Global High-Strength Concrete Market - Key Trends and Drivers Summarized

Is High-Strength Concrete the Backbone of Modern Infrastructure and Engineering Marvels?

High-strength concrete (HSC) is rapidly becoming a cornerstone of contemporary construction and infrastructure development, but why is this material so critical for modern engineering? High-strength concrete is defined as concrete that has a compressive strength greater than 6,000 psi (pounds per square inch) compared to standard concrete, which typically ranges between 3,000 and 5,000 psi. HSC offers superior performance in terms of load-bearing capacity, durability, and resistance to environmental stressors, making it essential for constructing skyscrapers, bridges, highways, and other large-scale structures where traditional concrete may not meet the structural demands.The appeal of high-strength concrete lies in its ability to provide greater strength, durability, and flexibility in design, which is crucial in modern architecture and civil engineering projects. HSC allows for thinner, taller, and more intricate designs that push the boundaries of what can be achieved in construction while reducing the amount of material required. This leads to cost savings, more sustainable construction practices, and longer-lasting structures. With the global push for more resilient infrastructure in the face of rapid urbanization, climate change, and the need for sustainable building practices, high-strength concrete is playing an increasingly important role in shaping the future of the built environment.

How Has Technology Advanced High-Strength Concrete?

Technological advancements have significantly improved the formulation, performance, and application of high-strength concrete, making it more adaptable to the complex demands of modern construction. One of the key developments has been the use of advanced admixtures, such as superplasticizers and water-reducing agents, which enhance the workability and strength of concrete. Superplasticizers reduce the water content needed in the mix without compromising the concrete's flowability, allowing for higher strength without increasing the density. This improvement has enabled the production of concrete with strengths exceeding 10,000 psi, making it suitable for critical infrastructure projects like high-rise buildings, bridges, and tunnels.The introduction of supplementary cementitious materials (SCMs), such as silica fume, fly ash, and ground granulated blast furnace slag (GGBFS), has also greatly enhanced the properties of high-strength concrete. These materials not only improve the compressive strength of the concrete but also enhance its durability and resistance to chemical attacks, such as those caused by sulfates and chlorides. Silica fume, in particular, reacts with the calcium hydroxide in the concrete mix, forming additional calcium silicate hydrate (C-S-H), which contributes to higher strength and denser concrete. This makes high-strength concrete less porous, reducing the likelihood of water penetration and enhancing its resistance to freeze-thaw cycles, corrosion, and other environmental stressors.

Fiber reinforcement technology has also played a significant role in advancing high-strength concrete. Fibers such as steel, glass, and polypropylene are added to the concrete mix to improve its tensile strength, crack resistance, and overall durability. These fibers help mitigate the risk of microcracking, which can occur under high loads or stress, thus enhancing the long-term performance of the concrete. Fiber-reinforced high-strength concrete is particularly useful in applications that experience dynamic or cyclical loading, such as bridges, pavements, and seismic structures. The addition of fibers allows for greater flexibility in design and performance, reducing the need for traditional steel reinforcement in some cases.

Another breakthrough in high-strength concrete technology is the use of ultra-high-performance concrete (UHPC), which offers compressive strengths that exceed 20,000 psi and enhanced durability. UHPC is typically made with a combination of fine powders, high-performance admixtures, and fiber reinforcement. This type of concrete provides exceptional resistance to wear, abrasion, and chemical attacks, making it ideal for applications in extreme environments, such as offshore platforms, nuclear power plants, and military structures. UHPC also has a self-healing capability, where microcracks can seal themselves through the reaction of unhydrated cement particles, further increasing the lifespan of structures built with this material.

The development of high-performance concrete curing methods has further improved the strength and durability of high-strength concrete. Controlled curing environments, such as steam curing and high-pressure curing, help accelerate the hydration process and achieve higher compressive strengths in a shorter period. Additionally, advancements in concrete mixing and placement technologies, such as the use of computer-controlled batching plants and automated placement equipment, have improved the consistency and quality of high-strength concrete, ensuring that it meets the stringent specifications required for critical infrastructure projects.

Sustainability is another area where high-strength concrete technology has made significant strides. The use of recycled materials, such as crushed concrete, recycled aggregates, and industrial by-products like fly ash, has reduced the environmental impact of concrete production. These innovations contribute to reducing carbon emissions, conserving natural resources, and minimizing waste in the construction industry, making high-strength concrete a more eco-friendly option for large-scale infrastructure projects.

Why Is High-Strength Concrete Critical for Modern Infrastructure and Engineering?

High-strength concrete is critical for modern infrastructure and engineering because it enables the construction of more durable, efficient, and resilient structures that can withstand the increasing demands of contemporary society. In the context of urbanization and population growth, cities are building taller skyscrapers and more complex transportation networks, placing unprecedented demands on structural materials. High-strength concrete provides the necessary strength to support these massive loads while allowing architects and engineers to design thinner, more streamlined structural elements. This makes it possible to create taller buildings with smaller footprints, maximizing land use in densely populated urban areas.In bridge construction, high-strength concrete is essential for building longer spans and more slender support structures without compromising safety or performance. The higher load-bearing capacity of high-strength concrete allows engineers to design bridges that can handle heavier traffic loads while using less material, resulting in lower construction costs and reduced environmental impact. Moreover, the durability of high-strength concrete ensures that bridges can withstand environmental stressors, such as saltwater exposure, freeze-thaw cycles, and seismic activity, with minimal maintenance over their service life. The use of high-strength concrete in iconic bridge projects, such as cable-stayed and suspension bridges, has enabled the construction of record-breaking spans that push the limits of engineering.

High-strength concrete also plays a vital role in the construction of infrastructure that must endure extreme environmental conditions, such as nuclear power plants, dams, and offshore oil platforms. In these high-stakes environments, materials must withstand extreme temperatures, high pressures, and aggressive chemical attacks without degrading. The superior compressive strength and low permeability of high-strength concrete make it ideal for these applications, where safety and long-term performance are critical. For example, in the construction of nuclear containment structures, high-strength concrete provides the necessary barrier to prevent radiation leakage, ensuring the safety of surrounding communities and ecosystems.

In the transportation sector, high-strength concrete is used in the construction of highways, tunnels, and airport runways, where heavy traffic loads and dynamic forces demand materials with exceptional strength and durability. High-strength concrete ensures that these structures can resist cracking, wear, and deformation under constant use, reducing the need for frequent repairs and maintenance. This not only extends the lifespan of critical transportation infrastructure but also minimizes disruptions to travel and commerce, which are essential for economic growth and development. The use of high-strength concrete in pavements and runways has also been shown to improve resistance to fatigue and rutting, making it an ideal material for areas subjected to heavy vehicular or aircraft loads.

In seismic-prone regions, high-strength concrete is increasingly being used in earthquake-resistant structures. The enhanced tensile strength, ductility, and crack resistance of fiber-reinforced high-strength concrete allow buildings and bridges to better withstand seismic forces. In addition, high-strength concrete's superior bonding with steel reinforcement improves the structural integrity of reinforced concrete elements, reducing the likelihood of catastrophic failure during an earthquake. As seismic design codes evolve to address the growing risks of earthquakes in densely populated regions, the use of high-strength concrete is becoming a critical component of earthquake-resistant construction.

High-strength concrete is also essential for sustainable construction practices. Its increased durability means that structures built with high-strength concrete require less maintenance and have longer lifespans, reducing the need for repair and replacement. This results in lower life-cycle costs and fewer material and energy resources being consumed over time. Additionally, high-strength concrete allows for more efficient use of materials, as thinner structural elements can achieve the same performance as thicker elements made from standard concrete. This reduces the amount of raw materials needed, lowering the environmental footprint of construction projects.

What Factors Are Driving the Growth of the High-Strength Concrete Market?

The growth of the high-strength concrete market is driven by several key factors, including the increasing demand for high-performance construction materials, advancements in concrete technology, the push for sustainable building practices, and the need for more resilient infrastructure in the face of urbanization and climate change. One of the primary drivers is the global demand for durable and cost-effective building materials that can support the construction of modern infrastructure. As cities grow and develop more complex transportation systems, skyscrapers, and bridges, the need for stronger, more efficient construction materials like high-strength concrete is increasing.Advancements in concrete technology, particularly in the development of admixtures and supplementary cementitious materials, have further contributed to the growth of the high-strength concrete market. The use of advanced additives, fibers, and SCMs has improved the workability, strength, and durability of concrete, making high-strength concrete more accessible for a wide range of applications. These technological advancements have expanded the use of high-strength concrete beyond traditional large-scale infrastructure projects to include commercial buildings, industrial facilities, and even residential construction, driving market growth across various sectors.

Sustainability is another major factor driving the adoption of high-strength concrete. As the construction industry faces increasing pressure to reduce its carbon footprint and conserve natural resources, high-strength concrete offers a more sustainable option for builders and developers. Its ability to reduce material use, extend the lifespan of structures, and incorporate recycled or industrial by-products into its mix makes high-strength concrete an attractive choice for green building projects. Governments and regulatory bodies worldwide are promoting the use of sustainable construction materials through incentives, certifications, and building codes, further driving demand for high-strength concrete in eco-friendly projects.

Urbanization and the need for resilient infrastructure in disaster-prone areas are also fueling the demand for high-strength concrete. With more people living in cities and regions vulnerable to earthquakes, hurricanes, and other natural disasters, there is a growing need for buildings and infrastructure that can withstand extreme conditions. High-strength concrete's superior load-bearing capacity, durability, and crack resistance make it ideal for constructing resilient infrastructure that can better resist environmental stressors, reducing the risk of damage and improving the safety of urban populations.

The growing investment in megaprojects, particularly in developing regions, is another key factor driving the market for high-strength concrete. Countries in Asia, the Middle East, and Latin America are investing heavily in large-scale infrastructure projects, such as high-speed rail networks, bridges, dams, and airports, to support economic growth and urbanization. These projects require materials that can deliver high performance under demanding conditions, making high-strength concrete a critical component in their construction. Additionally, the need for durable, long-lasting materials in these projects aligns with the increasing focus on reducing maintenance costs and ensuring long-term sustainability.

The increasing use of precast concrete elements in construction is also contributing to the growth of the high-strength concrete market. Precast elements, such as beams, columns, and slabs, are often made from high-strength concrete due to its superior performance and ease of handling. The use of precast high-strength concrete allows for faster construction times, reduced labor costs, and improved quality control in large-scale projects. As more construction companies adopt prefabrication techniques to improve efficiency and meet project timelines, the demand for high-strength concrete in precast applications is expected to rise.

With advancements in concrete technology, the growing demand for resilient and sustainable infrastructure, and the increasing need for high-performance materials in large-scale construction, the high-strength concrete market is poised for significant growth. As cities continue to expand, and the need for durable, efficient, and environmentally friendly construction materials rises, high-strength concrete will remain a key player in shaping the future of infrastructure and the built environment.

Report Scope

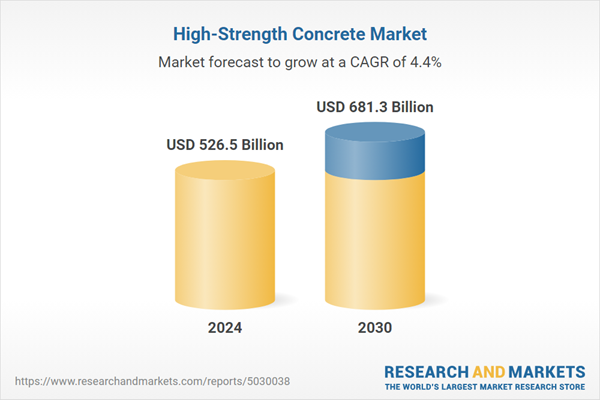

The report analyzes the High-Strength Concrete market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (On-Site, Precast Concrete, Ready-Mix / Pre-Mix Concrete); End-Use (Residential, Commercial, Industrial, Infrastructure).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the On-Site Concrete segment, which is expected to reach US$468 Billion by 2030 with a CAGR of 4.6%. The Precast Concrete segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $145.6 Billion in 2024, and China, forecasted to grow at an impressive 3.6% CAGR to reach $102 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High-Strength Concrete Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High-Strength Concrete Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High-Strength Concrete Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACC Ltd., AfriSam (South Africa) Proprietary Limited, BASF SE, Cemex S.A.B. de C.V., Clayton Block Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this High-Strength Concrete market report include:

- ACC Ltd.

- AfriSam (South Africa) Proprietary Limited

- BASF SE

- Cemex S.A.B. de C.V.

- Clayton Block Co.

- Lafarge S.A.

- Sakrete of North America LLC

- Sika AG

- Tarmac (CRH)

- The QUIKRETE Companies

- U.S. Concrete, Inc.

- UltraTech Cement Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACC Ltd.

- AfriSam (South Africa) Proprietary Limited

- BASF SE

- Cemex S.A.B. de C.V.

- Clayton Block Co.

- Lafarge S.A.

- Sakrete of North America LLC

- Sika AG

- Tarmac (CRH)

- The QUIKRETE Companies

- U.S. Concrete, Inc.

- UltraTech Cement Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 294 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 526.5 Billion |

| Forecasted Market Value ( USD | $ 681.3 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |