Global Industrial Coatings Market - Key Trends & Drivers Summarized

Why Are Industrial Coatings Becoming Essential for Enhancing Durability and Performance Across Sectors?

Industrial coatings are becoming essential for enhancing durability and performance across various sectors due to their ability to protect surfaces from environmental degradation, improve aesthetics, and extend the lifespan of equipment and structures. These coatings are designed to provide a protective layer that prevents corrosion, abrasion, chemical exposure, and other forms of wear and tear that can compromise the integrity and functionality of industrial assets. Industries such as automotive, aerospace, oil and gas, marine, construction, and manufacturing rely heavily on industrial coatings to safeguard their machinery, infrastructure, and products from harsh conditions. By offering superior protection, industrial coatings reduce maintenance costs, minimize downtime, and enhance overall asset performance, making them critical components in ensuring operational efficiency and safety.Moreover, industrial coatings are used to impart specific functional properties, such as heat resistance, electrical conductivity, or anti-static characteristics, depending on the application. For instance, in the automotive industry, coatings are used to protect vehicle bodies and components from corrosion and UV damage while providing a glossy finish that enhances visual appeal. In the oil and gas sector, coatings are applied to pipelines, storage tanks, and offshore platforms to prevent corrosion caused by exposure to saltwater, chemicals, and extreme temperatures. In manufacturing, anti-stick and non-slip coatings are used to improve the performance and safety of equipment. The versatility and effectiveness of industrial coatings in providing both protective and functional benefits are driving their widespread adoption across diverse industries.

How Are Technological Advancements Transforming the Industrial Coatings Market?

Technological advancements are transforming the industrial coatings market by introducing innovative formulations, advanced application techniques, and environmentally friendly solutions that enhance performance and sustainability. One of the most significant innovations is the development of high-performance coatings that offer improved adhesion, chemical resistance, and longevity. These advanced coatings are formulated using new-generation resins, cross-linkers, and additives that enhance their mechanical properties and make them suitable for use in extreme conditions. For example, coatings based on polyurethanes, fluoropolymers, and polysiloxanes are being used in applications that require high durability, UV stability, and resistance to aggressive chemicals. The use of nanotechnology in coatings is another breakthrough, enabling the creation of nanocoatings that offer superior scratch resistance, anti-fouling properties, and self-cleaning capabilities.Another transformative trend is the shift towards sustainable and eco-friendly coatings that comply with stringent environmental regulations and reduce the impact of volatile organic compounds (VOCs). Traditional solvent-based coatings release VOCs during application and curing, contributing to air pollution and posing health risks to workers. In response, the industry is moving towards water-based coatings, powder coatings, and high-solids coatings that minimize or eliminate VOC emissions. Water-based coatings, for example, use water as the primary solvent, making them safer and more environmentally friendly. Powder coatings, which are applied as dry powders and cured under heat, offer zero VOC emissions and are gaining popularity in automotive, appliance, and architectural applications. The use of bio-based and renewable raw materials in coating formulations is also supporting the development of sustainable coatings that meet the growing demand for greener solutions.

The adoption of advanced application techniques and digital technologies is further revolutionizing the industrial coatings market. Automated and robotic spray systems are being used to apply coatings with greater precision and consistency, reducing material waste and improving quality control. The use of digital tools such as real-time monitoring, AI-driven analytics, and digital twin technology is enabling companies to optimize coating processes, predict performance outcomes, and enhance operational efficiency. Coatings with smart functionalities, such as self-healing, anti-microbial, and anti-icing properties, are being developed to address specific industry challenges. As these technologies continue to evolve, they are making industrial coatings more versatile, reliable, and aligned with the needs of modern industrial applications.

What Role Do Environmental Regulations and Sustainability Initiatives Play in Driving the Adoption of Industrial Coatings?

Environmental regulations and sustainability initiatives are playing a pivotal role in driving the adoption of industrial coatings that are safer for the environment and reduce health risks for workers. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have implemented stringent standards to limit the use of hazardous chemicals and reduce VOC emissions from coatings. These regulations are prompting companies to reformulate their products and adopt greener alternatives that comply with environmental standards. Water-based coatings, low-VOC coatings, and powder coatings are gaining traction as industries seek to reduce their environmental impact and adhere to regulations such as the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) in Europe and the Clean Air Act in the United States.The growing emphasis on sustainability is also driving the development of coatings that support the transition to a circular economy. Manufacturers are exploring the use of renewable raw materials, such as bio-based resins and natural pigments, to reduce the reliance on petrochemicals and minimize carbon footprint. The development of coatings with longer service life and enhanced durability is reducing the frequency of reapplication and the amount of waste generated. Additionally, advancements in coating technology are enabling the development of self-cleaning and anti-corrosion coatings that reduce the need for harsh cleaning chemicals and maintenance, further supporting sustainability goals.

The adoption of sustainable industrial coatings is being supported by various certification programs and eco-labels, such as the Green Seal and the Eco-Label certification in Europe, which recognize products that meet high environmental and performance standards. The use of these eco-labels is helping companies demonstrate their commitment to sustainability and attract environmentally conscious customers. In industries such as construction, where green building certifications like LEED (Leadership in Energy and Environmental Design) are gaining importance, the use of low-VOC and eco-friendly coatings is becoming a key differentiator. As environmental regulations become more stringent and sustainability continues to be a priority for companies and consumers alike, the demand for advanced industrial coatings that meet these requirements is expected to increase significantly.

What Factors Are Driving the Growth of the Global Industrial Coatings Market?

The growth in the global industrial coatings market is driven by several factors, including the expansion of key end-use industries, the rising demand for protective and functional coatings, and the increasing focus on sustainable and high-performance solutions. One of the primary growth drivers is the expanding construction, automotive, and manufacturing sectors, particularly in emerging economies. The growth of these industries is creating a strong demand for coatings used in protecting infrastructure, vehicles, machinery, and equipment from environmental and mechanical damage. In the construction industry, for example, industrial coatings are used to protect steel structures, pipelines, and concrete surfaces from corrosion, weathering, and wear. The increasing investment in infrastructure development and urbanization is further boosting the demand for coatings that enhance the durability and appearance of buildings and facilities.The rising demand for protective and functional coatings is another key factor contributing to market growth. Industries such as oil and gas, marine, and aerospace require coatings that offer superior protection against corrosion, abrasion, and chemical exposure. Anti-corrosion coatings, for instance, are widely used to protect pipelines, offshore platforms, and storage tanks from harsh environmental conditions, extending their service life and reducing maintenance costs. In the automotive industry, coatings are used to protect car bodies and components from rust and impact damage, while also providing aesthetic finishes that enhance the visual appeal of vehicles. The growing focus on improving the performance and longevity of assets is driving the adoption of advanced coatings that offer multi-functional benefits, such as thermal insulation, fire resistance, and anti-static properties.

The increasing focus on sustainable and high-performance solutions is further driving the growth of the industrial coatings market. Companies are investing in research and development (R&D) to create coatings that meet environmental regulations and offer improved performance characteristics. The development of low-VOC, water-based, and bio-based coatings is supporting the shift towards greener solutions that reduce environmental impact without compromising on quality or durability. The use of smart coatings with self-healing, anti-microbial, and anti-fouling properties is gaining traction in applications such as healthcare, food processing, and marine, where hygiene, cleanliness, and safety are critical. These innovative coatings offer long-lasting protection and minimize the need for frequent maintenance, contributing to overall cost savings and operational efficiency.

Moreover, the increasing focus on corrosion protection in infrastructure and industrial equipment is creating new opportunities for the industrial coatings market. Corrosion is a major challenge in industries such as oil and gas, chemicals, and marine, where exposure to moisture, chemicals, and extreme temperatures can cause significant damage to assets. The use of advanced anti-corrosion coatings that provide superior barrier properties and resistance to harsh environments is helping companies extend the lifespan of their assets and reduce maintenance costs. The development of coatings with enhanced adhesion, flexibility, and resistance to cracking is further supporting their use in challenging applications.

Furthermore, the trend towards digitization and smart manufacturing is influencing the industrial coatings market. Digital tools and technologies, such as real-time monitoring, AI-driven analytics, and digital twins, are being used to optimize coating processes, monitor coating performance, and predict maintenance needs. These technologies are enabling companies to achieve higher levels of quality control, reduce material waste, and improve overall process efficiency. The use of digital tools to simulate coating behavior and performance under different conditions is also supporting the development of coatings that are better suited to specific applications. As these factors converge, the global industrial coatings market is poised for robust growth, supported by technological advancements, evolving industry requirements, and the increasing demand for high-performance, sustainable, and multifunctional coating solutions across various sectors.

Report Scope

The report analyzes the Industrial Coatings market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Resin (Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, Vinyl, Fluoropolymer, Other Resins); Technology (Solvent-borne, Water-borne, Powder Coatings, Other Technologies); End-Use (General Industrial, Protective, Automotive Refinish, Automotive OEM, Industrial Wood, Marine, Coil, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Acrylic Resin segment, which is expected to reach US$35.7 Billion by 2030 with a CAGR of 4.3%. The Alkyd Resin segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $29.9 Billion in 2024, and China, forecasted to grow at an impressive 5% CAGR to reach $27.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Coatings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Coatings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Coatings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzo Nobel NV, Axalta Coating Systems LLC, BASF Coatings GmbH, Hempel A/S, Jotun A/S and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Industrial Coatings market report include:

- Akzo Nobel NV

- Axalta Coating Systems LLC

- BASF Coatings GmbH

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International, Inc.

- The Sherwin-Williams Company

- Tikkurila Oyj

- Valspar Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel NV

- Axalta Coating Systems LLC

- BASF Coatings GmbH

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International, Inc.

- The Sherwin-Williams Company

- Tikkurila Oyj

- Valspar Corporation

Table Information

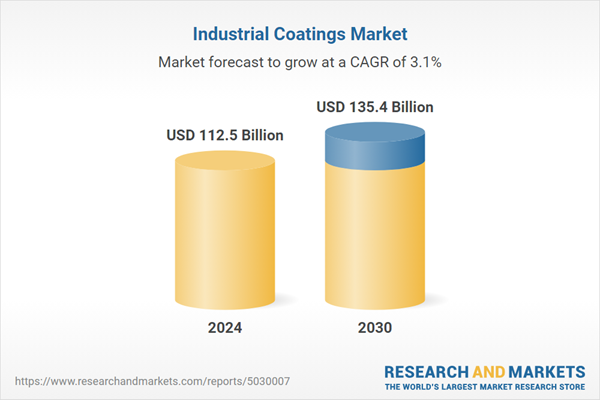

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 112.5 Billion |

| Forecasted Market Value ( USD | $ 135.4 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |