Global Container Fleet Market - Key Trends and Drivers Summarized

How Is the Global Supply Chain Weathering the Storm? The Vital Role of Container Fleets

The global economy relies heavily on the efficiency and effectiveness of container fleets, which are integral to international trade. Container fleets consist of ships specifically designed to carry standardized cargo containers, enabling goods to be transported across the world with unprecedented speed and efficiency. These fleets form the backbone of global supply chains, moving everything from perishable food items to electronics and apparel across oceans. The system's efficiency has been honed over decades, with innovations in ship design, container handling, and logistic management systems enhancing throughput and reducing costs. Furthermore, the rise of global commerce has led to the proliferation of mega-ships, which can carry thousands of containers, leveraging economies of scale to further drive down shipping costs per unit, thereby making products cheaper for consumers worldwide.What Innovations Are Shaping the Future of Container Shipping?

As the demand for global trade grows, so does the need for innovation in the container fleet industry. In recent years, technological advancements have been pivotal, with the integration of automation and data analytics transforming operations. Automated ports and robotic cranes allow for faster loading and unloading times, minimizing human error and optimizing operational efficiency. GPS and IoT technology provide real-time tracking of ships and containers, enhancing route planning and inventory management. Additionally, the push towards sustainability has led to the development of greener shipping practices, such as using cleaner fuels, improving the aerodynamic design of ships to reduce fuel consumption, and applying advanced water treatment systems. These innovations not only contribute to cost efficiency but are also crucial for the industry's compliance with international environmental regulations.How Are Economic and Political Factors Influencing Container Fleet Operations?

Container fleet operations are significantly influenced by global economic and political factors. Trade policies, tariffs, and international relations can either facilitate or hinder the flow of goods across borders. For instance, trade wars can lead to increased tariffs, which affect shipping routes and volumes, prompting companies to adjust their operational strategies. Economic downturns or booms also impact container shipping, as they directly affect demand for consumer goods and, consequently, shipping services. Additionally, regional conflicts or geopolitical tensions can necessitate rerouting of fleets, adding to operational costs and affecting delivery times. The container fleet industry must remain agile, ready to adapt to the dynamic global landscape to maintain supply chain continuity and efficiency.What Drives the Growth in the Container Fleet Market?

The growth in the container fleet market is driven by several factors, including increasing global consumer demand, advancements in shipping technology, and strategic industry alliances. As emerging markets grow, their expanding middle classes demand more diverse products, which in turn fuels international trade and necessitates a larger, more efficient fleet. Technological advancements that enhance ship capacity and fuel efficiency make it possible to meet this demand in a cost-effective manner. Additionally, shipping companies are forming alliances and sharing vessels to maximize their operational capacity and geographic reach, reducing overall transportation costs and improving service delivery. Furthermore, the modernization of trade agreements and easing of trade barriers have facilitated smoother and faster international trade. These factors collectively contribute to the robust growth of the container fleet market, reinforcing its critical role in powering the global economy.Report Scope

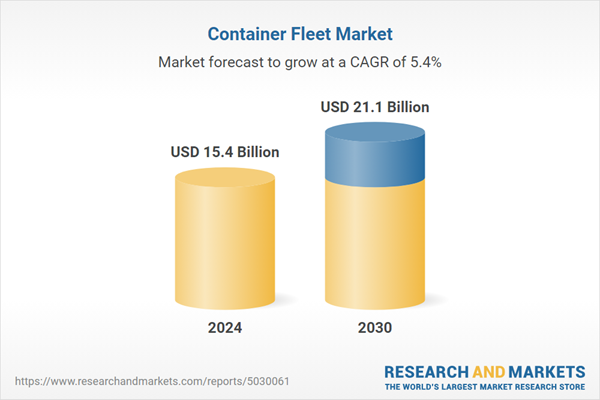

The report analyzes the Container Fleet market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Dry Container Fleet, Reefer Container Fleet, Tank Container Fleet); End-Use (Automotive, Mining & Minerals, Oil & Gas, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dry Container Fleet segment, which is expected to reach US$13.9 Billion by 2030 with a CAGR of 5.1%. The Reefer Container Fleet segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $4.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Container Fleet Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Container Fleet Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Container Fleet Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A.P. Moller - Maersk A/S, China Ocean Shipping (Group) Company (COSCO), Cma Cgm S.A, Evergreen Marine Corp. (Taiwan) Ltd., Hapag-Lloyd AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Container Fleet market report include:

- A.P. Moller - Maersk A/S

- China Ocean Shipping (Group) Company (COSCO)

- Cma Cgm S.A

- Evergreen Marine Corp. (Taiwan) Ltd.

- Hapag-Lloyd AG

- HYUNDAI Merchant Marine Co., Ltd.

- Kawasaki Kisen Kaisha, Ltd.

- Mitsui O.S.K. Lines, Ltd.

- MSC - Mediterranean Shipping Agency AG

- Westfal-Larsen group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A.P. Moller - Maersk A/S

- China Ocean Shipping (Group) Company (COSCO)

- Cma Cgm S.A

- Evergreen Marine Corp. (Taiwan) Ltd.

- Hapag-Lloyd AG

- HYUNDAI Merchant Marine Co., Ltd.

- Kawasaki Kisen Kaisha, Ltd.

- Mitsui O.S.K. Lines, Ltd.

- MSC - Mediterranean Shipping Agency AG

- Westfal-Larsen group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.4 Billion |

| Forecasted Market Value ( USD | $ 21.1 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |