Global Commercial Refrigeration Equipment Market - Key Trends & Drivers Summarized

Refrigeration plays an indispensable role in the modern global economy, impacting various sectors such as food preservation, healthcare, and environmental management. Commercial refrigeration equipment is a vital component in various industries, particularly in food and beverage, hospitality, retail, and healthcare. The systems are designed to store and preserve perishable goods at optimal temperatures, ensuring product safety and quality. Refrigeration is also pivotal in numerous manufacturing processes across sectors like chemical production, plastics, and mechanical engineering. Its role in scientific research further underscores its importance, with many cutting-edge projects relying on sophisticated cooling technologies.Technological advancements have significantly enhanced the functionality, efficiency, and sustainability of commercial refrigeration equipment. Several recent innovations have been achieved in commercial refrigeration technology for storing and transporting frozen foods. Carbon dioxide (CO2) refrigeration systems have been gaining popularity as an environmentally friendly alternative to traditional HFC refrigerants. Phase Change Materials (PCMs) is another innovative concept that can absorb and release large amounts of thermal energy during phase transitions, making them an effective way to maintain temperature inside refrigerated containers during transportation. PCMs can help in reducing energy consumption and maintaining the quality of frozen foods during transportation. Also developed are solar-powered refrigeration systems that use solar panels to generate electricity, which is then used to power the refrigeration unit. Innovations such as smart refrigeration systems equipped with IoT sensors and remote monitoring capabilities allow for real-time tracking and management of temperature and energy consumption.

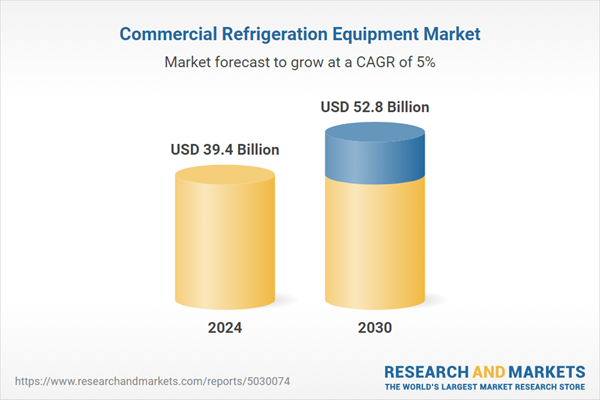

The growth in the commercial refrigeration equipment market is driven by several factors. Advances in refrigeration technology and the increasing adoption of energy-efficient and sustainable solutions are boosting the market. The development of cold chain warehousing, distribution & logistics also provides the cornerstone for growth in the commercial refrigeration equipment market. The expanding global trade & retail is also driving demand for transportation refrigeration equipment. The growing food and beverage industry, particularly in emerging markets, is driving demand for commercial refrigeration as businesses seek to meet consumer needs for fresh and safe products. Additionally, stringent food safety regulations and standards are compelling businesses to invest in advanced refrigeration systems to ensure compliance and maintain product integrity. The continuous innovation in refrigeration solutions to enhance performance, reduce environmental impact, and improve cost-efficiency is expected to sustain the growth of the commercial refrigeration equipment market in the coming years.

Report Scope

The report analyzes the Commercial Refrigeration Equipment market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Transportation Refrigeration Equipment, Freezers & Refrigerators, Refrigerated Display Cases, Beverage Refrigerators, Other Product Types); Application (Food Service Application, Food & Beverage Retail Application, Food & Beverage Distribution Application, Food & Beverage Production Application, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Transportation Refrigeration Equipment segment, which is expected to reach US$15.1 Billion by 2030 with a CAGR of 5.1%. The Freezers & Refrigerators segment is also set to grow at 4.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.5 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $6.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Refrigeration Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Refrigeration Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Refrigeration Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Electrolux, AHT Cooling Systems GmbH, Ali Group, Carrier Global Corporation, Daikin Industries Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 201 companies featured in this Commercial Refrigeration Equipment market report include:

- AB Electrolux

- AHT Cooling Systems GmbH

- Ali Group

- Carrier Global Corporation

- Daikin Industries Ltd.

- Dover Corporation

- Felix Storch Inc.

- Foster Refrigerator

- HOSHIZAKI Corp.

- Standex International Corp.

- Tefcold A/S

- The Middleby Corp.

- TURBO AIR Inc.

- UAB FREOR LT

- Valpro Commercial Refrigeration

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Electrolux

- AHT Cooling Systems GmbH

- Ali Group

- Carrier Global Corporation

- Daikin Industries Ltd.

- Dover Corporation

- Felix Storch Inc.

- Foster Refrigerator

- HOSHIZAKI Corp.

- Standex International Corp.

- Tefcold A/S

- The Middleby Corp.

- TURBO AIR Inc.

- UAB FREOR LT

- Valpro Commercial Refrigeration

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 584 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 39.4 Billion |

| Forecasted Market Value ( USD | $ 52.8 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |