Global Coagulation Testing Market - Key Trends and Drivers Summarized

Why Is Coagulation Testing Essential in Modern Healthcare?

Coagulation testing plays a crucial role in modern healthcare. Coagulation tests are used to assess the blood's ability to clot properly and are critical for diagnosing bleeding disorders, monitoring anticoagulant therapy, and managing patients during surgical procedures. Proper blood clotting is essential for preventing excessive bleeding, but abnormalities in this process can lead to serious conditions such as thrombosis (excessive clotting) or hemorrhage (inability to clot). Coagulation tests are particularly important for patients with conditions like hemophilia, deep vein thrombosis (DVT), or those taking blood-thinning medications like warfarin. These tests, including prothrombin time (PT), activated partial thromboplastin time (aPTT), and international normalized ratio (INR), provide doctors with critical information about how well a patient's blood coagulates, allowing for the timely diagnosis of disorders and adjustments in treatment plans. Without coagulation testing, the risk of uncontrolled bleeding or clotting-related complications would significantly increase, especially in high-risk populations such as those undergoing surgery, trauma victims, or patients with chronic cardiovascular diseases.What Makes Coagulation Testing So Advanced and Reliable?

Coagulation testing is highly specialized due to the precision and complexity involved in measuring how quickly and efficiently blood clots. Modern coagulation analyzers have evolved significantly from traditional manual methods, incorporating advanced technologies that enhance both accuracy and efficiency. These devices use optical, mechanical, or electrochemical systems to measure clot formation in real-time, providing quick and reliable results. Optical methods, for example, detect changes in the turbidity of plasma as the clot forms, while mechanical systems track the physical movement of clots. Modern systems are also capable of handling multiple tests at once, automating processes such as sample preparation and reagent handling, thereby reducing human error and increasing throughput in laboratories. In addition to technological advancements in the hardware, innovations in reagent formulation have improved the sensitivity and specificity of coagulation tests. This ensures that even slight abnormalities in clotting can be detected, which is particularly important in patients who may have subtle or early-stage coagulation disorders. Some advanced analyzers are also equipped with point-of-care testing capabilities, allowing healthcare providers to perform coagulation tests outside the laboratory setting, such as in emergency rooms or during home visits for patients on long-term anticoagulation therapy. These advancements in both instrumentation and reagent chemistry make coagulation testing more reliable, offering healthcare providers the accuracy and efficiency needed to manage critical patient conditions with confidence.How Is Coagulation Testing Evolving With Modern Healthcare Trends?

The landscape of coagulation testing is evolving rapidly in response to growing healthcare needs and technological advancements. One of the most significant trends is the shift toward point-of-care (POC) testing, which allows for immediate results outside traditional laboratory settings. This is particularly beneficial for managing patients on anticoagulants, such as warfarin, where regular monitoring is required to adjust dosages and avoid complications. Portable coagulation analyzers now allow healthcare providers to conduct these tests in clinics, at home, or even in remote locations, improving patient access to care and reducing the need for frequent hospital visits. This trend is aligned with the broader movement toward personalized medicine, where care is tailored to the individual patient's needs, and POC testing helps make this approach more feasible. Another area of evolution is the integration of digital technologies and data analytics into coagulation testing. Many modern analyzers are equipped with software that can track patient results over time, flagging any significant changes in clotting ability and generating detailed reports for clinicians. The use of machine learning and artificial intelligence (AI) is also beginning to play a role in coagulation testing, with AI-powered algorithms helping to predict patient outcomes based on test results, past medical history, and other health data. Additionally, the development of novel biomarkers and next-generation reagents is expanding the scope of coagulation tests beyond standard PT/INR and aPTT measurements. These emerging tests provide deeper insights into coagulation pathways, helping physicians diagnose complex disorders such as disseminated intravascular coagulation (DIC) or monitor the effects of newer anticoagulant therapies like direct oral anticoagulants (DOACs).What Is Driving the Growth of the Coagulation Testing Market?

The growth in the coagulation testing market is driven by several factors. One of the primary drivers is the increasing global prevalence of cardiovascular diseases, which necessitates regular monitoring of blood coagulation, particularly in patients at risk of thrombosis or those receiving anticoagulant therapy. As cardiovascular conditions such as stroke, heart attack, and atrial fibrillation become more common, the demand for coagulation testing is rising sharply. The aging global population is also a major contributor to market growth, as older adults are more likely to suffer from clotting disorders and require routine testing for conditions like venous thromboembolism (VTE) or to manage anticoagulant therapies. This demographic shift is creating a sustained demand for both laboratory-based and point-of-care coagulation testing solutions. Additionally, the rapid development of direct oral anticoagulants (DOACs) has expanded the scope of coagulation monitoring. The rise in outpatient care and home healthcare services is further driving the demand for portable and easy-to-use coagulation testing devices. Point-of-care testing is becoming increasingly popular among patients on long-term anticoagulation therapy, as it offers convenience and timely results, which are critical for adjusting medication dosages. Another significant growth driver is the increasing investment in healthcare infrastructure, particularly in emerging markets. As these regions develop their healthcare systems, the demand for sophisticated diagnostic tools, including coagulation analyzers, is rising. Governments and healthcare organizations are investing in state-of-the-art laboratories and diagnostic centers, expanding access to coagulation testing in underserved areas. Finally, technological advancements, including automation, AI integration, and real-time data analytics, are enhancing the accuracy and speed of coagulation testing. These combined factors are fueling the growth of the coagulation testing market, making it a vital component of the global healthcare landscape.Report Scope

The report analyzes the Coagulation Testing market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Consumables, Instruments); Test Type (PT, Other Test Types); End-Use (Hospitals & Clinics, Diagnostic Laboratories, Home Care Settings, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Coagulation Testing Consumables segment, which is expected to reach US$3.7 Billion by 2030 with a CAGR of 5.1%. The Coagulation Testing Instruments segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $894.6 Million in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $990 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Coagulation Testing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Coagulation Testing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Coagulation Testing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Inc., Agappe Diagnostics Ltd., Alere, Inc., F. Hoffmann-La Roche AG, Helena Laboratories, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Coagulation Testing market report include:

- Abbott Laboratories, Inc.

- Agappe Diagnostics Ltd.

- Alere, Inc.

- F. Hoffmann-La Roche AG

- Helena Laboratories, Inc.

- HemoSonics, LLC

- Horiba, Ltd.

- Medtronic PLC

- Randox Laboratories Ltd.

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific, Inc.

- Universal Biosensors Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories, Inc.

- Agappe Diagnostics Ltd.

- Alere, Inc.

- F. Hoffmann-La Roche AG

- Helena Laboratories, Inc.

- HemoSonics, LLC

- Horiba, Ltd.

- Medtronic PLC

- Randox Laboratories Ltd.

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific, Inc.

- Universal Biosensors Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 171 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

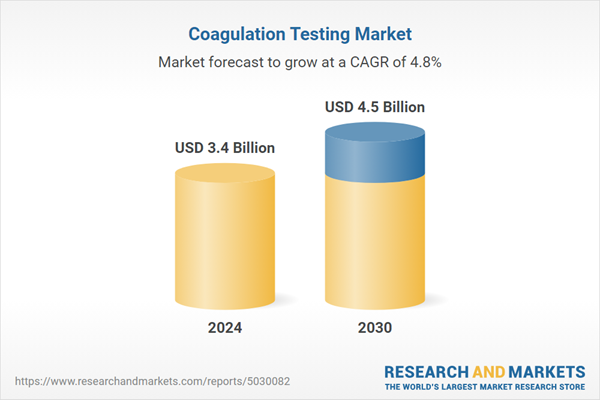

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 4.5 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |