Global Hexamethylenediamine Market - Key Trends and Drivers Summarized

Is Hexamethylenediamine the Backbone of High-Performance Polymers?

Hexamethylenediamine (HMDA) is a vital chemical compound that serves as the backbone for a wide range of high-performance polymers, but why is it so essential? HMDA is a colorless, crystalline substance that plays a critical role in the production of nylon, particularly nylon 6,6, one of the most commonly used engineering plastics. It acts as a building block for these materials by reacting with adipic acid to form nylon 6,6, which is known for its exceptional strength, durability, and resistance to heat and chemicals. This makes it invaluable in a variety of industries, including automotive, textiles, electronics, and consumer goods.HMDA's unique chemical structure, with two amine groups, makes it ideal for polyamide synthesis, providing the toughness and elasticity needed for high-performance applications. Nylon 6,6, derived from HMDA, is commonly used in products like automotive components, electrical connectors, industrial machinery, and fibers for textiles such as carpets and clothing. The ability to produce strong, lightweight, and resistant materials has made HMDA a cornerstone in the manufacturing of advanced polymers. As the demand for durable and lightweight materials continues to grow in industries like automotive and aerospace, hexamethylenediamine is increasingly critical to meeting these needs.

How Has Technology Advanced the Production and Applications of Hexamethylenediamine?

Technological advancements have greatly improved the production of hexamethylenediamine (HMDA), enhancing its efficiency and expanding its applications in new fields. One of the most significant innovations in HMDA production is the development of more sustainable and cost-effective manufacturing processes. Traditional HMDA production involves reacting hexanenitrile with hydrogen in the presence of a catalyst. However, new methods are emerging that aim to reduce energy consumption and waste. Catalysts that improve yield, reduce by-products, and enhance reaction efficiency have been introduced, lowering the overall environmental impact of HMDA production. These advancements are particularly important as industries strive to meet sustainability goals while maintaining high levels of production.Another key advancement is the increasing integration of bio-based processes in HMDA production. Research into using bio-based feedstocks, such as renewable plant materials, to produce hexamethylenediamine is gaining traction. This shift toward bio-based HMDA production is part of a broader effort to reduce dependence on fossil fuels and create more sustainable supply chains. As demand for environmentally friendly products grows, bio-based HMDA is becoming an attractive alternative for manufacturers looking to reduce their carbon footprint while still producing high-quality polymers.

Technological improvements in polymer engineering have also expanded the applications of HMDA. Beyond its traditional use in nylon 6,6 production, HMDA is now finding applications in other advanced polyamides and specialty polymers that offer superior performance characteristics. These materials are being used in high-tech sectors such as aerospace, electronics, and medical devices, where strength, heat resistance, and chemical durability are paramount. The ability to tailor HMDA-derived polymers to specific needs through molecular engineering has opened new possibilities for innovation in these fields. These advancements ensure that HMDA remains a key player in the development of materials that meet the stringent demands of modern technology.

Why Is Hexamethylenediamine Critical for High-Performance Polymers and Industrial Applications?

Hexamethylenediamine (HMDA) is essential for high-performance polymers and industrial applications because of its unique ability to impart strength, flexibility, and resistance to the materials it helps create. One of its most important roles is in the production of nylon 6,6, a polymer that is renowned for its excellent mechanical properties, including high tensile strength, abrasion resistance, and thermal stability. These attributes make nylon 6,6 an ideal material for a wide variety of demanding applications. For example, in the automotive industry, it is used to produce lightweight, durable components such as radiator parts, air intake manifolds, and fuel lines. The reduced weight of nylon-based parts helps improve fuel efficiency, which is increasingly important as automakers seek to meet environmental standards.In industrial applications, HMDA-derived polymers are crucial in the production of high-performance fibers and textiles, such as those used in carpets, clothing, and industrial fabrics. Nylon 6,6 fibers offer superior wear resistance and resilience, making them popular in heavy-duty environments such as construction and manufacturing. HMDA also contributes to the development of industrial machinery components that need to withstand extreme temperatures, mechanical stress, and exposure to chemicals, further demonstrating the versatility and importance of this compound.

Additionally, HMDA's role extends beyond nylon. It is also used to produce adhesives, coatings, and other specialty polymers that require strong bonding and protective properties. In coatings, for instance, HMDA-derived products are used to provide corrosion resistance in harsh environments, such as those faced in the oil and gas industry. Its ability to form durable bonds and resist chemical degradation makes it essential in environments where failure of materials can lead to significant safety and operational issues. The combination of strength, durability, and chemical resistance that HMDA imparts to polymers is crucial for creating materials that can perform reliably under the most challenging conditions.

What Factors Are Driving the Growth of the Hexamethylenediamine Market?

The growth of the hexamethylenediamine (HMDA) market is driven by several key factors, including the rising demand for lightweight and durable materials in the automotive and aerospace industries, advancements in polymer technology, and the increasing focus on sustainability. One of the primary drivers is the growing use of nylon 6,6 and other HMDA-derived materials in automotive manufacturing. As the automotive industry shifts toward producing more fuel-efficient and environmentally friendly vehicles, manufacturers are increasingly using lightweight materials to reduce vehicle weight and improve fuel economy. Nylon 6,6, with its high strength-to-weight ratio, is playing a key role in replacing traditional metal components, which contributes to improved vehicle performance and reduced emissions.The aerospace industry is another major factor contributing to the growth of the HMDA market. Aerospace manufacturers rely on lightweight, high-strength materials to improve the efficiency and performance of aircraft. HMDA-based polymers, such as nylon 6,6 and other advanced polyamides, are used in various aerospace applications, including interior components, structural elements, and insulation materials. These polymers help reduce aircraft weight, leading to lower fuel consumption and increased flight efficiency. As the aerospace industry continues to grow and prioritize sustainability, the demand for high-performance materials like HMDA-derived polymers is expected to increase significantly.

Advancements in polymer technology are also driving market growth by expanding the range of applications for HMDA-derived materials. New polymer formulations and composite materials are being developed to meet the specific needs of industries like electronics, medical devices, and renewable energy. For example, in the electronics sector, HMDA-based polymers are used in the production of connectors, housings, and insulation materials that require both electrical resistance and mechanical durability. The development of these specialized materials is fueling demand for HMDA as companies seek to create more advanced and reliable products for increasingly sophisticated applications.

Sustainability is another important factor driving the HMDA market. With growing concerns about the environmental impact of traditional petrochemical-based products, there is increasing interest in developing bio-based HMDA and reducing the carbon footprint of polymer production. Companies are investing in research to develop renewable feedstocks for HMDA production, which could significantly reduce the reliance on fossil fuels. As consumer demand for environmentally friendly products rises and regulations surrounding sustainability become more stringent, bio-based HMDA could see significant growth in the coming years.

Lastly, the expanding use of HMDA in developing regions, particularly in Asia-Pacific, is contributing to market growth. The rapid industrialization and urbanization in countries like China and India are driving demand for high-performance materials in construction, automotive, and manufacturing sectors. As these economies continue to develop and modernize, the need for durable, lightweight, and high-strength materials is expected to increase, further boosting the demand for hexamethylenediamine. With its broad range of applications and the ongoing advancements in production technology, the HMDA market is poised for steady growth, making it a critical material in the future of polymer and industrial manufacturing.

Report Scope

The report analyzes the Hexamethylenediamine market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Nylon Synthesis, Curing Agents, Lubricants, Biocides, Other Applications); End-Use (Automotive, Textiles, Paints & Coatings, Petrochemicals, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Nylon Synthesis Application segment, which is expected to reach US$11.7 Billion by 2030 with a CAGR of 5.8%. The Curing Agents Application segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.7 Billion in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $3.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hexamethylenediamine Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hexamethylenediamine Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hexamethylenediamine Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Aesar, Asahi Kasei Corporation, Ascend Performance Materials LLC, Ashland Global Holdings, Inc., BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 17 companies featured in this Hexamethylenediamine market report include:

- Alfa Aesar

- Asahi Kasei Corporation

- Ascend Performance Materials LLC

- Ashland Global Holdings, Inc.

- BASF SE

- Chengdu Dacheng Chemical Co., Ltd.

- Compass Chemical International LLC

- Daejungche Chemicals & Metals Co., Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Genomatica, Inc.

- INVISTA

- Junsei Chemical Co., Ltd.

- Lanxess AG

- Merck KgaA

- Meryer (Shanghai) Chemical Technology Co., Ltd.

- Radici Partecipazioni SpA

- Rennovia Inc.

- Shenma Industrial Co., Ltd.

- Sinopharm Chemical Reagent Co., Ltd.

- Solvay SA

- Suzhou Sibian Chemicals Co., Ltd.

- Toray Industries Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Aesar

- Asahi Kasei Corporation

- Ascend Performance Materials LLC

- Ashland Global Holdings, Inc.

- BASF SE

- Chengdu Dacheng Chemical Co., Ltd.

- Compass Chemical International LLC

- Daejungche Chemicals & Metals Co., Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Genomatica, Inc.

- INVISTA

- Junsei Chemical Co., Ltd.

- Lanxess AG

- Merck KgaA

- Meryer (Shanghai) Chemical Technology Co., Ltd.

- Radici Partecipazioni SpA

- Rennovia Inc.

- Shenma Industrial Co., Ltd.

- Sinopharm Chemical Reagent Co., Ltd.

- Solvay SA

- Suzhou Sibian Chemicals Co., Ltd.

- Toray Industries Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

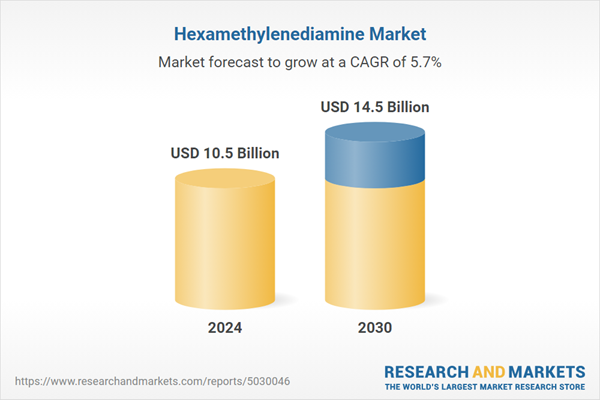

| Estimated Market Value ( USD | $ 10.5 Billion |

| Forecasted Market Value ( USD | $ 14.5 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |