. Moreover, the integration of smart technologies, such as electrochromic windows that can adjust their tint electronically, offers enhanced passenger comfort and reduces the need for window shades. Innovations in laminated glass technology have led to improved impact resistance and noise reduction, ensuring a quieter cabin environment. Additionally, developments in embedded sensors and diagnostics within windshields allow for real-time monitoring of structural health, thus enhancing maintenance efficiency and aircraft safety.Why Are Regulations and Safety Standards Evolving?

The aviation industry is highly regulated, and safety standards for aircraft windows and windshields are continuously evolving. Regulatory bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) mandate rigorous testing and certification processes to ensure these components can withstand extreme conditions. This includes bird strike resistance, high-speed debris impact, and resistance to thermal and mechanical stresses. The evolution of these standards is driven by both advancements in technology and lessons learned from past incidents. Compliance with these stringent regulations ensures that manufacturers are constantly innovating and improving their products to meet the highest safety standards, thereby fostering trust and reliability in the aviation industry.What Factors Are Driving Growth in the Aircraft Windows and Windshields Market?

The growth in the aircraft windows and windshields market is driven by several factors. Firstly, the increasing global air traffic and expansion of airline fleets necessitate frequent replacements and upgrades of these components. Secondly, advancements in material technology and manufacturing processes have propelled the development of more durable and lightweight windows and windshields, appealing to airlines seeking to improve fuel efficiency and reduce operational costs. Thirdly, the rising demand for enhanced passenger comfort and safety has led to the adoption of advanced features like electrochromic windows and impact-resistant windshields. Additionally, the trend towards more fuel-efficient aircraft and stringent environmental regulations are pushing manufacturers to innovate with sustainable and recyclable materials. Lastly, the growth of the commercial and private aviation sectors in emerging markets expands the addressable market for these high-performance components, further accelerating demand.Report Scope

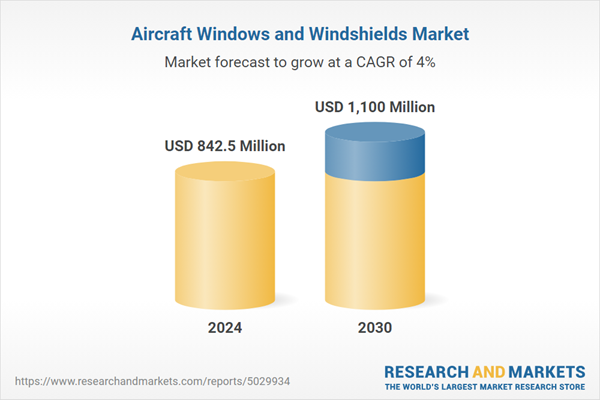

The report analyzes the Aircraft Windows and Windshields market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Acrylic, Polycarbonate, Glass); Product (Cabin Windows, Cockpit Windshields); Aircraft Type (Small Body Aircraft, Wide Body Aircraft, Very Large Body Aircraft, Regional Aircraft); Application (OEM, Aftermarket).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Acrylic Material segment, which is expected to reach US$517.1 Million by 2030 with a CAGR of 4.7%. The Polycarbonate Material segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $221.7 Million in 2024, and China, forecasted to grow at an impressive 6.3% CAGR to reach $227.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aircraft Windows and Windshields Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aircraft Windows and Windshields Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aircraft Windows and Windshields Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aerospace Plastic Components, Air-Craftglass Inc., Control Logistics Inc., Gentex Corporation, GKN PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Aircraft Windows and Windshields market report include:

- Aerospace Plastic Components

- Air-Craftglass Inc.

- Control Logistics Inc.

- Gentex Corporation

- GKN PLC

- Lee Aerospace Inc.

- Llamas Plastics

- LP Aero Plastics, Inc.

- Plexiweiss GmbH

- PPG Industries, Inc.

- Saint-Gobain SA

- Tech-Tool Plastics Inc.

- The Nordam Group, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aerospace Plastic Components

- Air-Craftglass Inc.

- Control Logistics Inc.

- Gentex Corporation

- GKN PLC

- Lee Aerospace Inc.

- Llamas Plastics

- LP Aero Plastics, Inc.

- Plexiweiss GmbH

- PPG Industries, Inc.

- Saint-Gobain SA

- Tech-Tool Plastics Inc.

- The Nordam Group, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 243 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 842.5 Million |

| Forecasted Market Value ( USD | $ 1100 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |