Global High-Pressure Oil and Gas Separator Market - Key Trends and Drivers Summarized

Are High-Pressure Oil and Gas Separators Pivotal to Maximizing Efficiency and Safety in Hydrocarbon Processing?

High-pressure oil and gas separators are fundamental components in the hydrocarbon processing industry, but why are these separators so essential in oil and gas extraction and production? High-pressure separators are used to split a well stream into its primary components - oil, gas, and water - under high-pressure conditions. They are critical in both upstream and midstream operations, where they manage the separation process by taking the mixture of hydrocarbons and water from the well and dividing it into distinct streams that can be processed, stored, or transported. These separators play a crucial role in ensuring the efficient production of oil and gas, removing impurities, and optimizing the quality of the extracted hydrocarbons.The appeal of high-pressure separators lies in their ability to manage complex well streams, especially in high-pressure reservoirs, deepwater fields, or unconventional resources like shale. By efficiently separating oil, gas, and water, these systems prevent equipment from being overloaded or damaged, reduce the risk of corrosion in pipelines, and ensure that only the desired products are transported or processed. As the global energy demand continues to rise and oil and gas production environments become more complex, high-pressure separators are becoming indispensable for maintaining operational efficiency, safety, and environmental compliance in the oil and gas industry.

How Has Technology Advanced High-Pressure Oil and Gas Separators?

Technological advancements have significantly improved the design, functionality, and efficiency of high-pressure oil and gas separators, making them more adaptable to modern extraction and production challenges. One of the most critical advancements is the development of more sophisticated internal designs, such as inlet diverters, mist extractors, and coalescing plates, which enhance the separation process. These innovations allow high-pressure separators to handle a broader range of well stream compositions and higher pressures, improving their ability to separate oil, gas, and water with greater precision. The use of multi-cyclone systems and enhanced mist extractors has also helped reduce the carryover of liquid in the gas phase and improve overall separation efficiency.In addition, the adoption of advanced materials in separator construction has led to improved durability and performance in extreme environments. High-pressure separators used in deepwater or high-temperature wells must withstand significant stress and harsh operating conditions, such as exposure to corrosive substances and extreme pressures. Materials such as high-strength stainless steel alloys, duplex stainless steel, and corrosion-resistant composites are now widely used to extend the lifespan of separators and ensure that they can operate safely in demanding environments. These materials also reduce the need for frequent maintenance, lowering operational costs and minimizing downtime.

Automation and digitalization have also played a key role in advancing high-pressure separators. Modern separators are now equipped with sophisticated sensors and control systems that monitor pressure, temperature, flow rates, and fluid composition in real time. These sensors provide operators with critical data that can be used to optimize the separation process and ensure safe operation. Automated control systems can adjust separator settings dynamically to account for changes in the well stream composition or pressure, improving overall efficiency and safety. The integration of Industrial Internet of Things (IIoT) technologies has further enhanced remote monitoring and control, enabling operators to manage separators from centralized locations and respond quickly to any anomalies.

Computational fluid dynamics (CFD) has also become an essential tool in the design and optimization of high-pressure separators. CFD modeling allows engineers to simulate fluid behavior within the separator, enabling them to optimize the design of internal components and improve separation performance. By analyzing the flow patterns and phase distribution within the separator, CFD helps identify potential bottlenecks or inefficiencies in the separation process, allowing manufacturers to refine their designs for better performance. This has led to the development of separators that are more efficient, compact, and capable of handling higher throughput without sacrificing separation quality.

Furthermore, the development of three-phase separators, which can separate oil, gas, and water in a single unit, has significantly improved the versatility and efficiency of high-pressure separators. Traditional separators often required multiple stages of separation to achieve the desired product streams, but modern three-phase separators allow for more compact, efficient designs that can handle complex well streams in a single pass. These separators are particularly valuable in offshore platforms and other space-constrained environments, where minimizing equipment size and weight is crucial. The ability to separate oil, gas, and water simultaneously not only improves operational efficiency but also reduces capital and operating costs by eliminating the need for multiple separation units.

Why Are High-Pressure Oil and Gas Separators Critical for Hydrocarbon Processing and Production?

High-pressure oil and gas separators are critical for hydrocarbon processing and production because they ensure the efficient separation of well streams into their component phases - oil, gas, and water - while managing the high pressures encountered during extraction. In the oil and gas industry, efficient separation is essential for maintaining production quality, minimizing environmental impact, and ensuring the safety of downstream equipment. Without effective separation, gas carryover into oil streams, water contamination, or hydrocarbon loss can occur, leading to operational inefficiencies, potential hazards, and significant economic losses.In upstream production, high-pressure separators play a vital role in reducing the complexity of well streams before they are sent for further processing. The separation of gas from liquids, and the removal of water from hydrocarbons, is crucial for ensuring that downstream processing facilities, such as gas plants and refineries, can operate effectively. Gas that is not properly separated can cause problems in pipelines and processing facilities by increasing the risk of hydrate formation or corrosion. Similarly, water that is not efficiently removed from oil can lead to issues such as scaling, pipeline corrosion, and decreased product quality. High-pressure separators prevent these issues by ensuring that each phase - oil, gas, and water - is separated and treated appropriately.

In high-pressure reservoirs and deepwater fields, where wellhead pressures can exceed 10,000 psi, the role of high-pressure separators becomes even more critical. These environments present unique challenges due to the extreme pressures, temperatures, and the complex composition of well streams, which often include emulsified oil and water, sand, and natural gas. High-pressure separators are designed to handle these conditions, providing reliable separation under extreme operating parameters. In deepwater offshore operations, the ability to efficiently separate hydrocarbons and water is vital for ensuring the safety and reliability of production operations, where equipment failure can lead to costly downtime, environmental spills, and safety hazards.

High-pressure oil and gas separators are also essential in optimizing oil recovery and enhancing production efficiency. By separating and treating gas and water on-site, separators help operators reinject gas into reservoirs to maintain reservoir pressure and improve oil recovery rates. In gas-dominated wells, separators allow for the recovery of valuable natural gas, which can be processed and sold or used for reinjection, enhancing overall field economics. Water separated from the well stream can be treated and reinjected into the reservoir for pressure maintenance or safely disposed of, further reducing environmental impact and improving production sustainability.

In the midstream and downstream sectors, high-pressure separators ensure that gas is separated from oil before transportation or refining. This reduces the risk of pressure surges or line blockages in pipelines, improving the safety and efficiency of oil and gas transport. In refining operations, high-pressure separators ensure that crude oil enters the refining process with minimal gas and water content, reducing the risk of equipment damage, corrosion, and operational downtime. Additionally, by ensuring that gas is separated and processed for sale or reinjection, high-pressure separators maximize the profitability of oil and gas operations.

The environmental benefits of high-pressure separators are also significant. By removing water from hydrocarbons and ensuring efficient gas separation, these systems reduce the risk of hydrocarbon emissions, oil spills, and contamination of water bodies. Modern high-pressure separators are designed to meet stringent environmental regulations, ensuring that produced water is treated and disposed of responsibly and that emissions from gas flaring or venting are minimized. In an industry that faces increasing pressure to reduce its environmental footprint, high-pressure separators are a critical tool for minimizing emissions, improving sustainability, and ensuring regulatory compliance.

What Factors Are Driving the Growth of the High-Pressure Oil and Gas Separator Market?

The growth of the high-pressure oil and gas separator market is driven by several key factors, including increasing global energy demand, advancements in oil and gas exploration and production technologies, stricter environmental regulations, and the expansion of deepwater and unconventional resource development. One of the primary drivers is the growing need for efficient oil and gas production as global energy consumption continues to rise. As companies seek to maximize hydrocarbon recovery while minimizing operational costs, high-pressure separators play a crucial role in improving the efficiency of production operations, ensuring that oil, gas, and water are properly separated and processed for transport, storage, or sale.The expansion of deepwater and ultra-deepwater drilling projects is also a significant driver of demand for high-pressure separators. As energy companies increasingly explore high-pressure reservoirs in offshore environments, the need for reliable separation equipment that can handle extreme pressures and complex well streams is critical. High-pressure separators are essential for managing the unique challenges of deepwater production, where space and weight constraints on offshore platforms necessitate highly efficient, compact separation systems. The increasing number of deepwater oil and gas projects, particularly in regions like the Gulf of Mexico, Brazil, and West Africa, is expected to drive further demand for high-pressure separators in the coming years.

Advancements in hydraulic fracturing and horizontal drilling technologies have led to increased production from unconventional resources, such as shale oil and gas, which has further driven the need for high-pressure separators. Unconventional reservoirs often produce complex well streams that contain high levels of gas, water, and solids, requiring efficient separation technologies to ensure that hydrocarbons can be processed and transported effectively. High-pressure separators are widely used in shale fields to manage the separation of gas, oil, and water at high pressures, improving production efficiency and reducing operational risks. As unconventional resource development continues to expand, particularly in regions like the U.S. Permian Basin, demand for high-pressure separators is expected to increase.

Stricter environmental regulations aimed at reducing emissions, water contamination, and hydrocarbon releases are also driving the adoption of high-pressure separators. Governments and regulatory bodies worldwide are implementing stricter rules to ensure that oil and gas operations minimize their environmental impact. High-pressure separators, which prevent the venting or flaring of gas and ensure proper treatment of produced water, help companies comply with these regulations. As environmental concerns grow and regulatory pressures increase, high-pressure separators are becoming essential for companies seeking to improve sustainability and reduce the environmental impact of their operations.

Technological advancements in separation technologies are also contributing to the growth of the high-pressure separator market. Improvements in internal designs, such as multi-cyclone systems and enhanced mist extractors, have made separators more efficient at handling complex well streams, reducing gas and liquid carryover and improving overall separation performance. The integration of digital monitoring systems, automation, and IIoT technologies has further enhanced the reliability and efficiency of high-pressure separators, enabling operators to monitor and control the separation process in real time. These innovations have made high-pressure separators more adaptable to the changing needs of modern oil and gas production, driving their adoption across a wide range of applications.

Finally, the trend toward increasing use of natural gas as a cleaner alternative to oil and coal is contributing to the demand for high-pressure separators. As natural gas production grows, driven by the global shift toward cleaner energy sources, the need for efficient separation systems to manage high-pressure gas streams is increasing. High-pressure separators play a critical role in separating gas from liquids and contaminants, ensuring that natural gas is processed and delivered efficiently. The continued expansion of natural gas production and infrastructure, including liquefied natural gas (LNG) projects, is expected to drive further demand for high-pressure separators.

With growing global energy demand, expanding exploration and production in high-pressure environments, advancements in separation technologies, and increasing environmental regulations, the high-pressure oil and gas separator market is poised for significant growth. As industries continue to push for greater efficiency, safety, and sustainability in hydrocarbon processing, high-pressure separators will remain a critical component in ensuring the safe and effective operation of oil and gas production facilities.

Report Scope

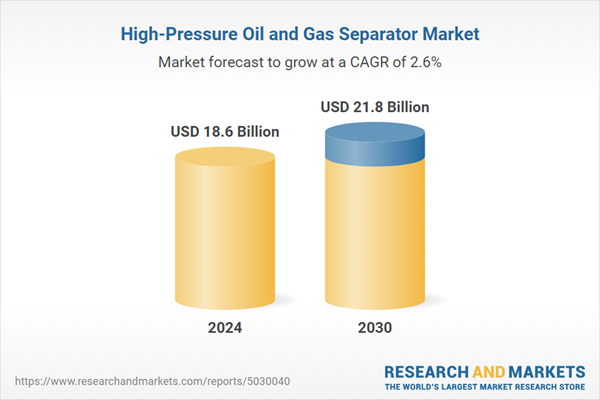

The report analyzes the High-Pressure Oil and Gas Separator market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Vessel Type (Horizontal, Vertical, Spherical); Application (On-Shore, Off-Shore).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the On-Shore Application segment, which is expected to reach US$13.6 Billion by 2030 with a CAGR of 2.5%. The Off-Shore Application segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5 Billion in 2024, and China, forecasted to grow at an impressive 3.7% CAGR to reach $4.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High-Pressure Oil and Gas Separator Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High-Pressure Oil and Gas Separator Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High-Pressure Oil and Gas Separator Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACS Manufacturing, Inc., Alfa Laval AB, AMACS Process Tower Internals, Cameron, CECO Environmental Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 23 companies featured in this High-Pressure Oil and Gas Separator market report include:

- ACS Manufacturing, Inc.

- Alfa Laval AB

- AMACS Process Tower Internals

- Cameron

- CECO Environmental Corporation

- China Oil HBP Group

- eProcess Technologies Pty., Ltd.

- Exterran Corporation

- Frames Energy Systems B.V.

- Grand Prix Engineering

- Halliburton

- HAT International Ltd.

- Hydrasep, Inc.

- KIRK Process Solutions Ltd.

- Kubco Services, LLC

- KW International, Inc.

- Metano Impianti S.r.l.

- Oil Water Separator Technologies

- Schlumberger Limited (M-I SWACO)

- Separator Spares & Equipment, LLC

- Sepco Process, Inc.

- Sopan O&M Co Pvt. Ltd.

- Southwest Milling and Industrial Company

- Stanley Filter Co.

- Sulzer Ltd.

- TechnipFMC plc

- Zeta-pdm Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACS Manufacturing, Inc.

- Alfa Laval AB

- AMACS Process Tower Internals

- Cameron

- CECO Environmental Corporation

- China Oil HBP Group

- eProcess Technologies Pty., Ltd.

- Exterran Corporation

- Frames Energy Systems B.V.

- Grand Prix Engineering

- Halliburton

- HAT International Ltd.

- Hydrasep, Inc.

- KIRK Process Solutions Ltd.

- Kubco Services, LLC

- KW International, Inc.

- Metano Impianti S.r.l.

- Oil Water Separator Technologies

- Schlumberger Limited (M-I SWACO)

- Separator Spares & Equipment, LLC

- Sepco Process, Inc.

- Sopan O&M Co Pvt. Ltd.

- Southwest Milling and Industrial Company

- Stanley Filter Co.

- Sulzer Ltd.

- TechnipFMC plc

- Zeta-pdm Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 283 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.6 Billion |

| Forecasted Market Value ( USD | $ 21.8 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |